This Cycle Outlook has been kindly provided by David Walling.

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by the contributor.

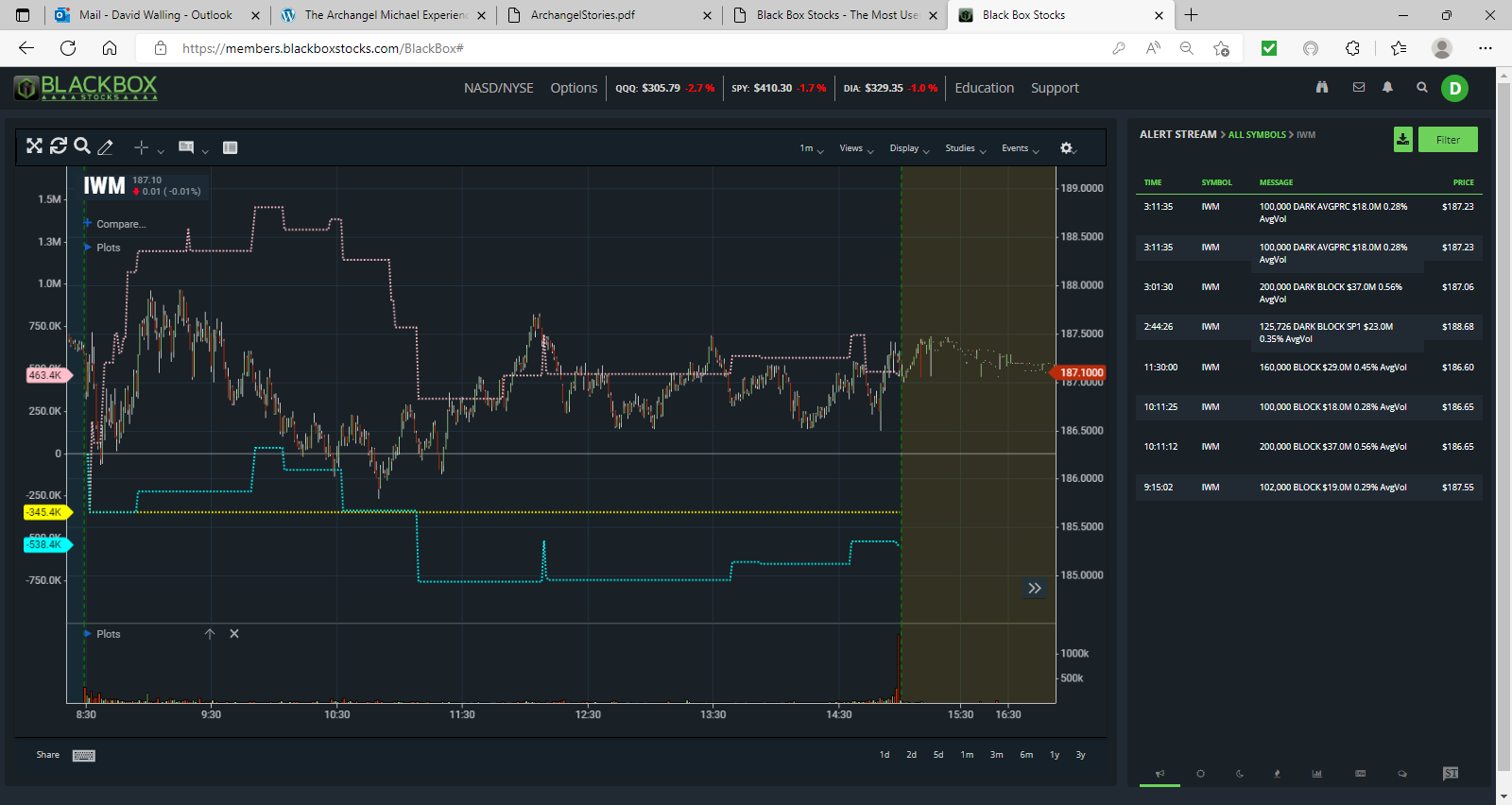

IWM is 22 days into its 40day cycle. It appears that it formed the 20d cycle trough on Wednesday. Price crossed the 40d FLD at 182.77 so this gives us an upside 40day cycle target of 196.64. It actually exceeded its 20d cycle target of 186.86 so one might assume that it can achieve its 80d cycle target as well. It is by far the strongest of the three and has rallied the most off of its May low—percentage wise that is.

