In early February I suggested that the 20-week cycle trough had formed early, implying new highs in the S&P 500. We have seen new highs since then, and the 20-week trough seems likely to have occurred at the beginning of February 2015.

In November 2014 I forecast an expected time for the 9-year cycle peak in stock markets, and I said this:

And there finally is the answer to our question: we expect the bull market to continue until about March 2015 (where the first peak of the 18-month cycle is likely to form). There will be another run up which will complete in about October 2015, but it is unlikely to exceed the earlier peak. – See more at: http://hurstcycles.com/the-9-year-cycle/

To receive these blogs as soon as they are posted Join/Like/Follow Us. If you don’t do social media – click to Join Feedburner to receive these blogs by email.

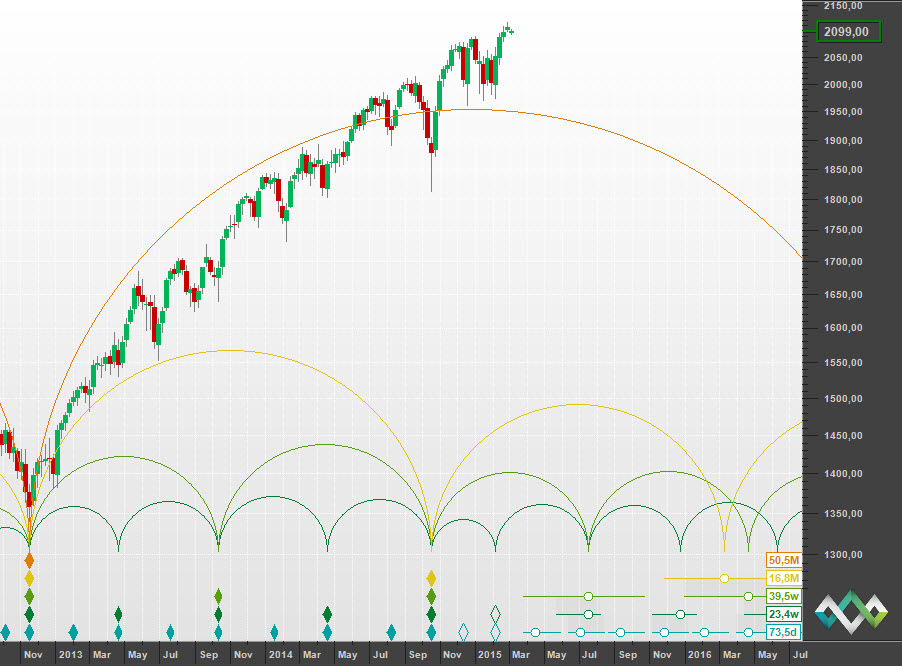

Well March 2015 has arrived, and so it is time to refine that forecast. In my opinion it all boils down to where we place the recent 18-month cycle trough. Here is the option with that trough in October 2014:

This implies that we are early in the central 18-month cycle of the current 54-month cycle. The peak of this 18-month cycle could occur in the first or second 40-week cycle. The first peak is expected in April – May 2015 (or any time soon), and then there will be a second peak in October – November 2015.

And so (according to this analysis) there has been a small change since my November 2014 forecast:

- Firstly there is a month or two delay for the first peak.

- And secondly the “other run up expected to complete in October 2015” might provide us with a new high.

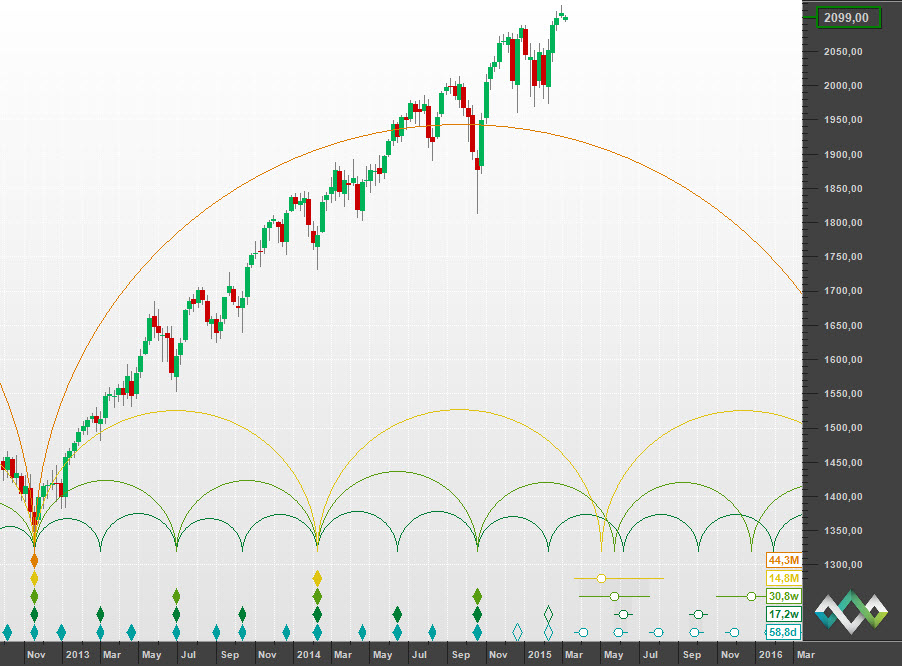

The other alternative in my opinion is that the 18-month cycle trough occurred in February 2014, and that the October 2014 trough was of 40-week magnitude:

This analysis implies that we are already much later in the central 18-month cycle of the current 54-month cycle, and that the approaching peak is likely to be the peak of the 54-month cycle. Of course there will still be a bounce up to a peak in about October 2015, but it is not likely to exceed the peak which should form soon, and so this analysis conforms more closely with my original forecast.

