I’m a bit of a gadget freak, I admit it. This week I realized that one of the reasons I created Sentient Trader was so that while preparing dinner for my family in rural Italy on Wednesday evening I would nevertheless be one of the first to know that a big Hurst Cycles moment was happening:

On Wednesday the S&P 500 (ES futures) crossed below the 18-month VTL, which I wrote about three weeks ago.

To receive these blogs as soon as they are posted Join/Like/Follow Us. If you don’t do social media – click to Join Feedburner to receive these blogs by email.

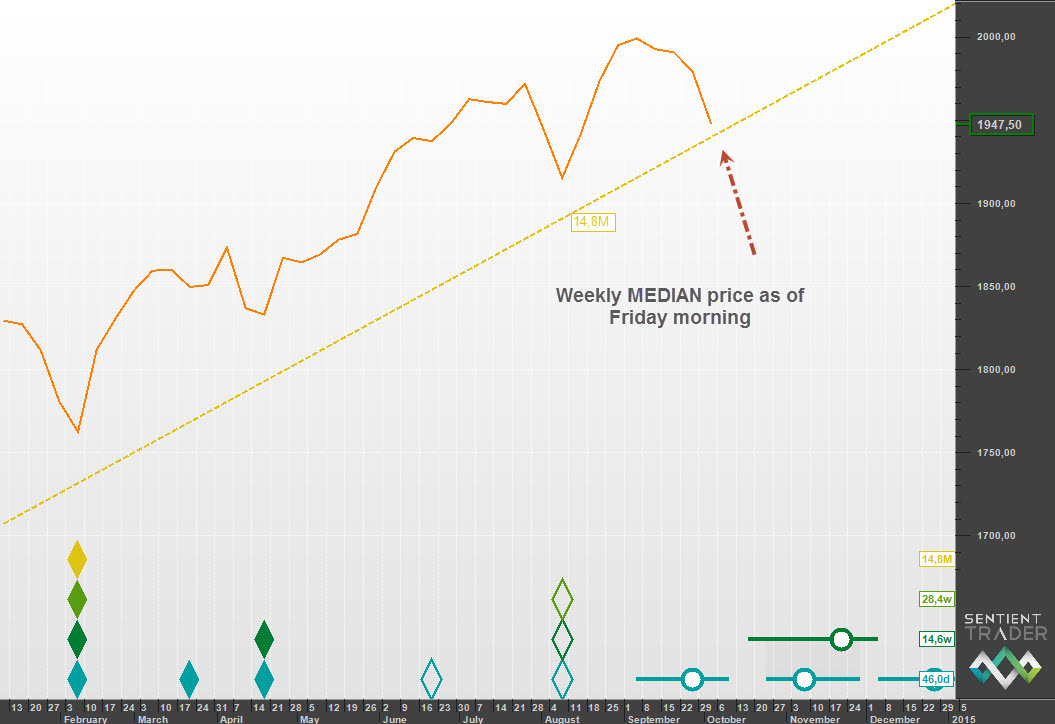

Now although price crossed below the VTL, that is only a big moment if median price crosses clearly below the VTL. On Thursday daily median price dipped below the VTL, but as this is an 18-month VTL I would like to see more than a single day dip below it. Ideally I would like to see the median price on a weekly chart cross below the VTL before declaring this Hurst Cycles moment. Here is the weekly median price as of Friday morning:

What is the importance of this moment?

If price crosses below the 18-month VTL it would confirm that the current 4 & 1/2 year cycle peak has formed in the market. That means that we are unlikely to see prices higher than the highs earlier this month until after the next 4 & 1/2 year cycle trough. That will probably only occur in 2016.

If price does not cross below the 18-month VTL then it will provide support, and we must wait another few cycles until the cross does happen. Eventually all VTL’s are crossed.

I wrote about the meaning of price crossing the VTL in this post, and also wrote this week about the formation of what I believe is a textbook G-category price and FLD interaction.

Even though the moment hasn’t actually occurred yet, I did sneak another look at that alert on Wednesday evening, just to savor the moment as it were:

Have a great week and profitable trading!

PS: There were other reasons for creating Sentient Trader, but receiving real-time alerts about Hurst Cycles events has to be one of the coolest!