IWM is 22 days into its 40day cycle. It appears that it formed the 20d cycle trough on Wednesday. Price crossed the 40d FLD at 182.77 so this gives us an upside 40day cycle target of 196.64. It actually exceeded its 20d cycle target of 186.86 so one might assume that it can achieve its 80d cycle target as well. It is by far the strongest of the three and has rallied the most off of its May low—percentage wise that is. As you can see options dollar flow for options one week to a month out are net bullish (pink dotted line). Longer dated options (more than one month out) were net bearish but by less that 540K (blue dotted line) — peanuts. So, based on today’s options flow there is nothing showing me that IWM can’t stage a rally out of its 20-day cycle trough as soon as Monday.

As you can see options dollar flow for options one week to a month out are net bullish (pink dotted line). Longer dated options (more than one month out) were net bearish but by less that 540K (blue dotted line) — peanuts. So, based on today’s options flow there is nothing showing me that IWM can’t stage a rally out of its 20-day cycle trough as soon as Monday. QQQ – Sentient Trader is suggesting that QQQ most likely formed a 20d cycle trough on Thursday. Thirteen days is quite short for a 20d cycle. In fact, three of the last four 20d cycles were 18 days in duration. However, if we see Thursday’s high exceeded early next week then the 40day cycle target could come into play which is 316. Note, that since the prior 80day cycle was so bearish, the Composite Line in orange, is not projecting price to rocket up out of this projected 40week cycle trough.