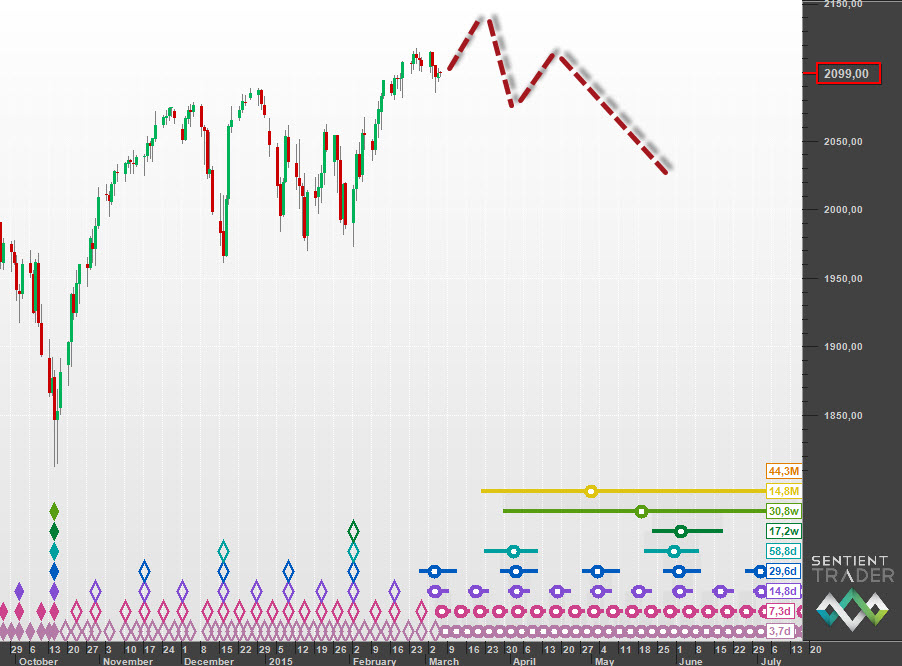

According to this analysis price should bounce out of a 40-day cycle trough soon, and the peak I have been looking forward to since November last year should form soon. Here is a closer view where I have marked a very rough expectation for price over the next few months:

This analysis has neat nests-of-lows which is always a good sign, and increases my confidence in it.

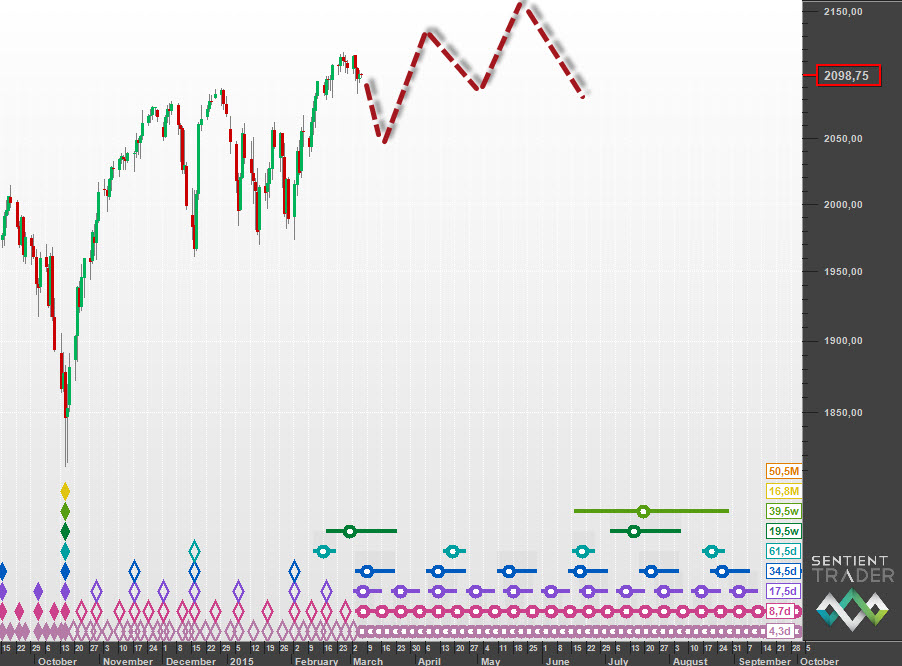

On the other hand it is still possible that the 20-week cycle trough didn’t form in early February 2015, in which case this chart shows what is expected:

There are two main differences:

- In the immediate term (next week or two) it implies a strong bearish move, as opposed to the bounce out of the 40-day cycle trough expected by the other analysis.

- The peak in late April or May is expected to be a higher peak, whereas in the other analysis it is expected to be a lower peak.

I think it will be interesting to see which analysis shows itself as the true one, and we should know that very soon. A strong move down now would imply the second analysis with a 20-week cycle trough forming soon, whereas a bounce up soon would imply the first analysis with a 40-day cycle trough forming now.

And in terms of the final peak of the 9-year cycle, that will depend on the correct position of the 18-month cycle trough.

Have a great week and profitable trading!

(This post was first published on the Hurst Cycles website here: http://hurstcycles.com/the-next-peak/)