This Cycle Outlook has been kindly provided by David Walling.

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by the contributor.

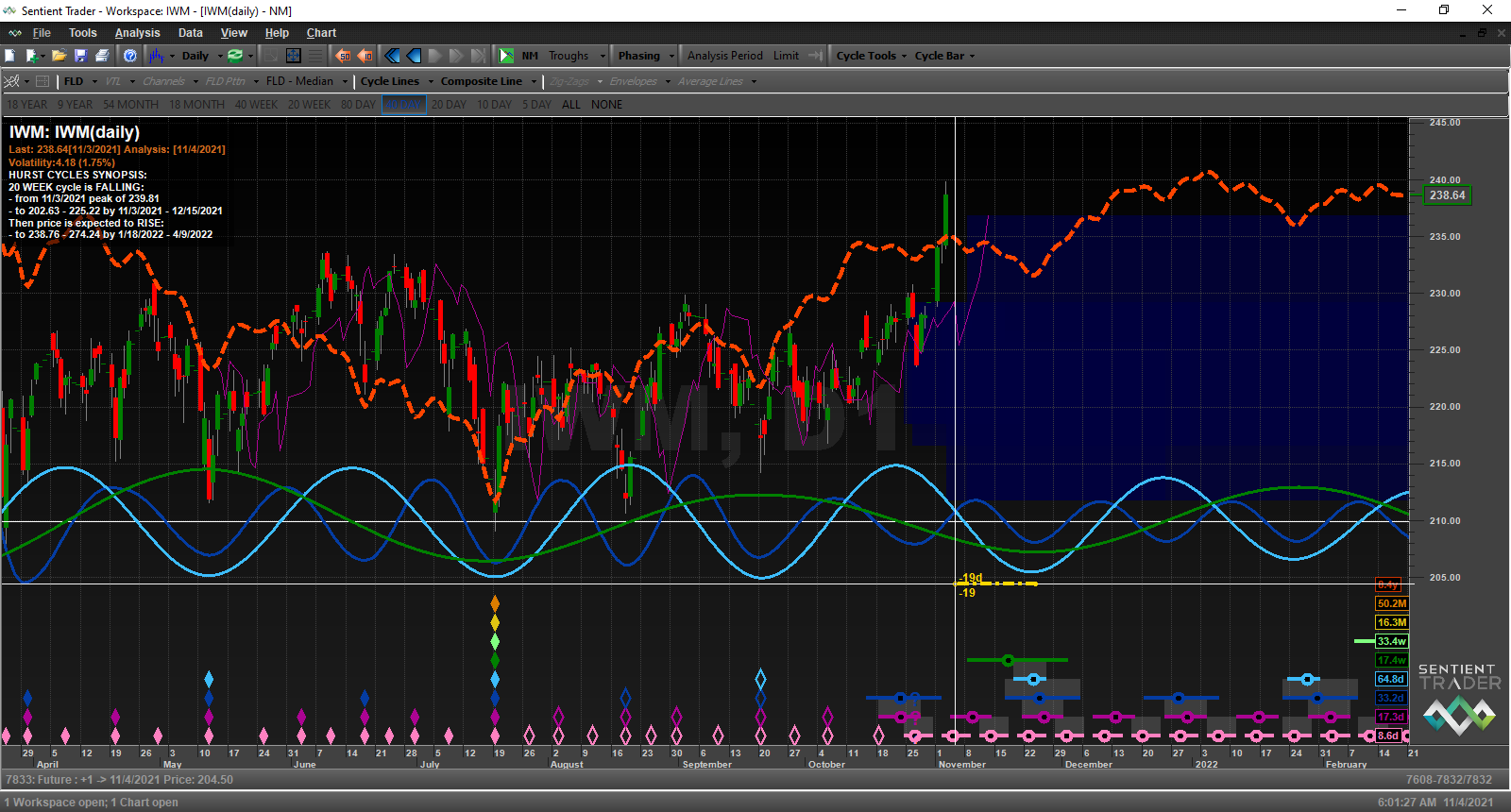

Here’s my latest cyclic update. IWM – since it formed its 18m trough in July, it is now the most vulnerable to a significant near term pullback. Its 20week cycle trough is due in around 19 days.

