You will come across specific terms in these notes (FLD, VTL, and so on). Rather than explain them each time, you will find definitions here: guidance notes for Hurst cycles terminology.

CBOE Volatility Index (VIX) – long term uptrend indicated, near-term 40 day cycle trough next low.

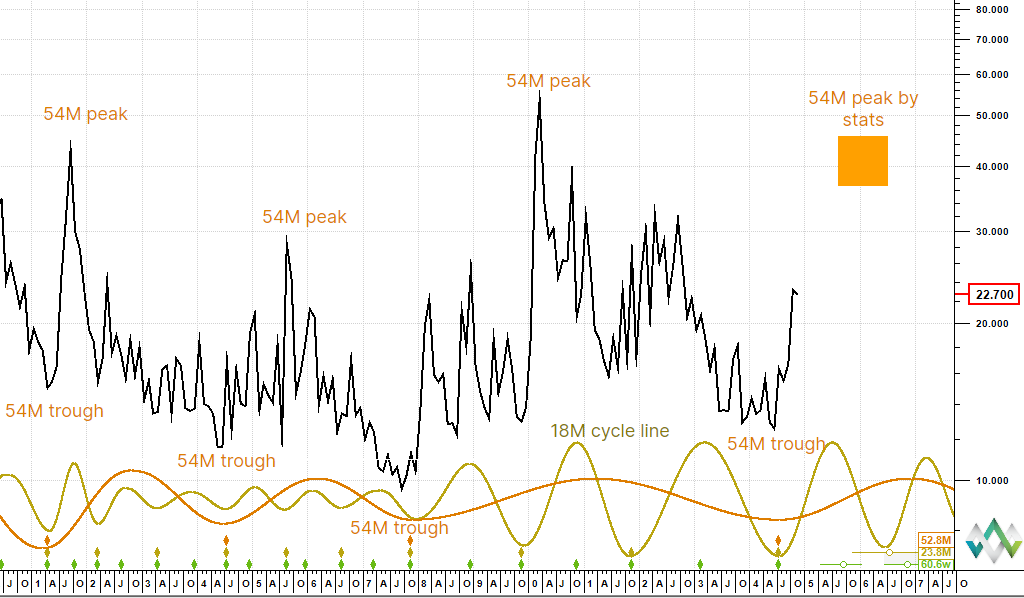

The monthly line log chart here is regular and shows stable rhythm, although the last 54 month cycle period was lengthened. The VIX shows the expected volatility of the S&P500 Index (SPX). When VIX rises SPX gets more volatile and moves (either up or down). The analysis shows that the July low was at least a 54 month cycle trough, which implies that a long term uptrend is in place now. There isn’t much data to go on in the chart, but the average rally out of the 54 month cycle trough is 338% and the average trough to peak time duration is 540 days. This tiny sample gives us a 54 month cycle target of around 40 in January 2026. Make of that what you will. Here is the daily chart:

Read the full post here.