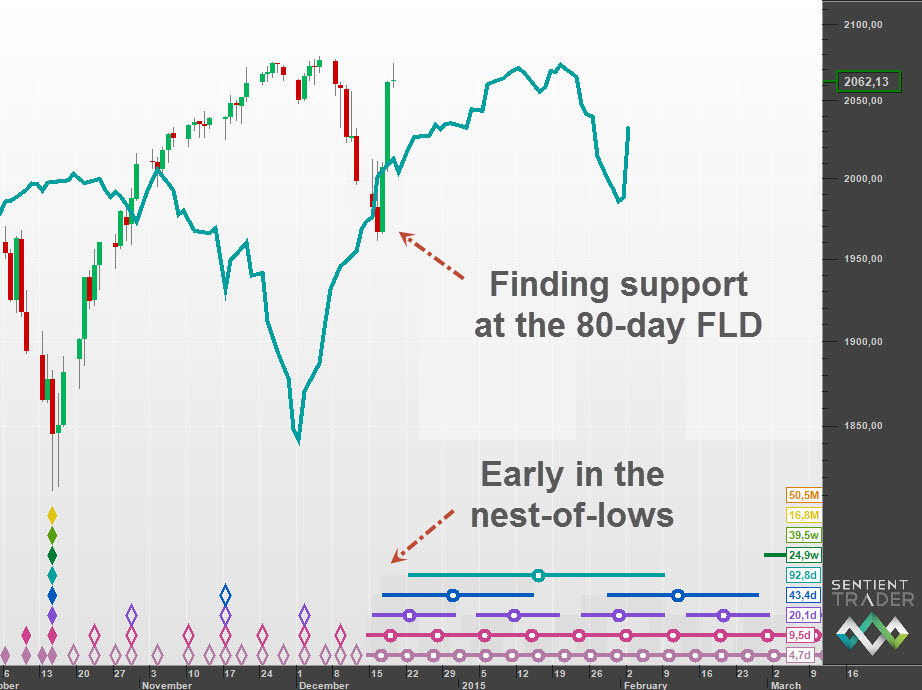

For the past three weeks I have been discussing the move down into the 80-day cycle trough in the Hurst Trading Room podcasts. On Monday I discussed the reasons why I expected the trough to occur “early” – in other words earlier than the average 68 days, and how the FLD’s of various cycles have provided a rough roadmap for the move.

On Monday and Tuesday of this week my mobile devices kept beeping with Hurst Cycles Alerts as one market after another reached the next FLD milestone. The FLD is an interesting tool, because at times price is expected to cross through the line, and at other times the FLD provides support or resistance.

I received so many queries about which behavior to expect this time that I was prompted to tweet this:

I expected price to find support at the 80-day FLD, and indeed it did:

Sometimes an FLD will provide perfect support at the low of a bar (or resistance at the high) but more often the support is apparent as price “tracks” along the FLD with the low of each bar below the FLD and high above the FLD.

It was a perfect example of the power of the FLD. But something else happened this week that deserves our attention: the British FTSE 100 index has confirmed a bearishness that has been developing for some time.

Here is the FTSE which found support at the 20-week FLD this week:

The significance of the fact that it found support at the 20-week FLD, as opposed to the 80-day FLD is that it confirms a shift of the longer cycles into a bearish mode.

In November I discussed my reasons for expecting the US markets to peak sometime early next year. But for some time the FTSE (and other European markets) has been lagging the US markets, and bearish cracks have started to appear. Here is my opinion on the long term analysis in the FTSE:

The current 18-month cycle is therefore expected to be bearish. The fact that this 80-day cycle trough found support at the lower level of the 20-week FLD confirms that this 18-month cycle is indeed already looking bearish.

This implies that the bear has already seized control of the London market, and that the 9-year peak probably occurred in September this year.

It also reminds us to stay alert to signs of the bear coming to the US markets. This hasn’t happened yet … at least our US friends (and those of us able to trade the US markets) get to see the year out on a high note.

I’m taking a break over Christmas and will be back next year with more Hurst analysis of the markets. I wish you a wonderful festive season. Thank you for your support and interest in Hurst Cycles. See you next year!