Last week I discussed the possibility that the October 2014 trough was of 18-month magnitude, and as the US markets all reached up to new highs today it seems most likely that it was indeed an 18-month cycle trough.

To receive these blogs as soon as they are posted Join/Like/Follow Us. If you don’t do social media – click to Join Feedburner to receive these blogs by email.

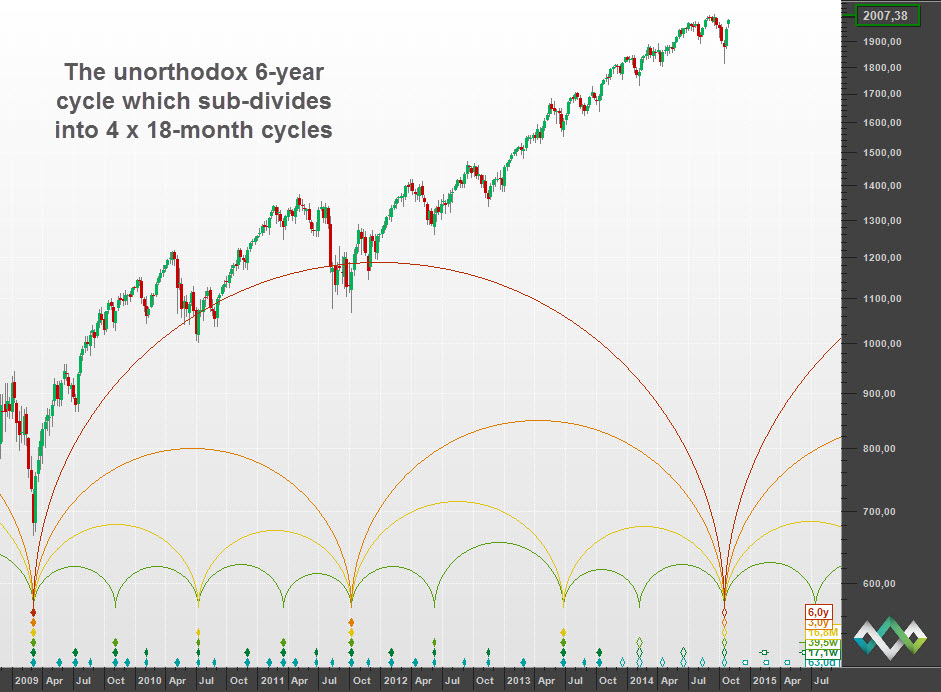

While I am mostly a bit of a Hurst purist, I have occasionally suggested some unconventional ideas, and one of them is that there seems to have been a fairly regular 6-year cycle in the stock markets recently. I have written about this before in various forms, and when I was writing last week’s post I toyed with the idea of showing you an update on that 6-year cycle idea, because of course the October 2014 trough completed the fourth 18-month cycle since March 2009 … which means that if there is a 6-year cycle, the October trough is also a 6-year cycle trough.

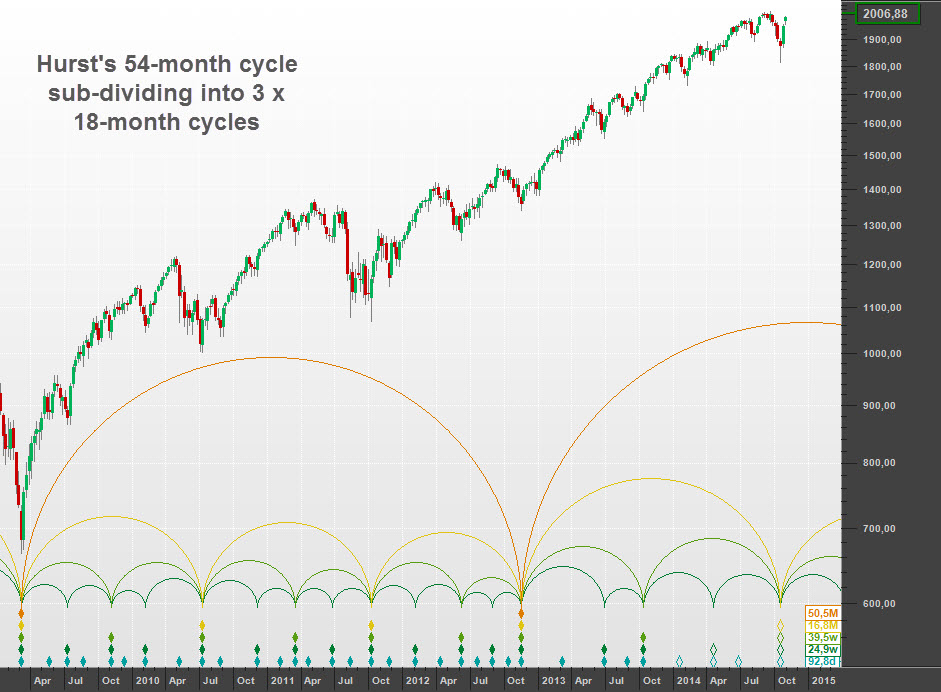

I thought it better to focus on a single discussion last week, which allows me to present this fairly “spooky” idea today. First of all here is an analysis using the traditional Hurst nominal model which has a 3:1 harmonic ratio between the 18-month cycle and the 54-month cycle:

Now here is a chart which includes a 6-year cycle:

As unorthodox as that is, it has a better “look” to it. I would love to hear what you think about it. Is it possible that we are bouncing out of a 6-year cycle trough? (Even if that 6-year cycle is only a harmonic echo caused by the 18-year and 18-month cycles)

Why is this a “spooky” thought? Because it means that there is lot more upside to the already impossibly long bull run that we have been enjoying. Just as I was turning long-term bearish, I’m wondering whether the bear isn’t another few years away? We might be in for a few more years of bullishness!

Have a great week and profitable trading!

(This post originally appeared on the Hurst Cycles site: http://hurstcycles.com/a-spooky-halloween-thought/)