This Cycle Outlook has been kindly provided by David Walling.

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by the contributor.

Greetings, Here is an update on NDX, RUT and SPX NDX – it appears that the 40d cycle trough which was expected around August 21st formed on August 19th. The mid-point of price crossing above the 40d FLD gives us confirmation of that and presently Sentient Trader is projecting higher prices as NDX moves out of that trough. See chart below.

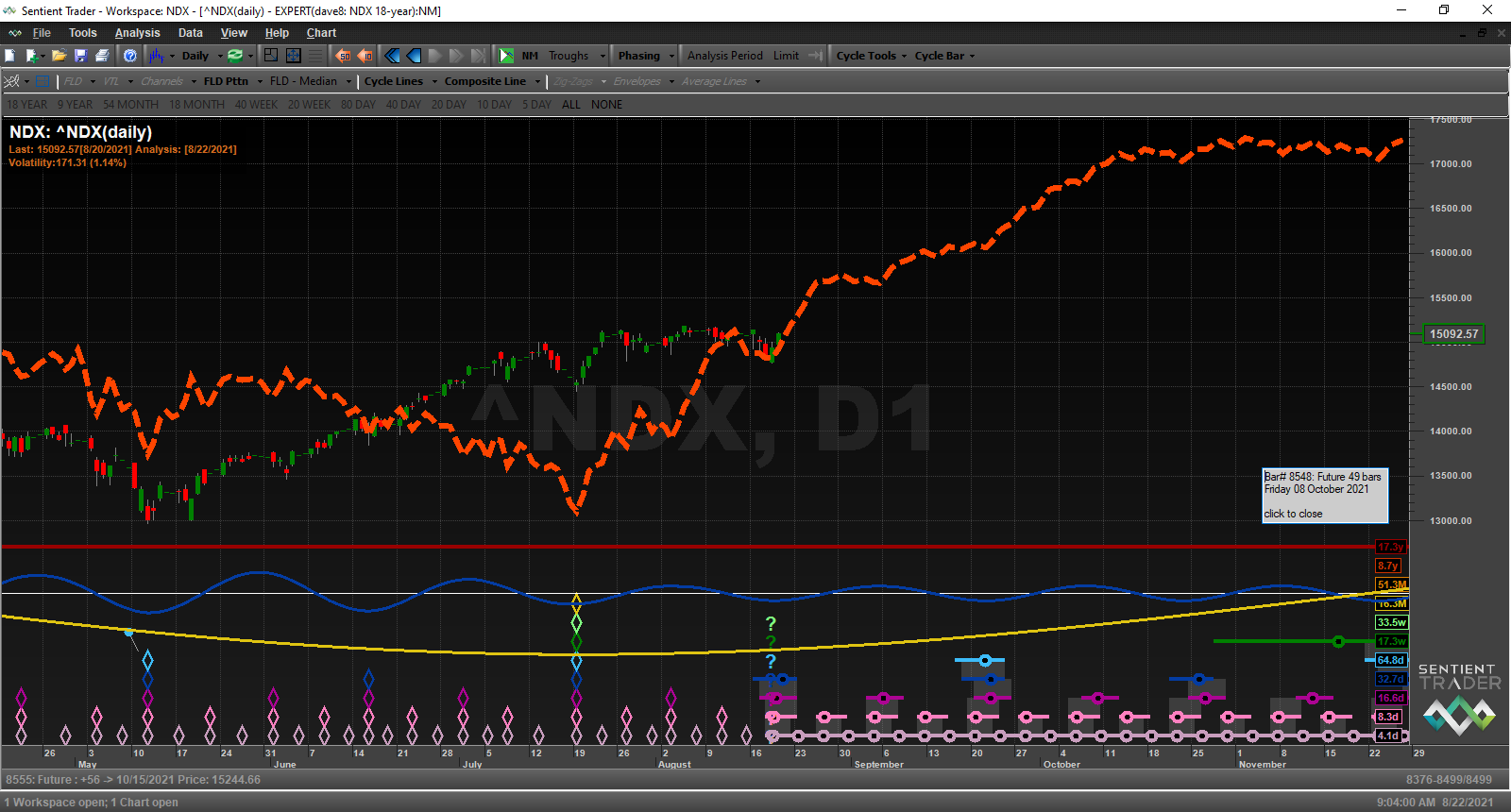

NDX – it appears that the 40d cycle trough which was expected around August 21st formed on August 19th. The mid-point of price crossing above the 40d FLD gives us confirmation of that and presently Sentient Trader is projecting higher prices as NDX moves out of that trough. See chart below.