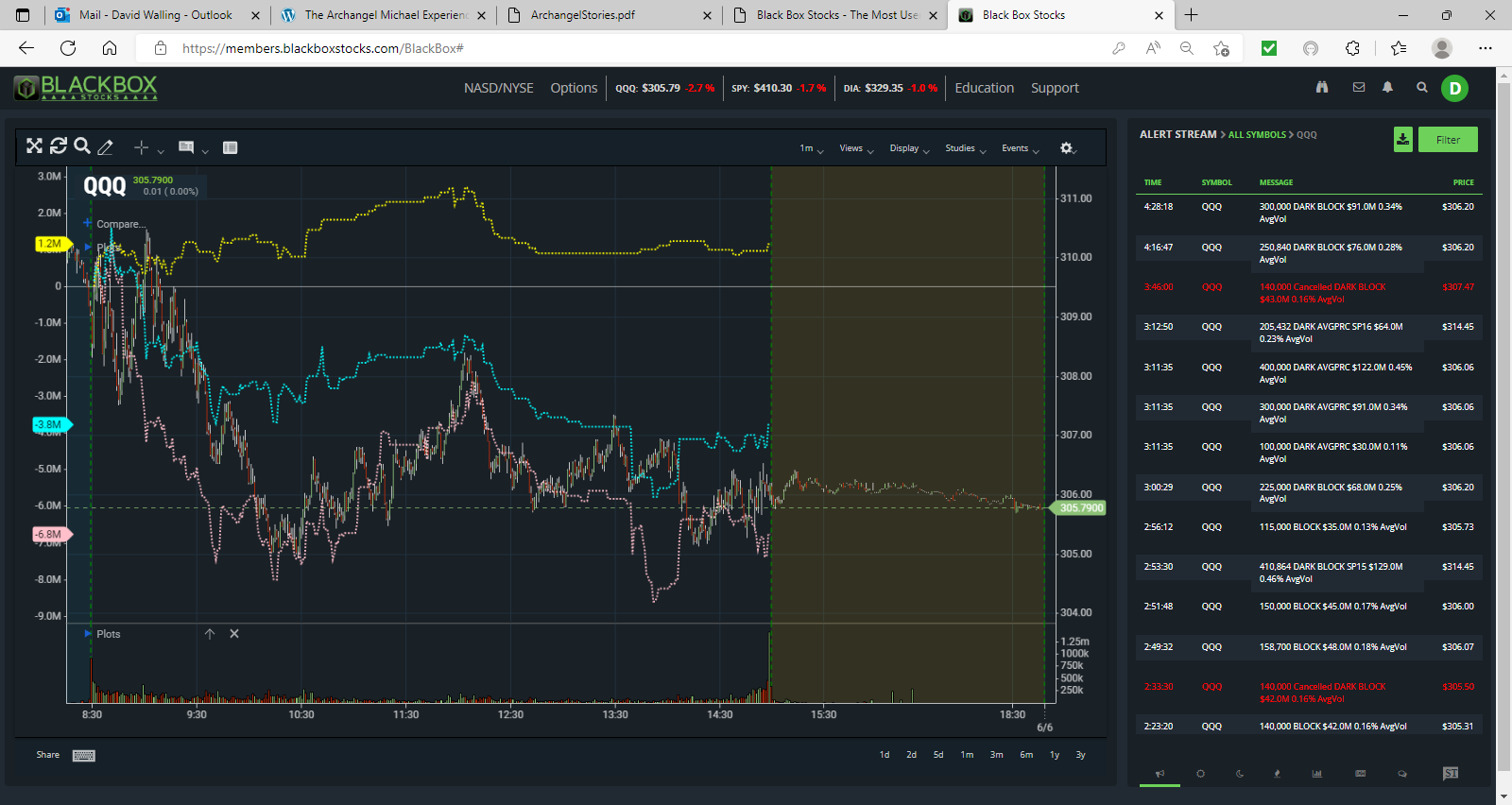

QQQ – Sentient Trader is suggesting that QQQ most likely formed a 20d cycle trough on Thursday. Thirteen days is quite short for a 20d cycle. In fact, three of the last four 20d cycles were 18 days in duration. However, if we see Thursday’s high exceeded early next week then the 40day cycle target could come into play which is 316. Note, that since the prior 80day cycle was so bearish, the Composite Line in orange, is not projecting price to rocket up out of this projected 40week cycle trough. QQQ – on the other hand QQQ has some serious options flow issues both for the coming week and the month (pink dotted line) and the month or more out doesn’t look so hot either (blue dotted line). Therefore, based on this flow it would seem reasonable that QQQ may continue to pull back 1 to 3 days longer before we see that bounce. Just trying to tie the cycle analysis and the options flow analysis together to help prepare me for what could happen on Monday.