IWM – since it formed its 18m trough in July, it is now the most vulnerable to a significant near term pullback. Its 20week cycle trough is due in around 19 days. SPY – as with IWM, SPY formed its 18m trough in July. However, its first 80d trough formed much later than the one IWM formed on Sept 20th; therefore, it should be pulling back soon for it to form a 40d cycle trough that is due early next. It has also nearly achieved the 80d FLD target of 466.54 prior to forming the 40d trough. What’s even more interesting is that price crossed the 20week FLD at a lower level than the 80d FLD. The resulting target was around 464 which has now been exceeded.

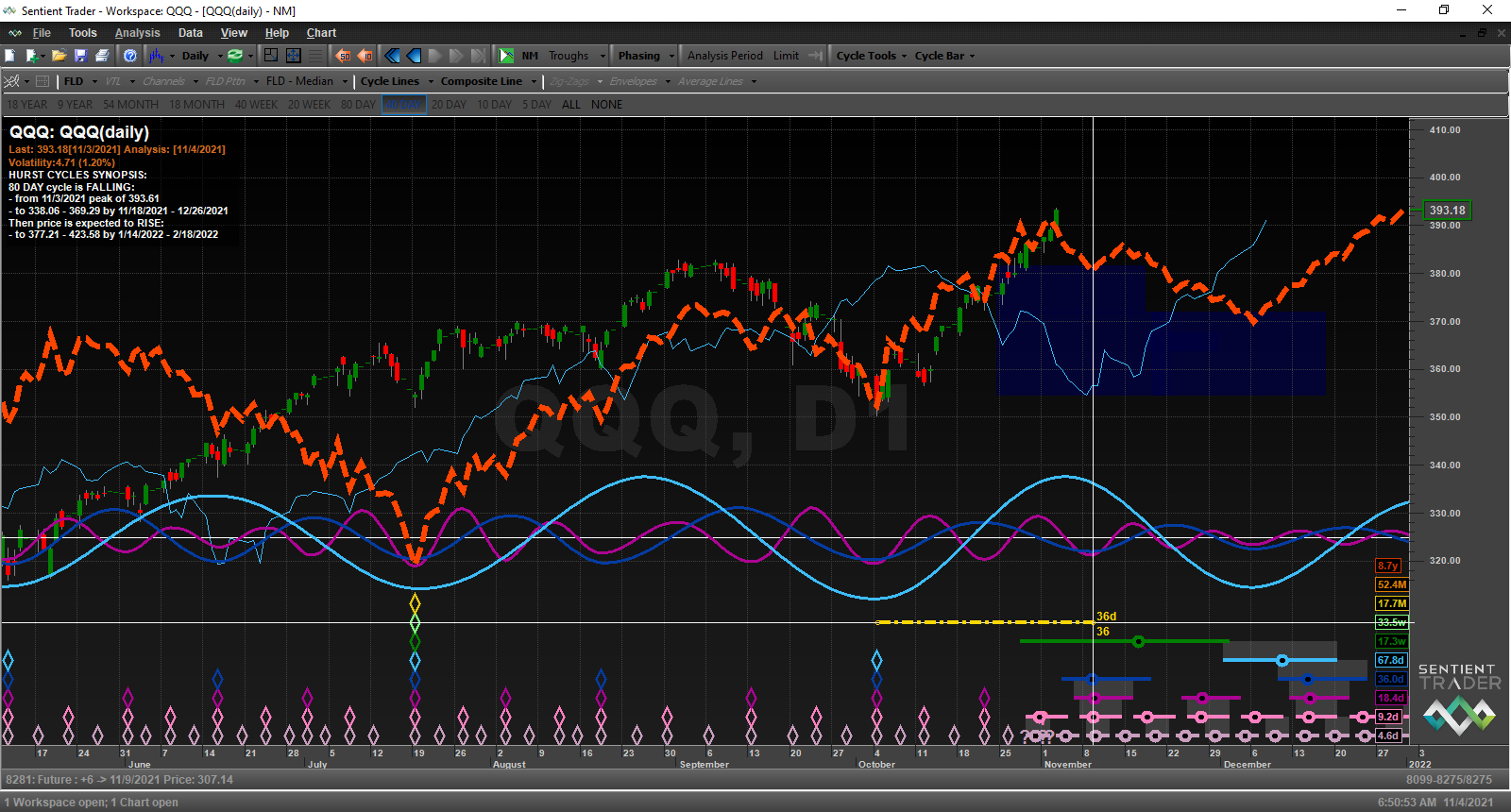

SPY – as with IWM, SPY formed its 18m trough in July. However, its first 80d trough formed much later than the one IWM formed on Sept 20th; therefore, it should be pulling back soon for it to form a 40d cycle trough that is due early next. It has also nearly achieved the 80d FLD target of 466.54 prior to forming the 40d trough. What’s even more interesting is that price crossed the 20week FLD at a lower level than the 80d FLD. The resulting target was around 464 which has now been exceeded. QQQ – similar to SPY it should also be forming a 40d cycle trough early next week. The upward price move has been dramatic since the Oct 4th 80d cycle low which has now resulted in the FLDs to be stacked as shown. This is called cascading indicating that things are getting stretched to the upside. The 40d FLD target was 350.32 which has been exceeded and the 80d FLD target is 399.48 which is close to being reached prior to the formation of the 40d trough let alone the 80d trough—which will also be the 20week trough as well. That trough is due to form in early December. 80d FLD is shown below.

QQQ – similar to SPY it should also be forming a 40d cycle trough early next week. The upward price move has been dramatic since the Oct 4th 80d cycle low which has now resulted in the FLDs to be stacked as shown. This is called cascading indicating that things are getting stretched to the upside. The 40d FLD target was 350.32 which has been exceeded and the 80d FLD target is 399.48 which is close to being reached prior to the formation of the 40d trough let alone the 80d trough—which will also be the 20week trough as well. That trough is due to form in early December. 80d FLD is shown below. I’ve turned off the Sigma L feature on the Composite line to have a better idea of when the various troughs should form.

