Hurst’s Principle of Variation tells us to expect that cycle wavelengths vary from their average length, resulting in a dynamic and constantly changing cyclic model. Hurst never discussed by how much a cycle wavelength can vary, and there are times when we cannot say for certain what the magnitude of a particular trough is.

There is a narrow band of uncertainty between any two cycles, where a trough could reasonably be the trough of either one of those cycles. For instance if a trough forms between 45 and 51 days after the trough of an 80-day cycle, is it a late trough of the 40-day cycle or an early trough of the 80-day cycle? Or is something else happening?

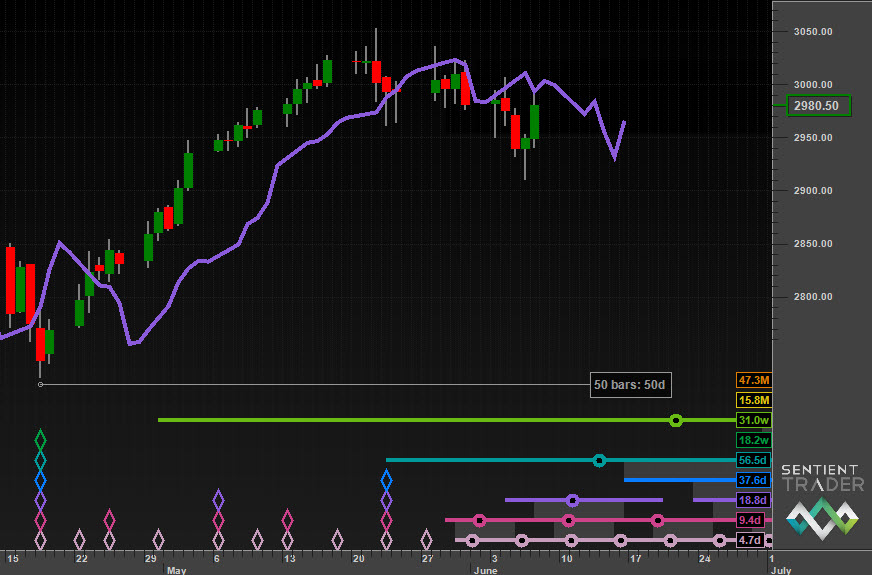

I have noticed an increased frequency of the formation of troughs in this band of uncertainty in the US markets over the past 18 months, in particular at the 50-day/100-day point, as this chart demonstrates:

This is what I mean by the 50-day puzzle, and it happened again this week, with a clear trough forming at 49 days since the 20-week trough of 18 April 2013. There are four possible solutions to the puzzle:

- The trough is a late 40-day cycle trough

- It is an early 80-day cycle trough

- It is the trough of a 20-day cycle, following a 40-day cycle trough which formed on 23 May 2013 (the 49 days consist of a 40-day cycle and a 20-day cycle)

- Or the nominal model we use should be modified to include a 50-day cycle (and a 100-day cycle)

As you can see from the analysis below, Sentient Trader has chosen solution 1 on the S&P 500 and solution 3 on the Nasdaq, but it is a good idea to bear in mind that the other solutions might well be playing out. Solution 4 is an interesting idea, one that would require several posts to explore (as a matter of interest if you are a Sentient Trader user, consider building a custom nominal model).

S&P 500

Here is solution 1 to the 50-day puzzle: The 40-day cycle is forming a late trough:

Nasdaq

And here is solution 3: The recent trough is a 20-day cycle trough:

Note the 20-day FLD which is plotted on both those charts (the purple line). The correct answer to the 50-day puzzle will most probably be revealed by the way in which price interacts with the FLD.

Euro/US Dollar

As discussed last week we are on the downward side of the current 80-day cycle in the Euro/US Dollar. This 40-day cycle is expected to be less bullish than the previous one. A new high was made this past week, but if that is the peak of the current 40-day cycle then it will have been an early peak, which will result in a more bearish cycle shape.

Gold

In how many ways can I express that the 40-week cycle peak forming in Gold at the moment is expected to be disappointing?

30 Year US Bonds

Bonds are in the grip of a dominant cycle pulling price downwards from the 40-week cycle peak of 1 May 2013. A 40-day cycle peak should be forming now, but it will probably be difficult to identify because of the strength of the dominant cycle.

Crude Oil

Crude Oil is presenting its own 50-day puzzle, (a 46-day puzzle to be exact). You can see here which solution I believe is correct:

US Dollar Index

The US Dollar is on the downward side of the 20-week cycle, and you can see how what started out as a promisingly bullish cycle has turned nastily bearish.

I would be very interested to hear which solution to the 50-day puzzle you believe is correct at the moment in the US markets.

Have a great week and profitable trading!