I published to Hurst Cycles today about a fascinating subject: the commonality between Hurst Cycles and Elliott Wave. You can read the full post here (and get involved in the discussion), or enjoy this summary:

Two Cycle Theories

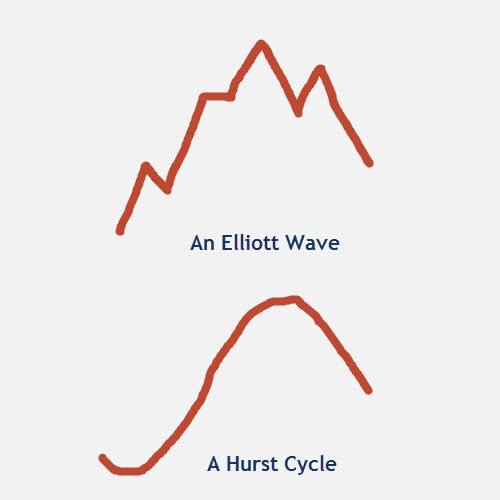

Of course at the most basic level there is an obvious link between Hurst Cycles and Elliott Wave Theory: they both describe cycles in financial markets. I was surprised to realize this at first because I had always focused on the concept of five moves up forming an impulsive move, and three moves down a correction, and had not considered Elliott Wave as a cycle theory per se. Of course the word “wave” is a dead giveaway.

At the most fundamental level the two approaches are both about identifying cycles in the price movement, and of course those cycles push price up, and then down again.

Cycle Shapes

The next interesting comparison between these two approaches has to do with what I call “cycle shapes”. Cycle shapes are not strictly speaking a part of either Hurst or Elliott, but they do form as a result of the underlying principles of both theories.

The number of waves

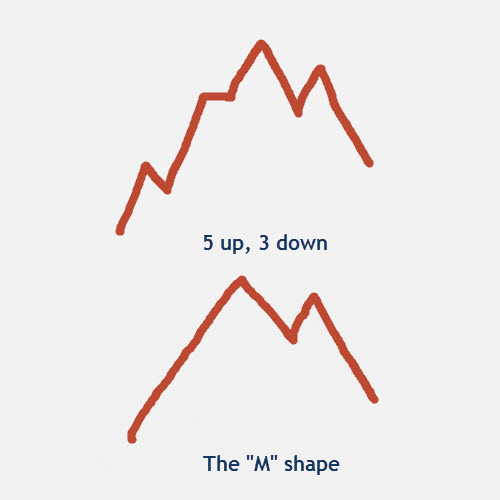

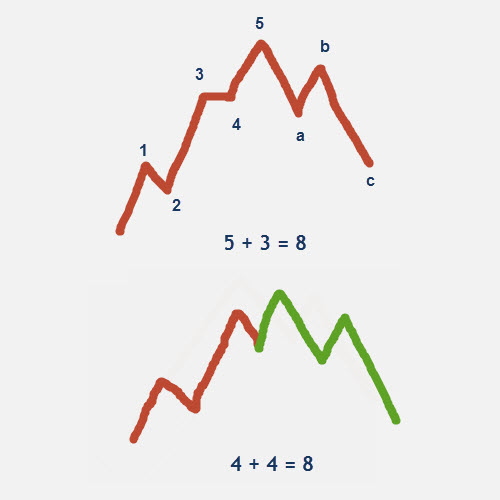

Perhaps the most fundamental concept of Elliott Wave theory is that price moves in impulsive waves which consist of five moves, and then corrective waves which consist of three moves. I know it can get more complicated, with extensions of waves, but let’s keep it simple for now.

Most people who have discussed with me the relationship between Hurst Cycles and Elliott Wave see this five and three wave combination as being a point of difference, but in fact it is a remarkable point of commonality between the two approaches.

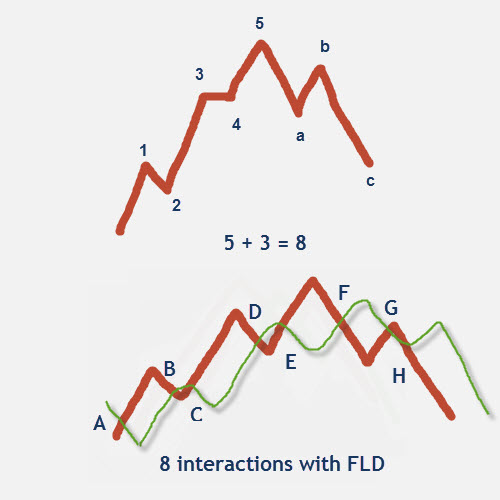

Let me explain: Hurst Cycles lead us to expect M-shaped cycles, which consist of four waves (the basis of the “sentient trading methodology”). We also know that the ratio between the wavelengths of adjacent cycles in Hurst’s nominal model is mostly 2 to 1, and so for each longer cycle we have two iterations of the shorter cycle. (For instance the 80-day cycle encompasses two 40-day cycles). As each shorter cycle consists of four moves, the longer cycle consists of eight moves. And so we have the commonality of 5 + 3 = 8, and 4 + 4 = 8.

8 waves and 8 interactions

You probably know that I like to trade the interaction between price and the FLD (the FLD Trading Strategy). There are eight interactions between price and the 20-day FLD within each 80-day cycle. There is that number 8 again. This is another common ground between the two approaches.

There are many further areas of discussion. Head over to the Hurst Cycles website to read the full post and add your own thoughts to the discussion.

Have a great week and profitable trading!