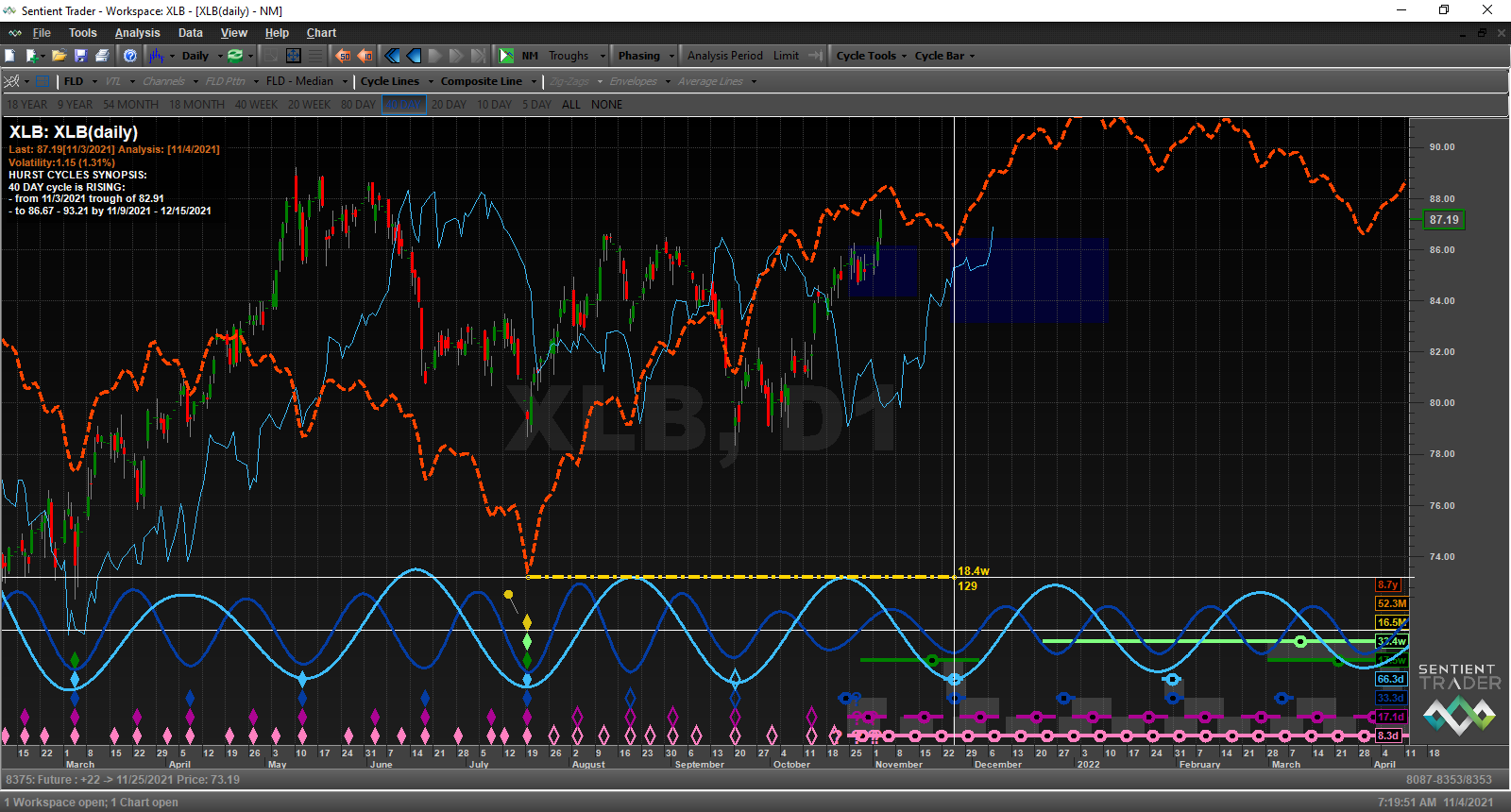

I’ve turned off the Sigma L feature on the Composite line to have a better idea of when the various troughs should form. XLB – it’s 20week cycle trough is projected to form around Nov 25th. — very close to nominal and very close to the time that IWM should form its 20week cycle trough.

