You will come across specific terms in these notes (FLD, VTL, and so on). Rather than explain them each time, you will find definitions here: guidance notes for Hurst cycles terminology

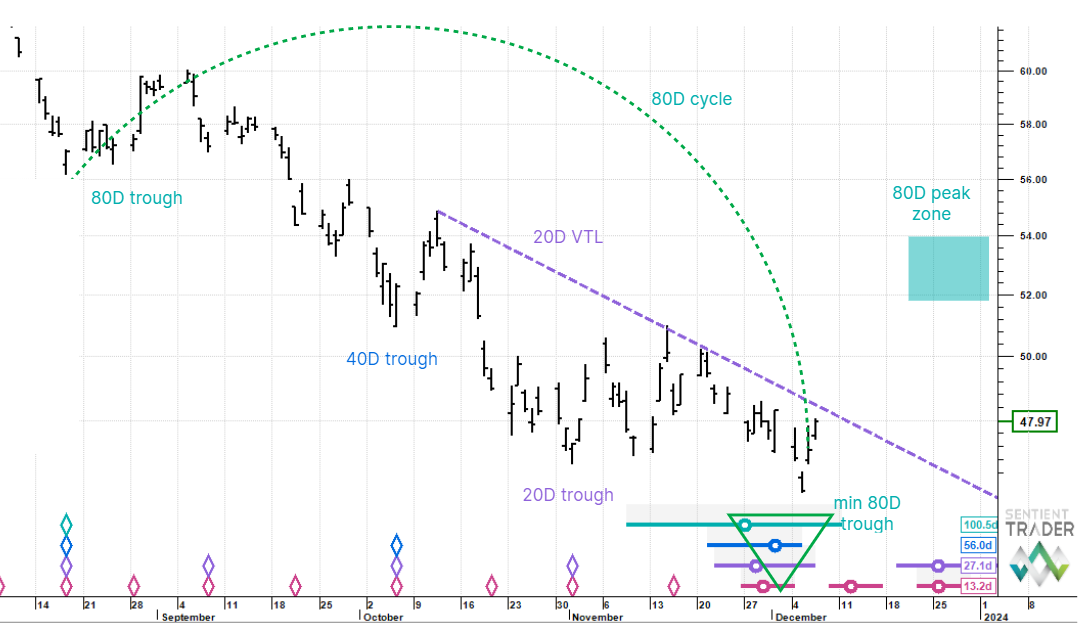

Lithium ETF – near term minimum of 80 day cycle trough at hand.

Two days ago we published the longer term analysis for Lithium ETF. The takeaway was: ingrained downtrend to next July but “bump ups” along the way. We think we are rolling through the first of these bump ups, the 80 day cycle trough. We need the down-sloping 20 day VTL just above current price to clear to the upside to begin the confirmation process, and if this happens, preferred view, we would be looking for a move up towards a left translated (early) 80 day cycle peak above 52 and around month end. After which, and refer to the long term analysis, we would be looking for a resumption of the downtrend.

A couple of other technical indicators (non Hurst) to consider:

1) we have a real gap down-real gap up “island reversal” three sessions back;

2) the move down from 15 November is an Elliott wave “ending diagonal” downtrend termination pattern.

This post was first published on Hurst Cycles Notes.