You will come across specific terms in these notes (FLD, VTL, and so on). Rather than explain them each time, you will find definitions here: guidance notes for Hurst cycles terminology

SPX E-Minis – 40 day cycle peak in place? Bearish forces at work on several timeframes.

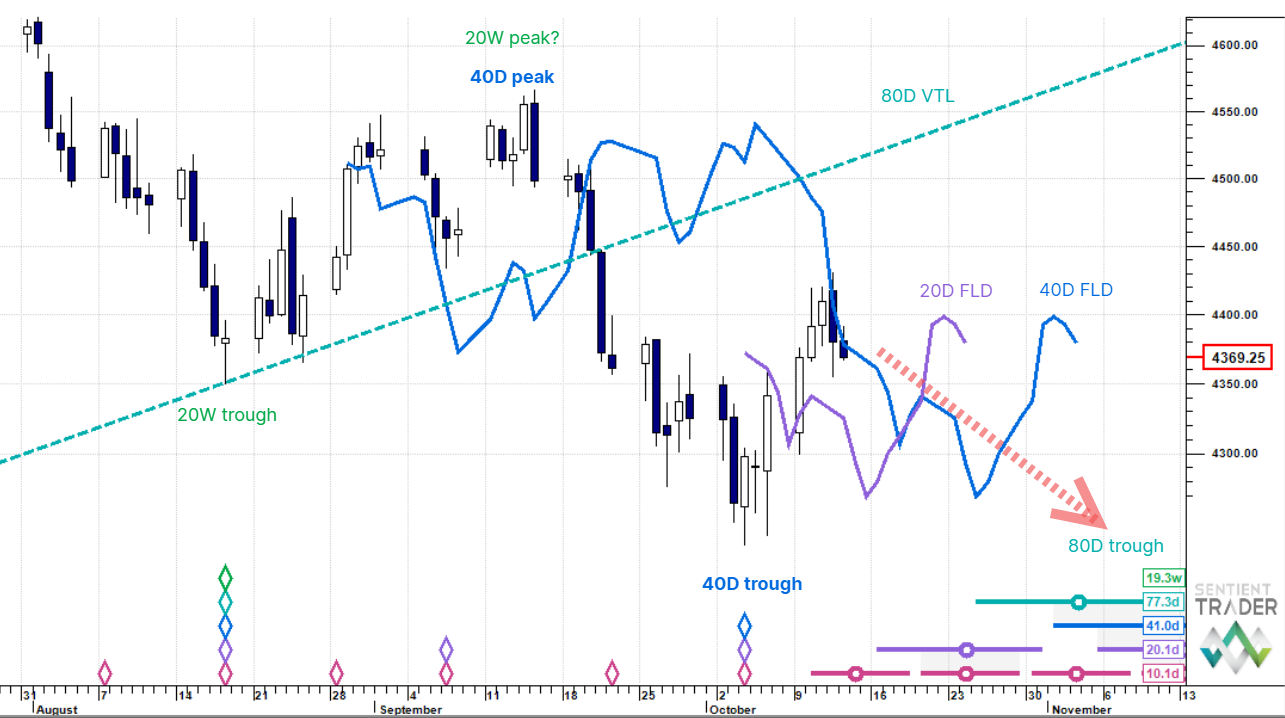

In Monday’s macro outlook report, the down arrow started pretty much at the local peak yesterday and more or less at yesterday’s date, the assumption was that the 40 day cycle would top out here. So let’s analyse what has happened since then and what is likely to happen going forward.

The 20 day FLD was crossed up on Monday and in a neutral market projects to 4,415. Yesterday’s high was 4,430, so that’s a slight overshoot, but the buyers were unable to control the high. Price was also rejected aggressively at the 40 day FLD, which provides some “evidence” that the 40 day cycle may have peaked. If that is the case then it peaked only 8 days after the trough. The average length of the 40 day cycle here is 41 days, which means that the cycle peaked at 19.5% of its estimated wavelength, which is left translated and bearish.

Is there any other bearish evidence? Yes. The 40 day FLD was crossed down by price on 20 September and the neutral market downside projection was 4,401. However, price came in at the 40 day cycle trough at 4,235. This is a downside overshoot and bearish. Also, if we look at the whole down zigzag structure from the end July top the first leg down was 6.1% and the second leg down was 7.3%. So clearly there are broader bearish forces at work.

What else? The mid August trough was at least that of a 20 week cycle (and perhaps a 40 week cycle too) and this low has already been taken out to the downside. Also, the 80 day VTL was crossed down savagely on 21 September, so it looks like the 20 week cycle has also peaked which means this down-swinging long cycle is weighing broadly on prices.

The 80 day cycle trough is expected around mid-November and our preferred view is down towards here, possibly even testing the early October low. It wont be a straight line, there is a 20 day cycle trough due on 25 October, but that’s the broad sweep in our view.

This post was first published on Hurst Cycles Notes.