In my last update, August 11th, I posted the NDX had a 20d FLD upside target of 15,394; now we can say it did not achieve that target since its 40d cycle high was only 15,184. So, it was a little short. I also, mentioned that if the downside target into the 40d cycle trough was exceeded, that would be concerning to me. Price did cross through the 20d FLD at 15,094 resulting in a downside target of 15,004. The August 19th low was 14,773 or 1.6% lower than expected. However, if in fact the August 19th trough turns out to be the 40d cycle low, the entire move was only a 2.8% pullback. Weakness maybe creeping in, but so far nothing earth shattering.

In my last update, August 11th, I posted the NDX had a 20d FLD upside target of 15,394; now we can say it did not achieve that target since its 40d cycle high was only 15,184. So, it was a little short. I also, mentioned that if the downside target into the 40d cycle trough was exceeded, that would be concerning to me. Price did cross through the 20d FLD at 15,094 resulting in a downside target of 15,004. The August 19th low was 14,773 or 1.6% lower than expected. However, if in fact the August 19th trough turns out to be the 40d cycle low, the entire move was only a 2.8% pullback. Weakness maybe creeping in, but so far nothing earth shattering. RUT – the Russell 2000 index has been by far the weakest of the of the three I follow. Currently, there is no cyclic evidence that the index has formed its 40d cycle trough. However, we do have timing for that trough and the beginnings of a nice bounce out of it.