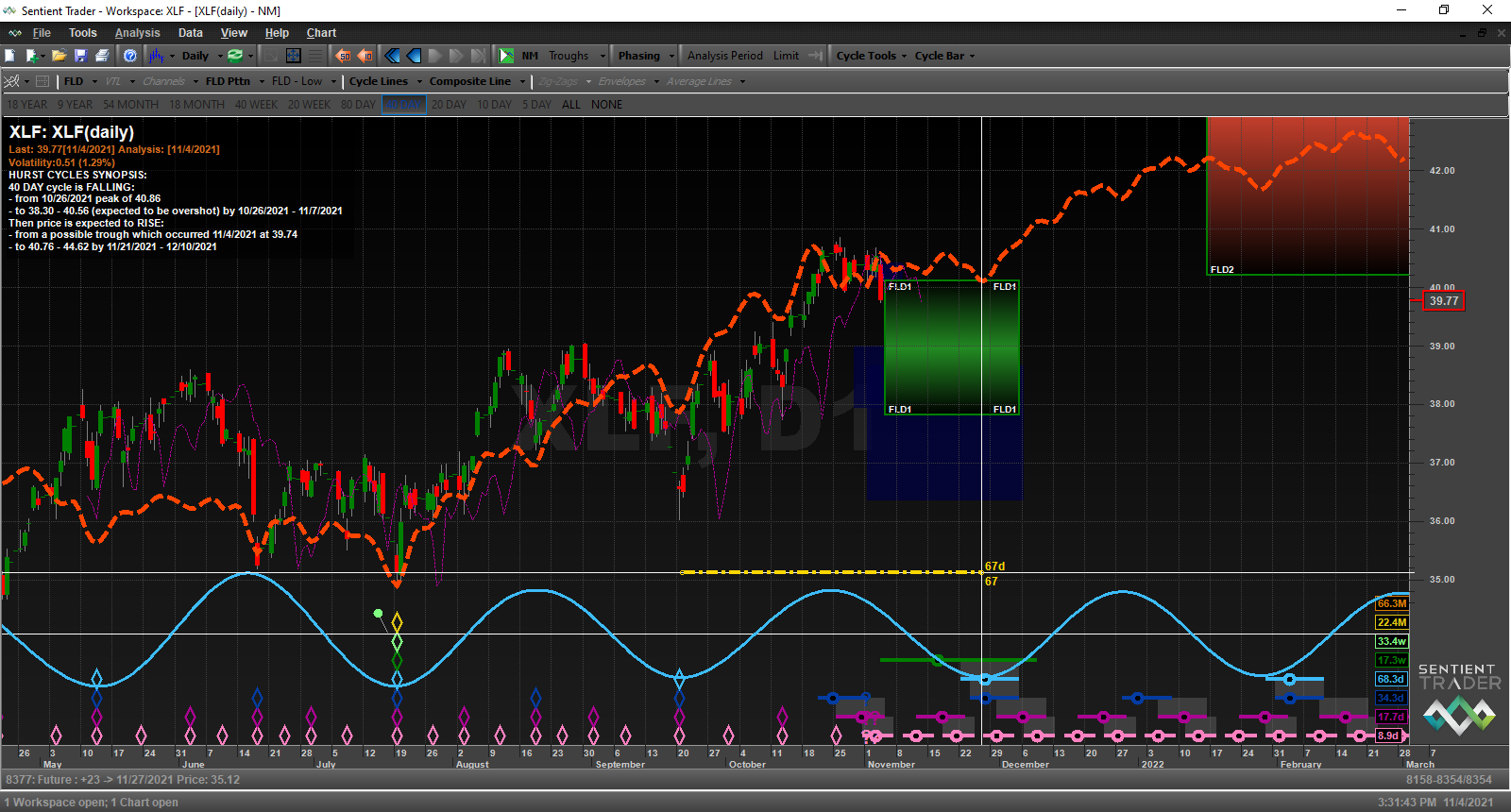

XLB – it’s 20week cycle trough is projected to form around Nov 25th. — very close to nominal and very close to the time that IWM should form its 20week cycle trough. XLF – it may already be starting to make the sideways to down move into a late November 20week cycle trough. This may mean that the 80d cycle troughs we’ve seen for the index ETFs QQQ and SPY might have formed earlier too if it were not for September’s bearish seasonality—see chart below—along with hand wringing over Covid and US infrastructure bills. Therefore, it would not surprise me if the current 80day cycles for QQQ and SPY become much shorter than nominal allowing them, IWM and sector ETFs like XLB to fall back into sync again.

XLF – it may already be starting to make the sideways to down move into a late November 20week cycle trough. This may mean that the 80d cycle troughs we’ve seen for the index ETFs QQQ and SPY might have formed earlier too if it were not for September’s bearish seasonality—see chart below—along with hand wringing over Covid and US infrastructure bills. Therefore, it would not surprise me if the current 80day cycles for QQQ and SPY become much shorter than nominal allowing them, IWM and sector ETFs like XLB to fall back into sync again. The VIX analysis that follows also lends some support to such a possibility as does November seasonality—see chart above.

The VIX analysis that follows also lends some support to such a possibility as does November seasonality—see chart above.