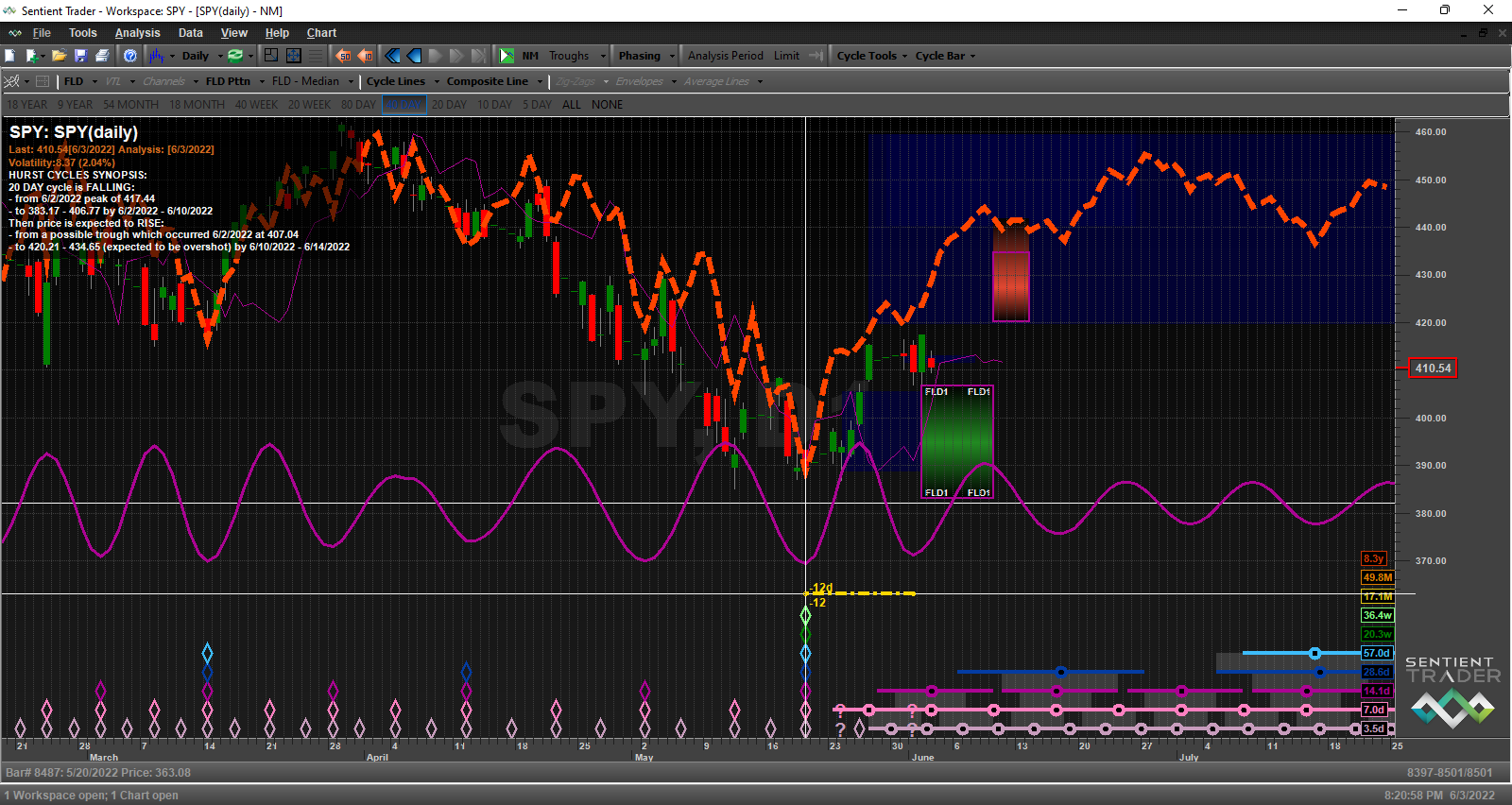

QQQ – on the other hand QQQ has some serious options flow issues both for the coming week and the month (pink dotted line) and the month or more out doesn’t look so hot either (blue dotted line). Therefore, based on this flow it would seem reasonable that QQQ may continue to pull back 1 to 3 days longer before we see that bounce. Just trying to tie the cycle analysis and the options flow analysis together to help prepare me for what could happen on Monday. SPY – Wednesday’s low was actually the low of the week. So, if this was the 20day cycle low it represents a quite short 20day cycle—12 days. It has had similar short 20day cycles in the recent past, but the current average is 14 days. Today is 14days from the cycle low and Monday we’ll be at 17 days. So, we could fall for another day or two or price could start to move out of that trough as early as Monday. For myself, when Thursday’s high is exceeded then I’ll consider that the 20-day cycle trough has formed.

SPY – Wednesday’s low was actually the low of the week. So, if this was the 20day cycle low it represents a quite short 20day cycle—12 days. It has had similar short 20day cycles in the recent past, but the current average is 14 days. Today is 14days from the cycle low and Monday we’ll be at 17 days. So, we could fall for another day or two or price could start to move out of that trough as early as Monday. For myself, when Thursday’s high is exceeded then I’ll consider that the 20-day cycle trough has formed. SPY here we see the longer dated options flow fairly bullish (blue dotted line). It is only the shortest duration one week or less — that is bearish (yellow dotted line) and only by 1.9 million—which is peanuts. So, can SPY move out of its 20day cycle trough on Monday? I’d have to say it could and the move lower today may have just been a shakeout move.

SPY here we see the longer dated options flow fairly bullish (blue dotted line). It is only the shortest duration one week or less — that is bearish (yellow dotted line) and only by 1.9 million—which is peanuts. So, can SPY move out of its 20day cycle trough on Monday? I’d have to say it could and the move lower today may have just been a shakeout move.