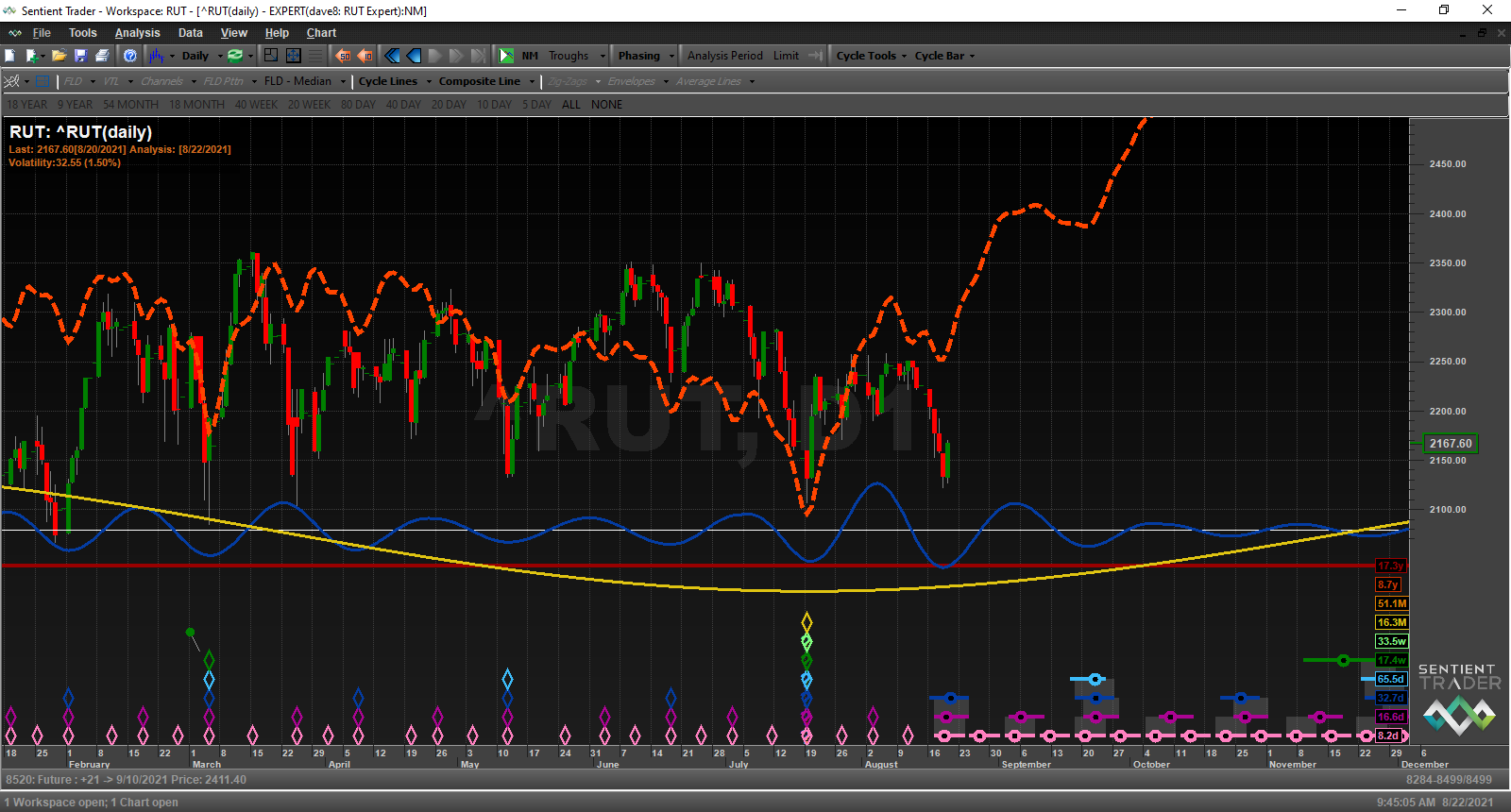

RUT – the Russell 2000 index has been by far the weakest of the of the three I follow. Currently, there is no cyclic evidence that the index has formed its 40d cycle trough. However, we do have timing for that trough and the beginnings of a nice bounce out of it. Currently, Sentient Trader is projecting that the trough did form and that we should see bullish price action into the first third of September, before price pulls back again into an 80d cycle trough.

Currently, Sentient Trader is projecting that the trough did form and that we should see bullish price action into the first third of September, before price pulls back again into an 80d cycle trough. RUT – although being frustrating to trade these balance areas are not uncommon. One of the core tenants of Market Profile theory, is price action moves from trend-to balance-to trend. The RUT did have a very healthy run from October 2020 to March 2021 and so far, it appears to be in the process of digesting that move before making a new leg higher–based on its current cyclic outlook. The fact that it is still holding above its weekly 40EMA is encouraging. However, if it losses that EMA support and breaks below this balance area, it could drag down the other indexes with it. This is not what I’m expecting, just something that I’ll be keeping my eye on.

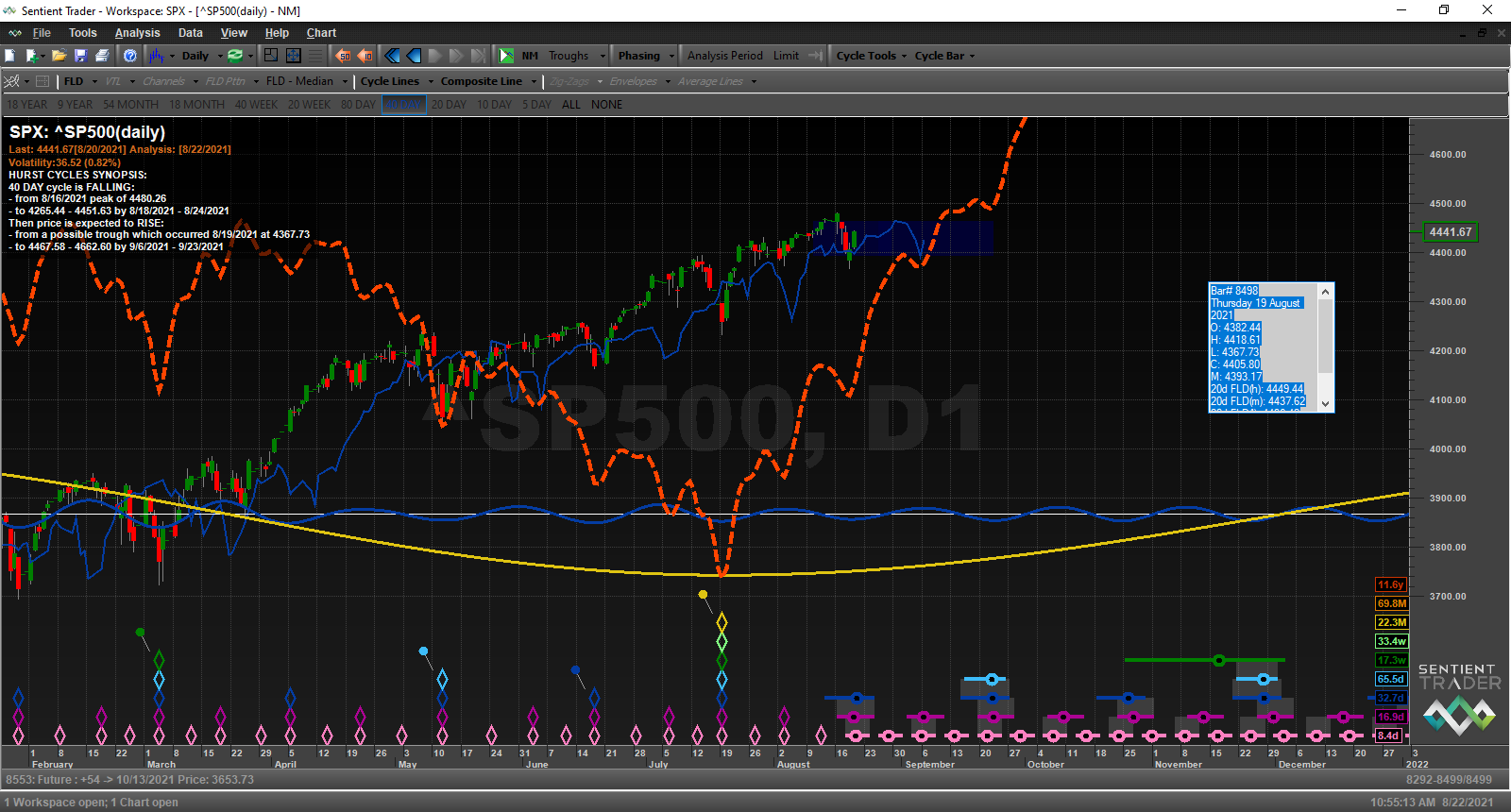

RUT – although being frustrating to trade these balance areas are not uncommon. One of the core tenants of Market Profile theory, is price action moves from trend-to balance-to trend. The RUT did have a very healthy run from October 2020 to March 2021 and so far, it appears to be in the process of digesting that move before making a new leg higher–based on its current cyclic outlook. The fact that it is still holding above its weekly 40EMA is encouraging. However, if it losses that EMA support and breaks below this balance area, it could drag down the other indexes with it. This is not what I’m expecting, just something that I’ll be keeping my eye on. SPX – last week I wrote, the 40d cycle trough is expected around August 20th. Despite breaking out of a Pause Zone, SPX has yet to achieve its 20d FLD price target of 4,526.53. SPX did not achieve the initial 20d FLD target at 4480.26, thus a slight miss which is slightly bearish. However, it did form its 40d cycle trough a day earlier than projected which is bullish. Additionally, having crossed the 40d FLD, it provides cyclic evidence that the 40d cycle trough did form and Sentient Trader’s Composite Line is projecting higher price action it continues to move out of that trough.

SPX – last week I wrote, the 40d cycle trough is expected around August 20th. Despite breaking out of a Pause Zone, SPX has yet to achieve its 20d FLD price target of 4,526.53. SPX did not achieve the initial 20d FLD target at 4480.26, thus a slight miss which is slightly bearish. However, it did form its 40d cycle trough a day earlier than projected which is bullish. Additionally, having crossed the 40d FLD, it provides cyclic evidence that the 40d cycle trough did form and Sentient Trader’s Composite Line is projecting higher price action it continues to move out of that trough.