One of the results of the way in which cycles combine to influence financial markets is something Hurst called the “Mid-Channel Pause”.

The mid-channel pause is, as the name implies, a pause in price movement which occurs “mid-channel”. But you don’t need to construct any channels in order to identify the mid-channel pause. It is simple to identify, and is a wonderfully powerful cyclic structure which gives you a real edge in terms of knowing what to expect next. Mid-channel pauses offer that rare trading opportunity: a high-confidence, highly profitable trade.

This week the EURUSD forex pair provided us with a text-book perfect example of a mid-channel pause, and so I am taking the opportunity to record this example, in the hope that it will provide a good reference to help you identify mid-channel pauses in the future.

First of all, what is the mid-channel pause?

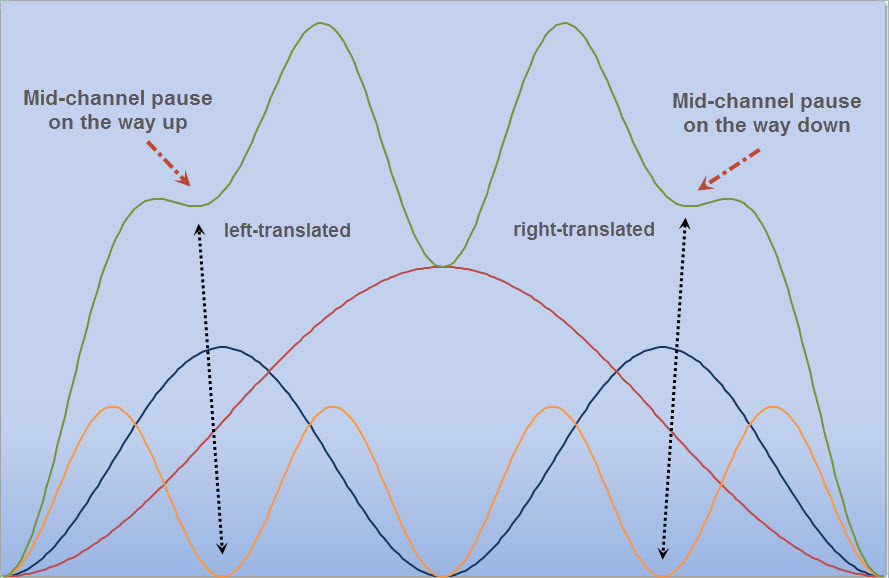

The mid-channel pause is a pause in price movement that occurs on the way up towards the first peak of the M-shape that cycles create in price movement, and then occurs again on the way down from the second peak of the M-shape. Here is a graphic showing both mid-channel pauses:

Price is represented in the graphic by means of the green line, and it is calculated as a composite of the three cycles shown at the foot of the graphic (the red, blue and orange lines). This combination of cycles is probably familiar to you – it is the way we Hurstonians usually explain how multiple cycles combine in a price movement.

Why does the mid-channel pause form?

The mid-channel pause forms because of the way in which cycles combine to influence price movement (according to Hurst’s Principles). In particular the way in which three cycles combine (three adjacent cycles in the nominal model). In the graphic above it can be seen that as the shortest (orange) cycle is forming a trough the next longer (blue) cycle is forming a peak. It is this combination of contradictory impulses that results in the mid-channel pause.

When does the mid-channel pause form?

The mid-channel pause forms on the way up at the first trough of the cycle which is two degrees shorter than the cycle which formed the “initial” trough. That is a bit of a mouthful, so let me try to clarify … in the graphic above the left edge of the graphic is where the red cycle is forming a trough. I call this the “initial” trough because it is where the pattern starts. The cycle two degrees shorter than the red cycle is the orange cycle … and so the mid-channel pause forms at the first orange cycle trough.

On the way down the mid-channel pause forms at the last trough of the cycle two degrees shorter (before the final trough of the longer cycle).

There is an important subtlety that I have highlighted in the above graphic. Notice how the mid-channel pause on the way up is left-translated. In other words the actual trough in price (the green line) occurs to the left (or before, considering that the x-axis is the time axis) the actual trough in the orange cycle. And the mid-channel pause on the way down is right-translated. This is really important, and is not some kind of “the markets are not perfect” expectation – it is the simple result of the mathematics of combining the cycles.

It is worth stating this point again: The trough in price occurs before the trough in the cycle on the way up, and after the trough in the cycle on the way down.

What can we expect from a mid-channel pause?

Now that we know what a mid-channel pause is, what can we do with that? A mid-channel pause has certain qualities which we can use to inform our trading. These qualities are:

- A mid-channel pause is a time of consolidation, a pause in price movement. This very often manifests as a contracting triangle. Other classic consolidation patterns are also found.

- The trough of the cycle at which the mid-channel pause forms is left-translated. Which means that we expect the trough in price to occur before the trough of the cycle is expected. When we see a mid-channel pause forming we should stand by for an earlier-than-expected bounce out of the trough of the cycle that is the shortest cycle in the mid-channel pause formation (the orange cycle in the graphic).

- The trough of the cycle at which the mid-channel pause forms is a shallow trough. This means that we do not expect price to come down into an obvious trough of the cycle that is the shortest cycle in the mid-channel pause formation (the orange cycle in the graphic). Combined with the fact that this trough can occur early we need to be ready to take quick action with a mid-channel pause, not wait around until we have seen a good clear trough form.

The mid-channel pause in the markets

Enough looking at idealized graphics! What does the mid-channel pause look like in the markets? Here is the text-book example that played out in the EURUSD this week:

The long cycle, the trough of which I consider the “initial” trough is the 40-week cycle, and the initial trough occurred on 3 December 2015. The 40-week cycle is therefore the red cycle in the graphic above. The mid-channel pause is expected to form at the first 80-day cycle after that trough. The 80-day cycle is two degrees shorter than the 40-week cycle (40-week > 20-week > 80-day).

Notice all the qualities of the mid-channel pause are present:

- The contracting triangle consolidation.

- The left-translated trough in price – that very perfect nest-of-lows for the 80-day cycle is centered around 6-7 February 2016, whereas the trough in price formed about a week earlier (29 January 2016, or one could argue that it occurred over the weekend of 30-31 January 2016).

- And the trough is a very shallow trough. If we accept the trough on 29 January 2016 as the trough of the 80-day cycle, then price fell for only one day into that trough! Not what you would normally expect from an 80-day cycle trough.

If you are interested in further discussion of this mid-channel pause, including the use of a VTL to confirm the formation of the trough, and the interaction between price and the FLD during a mid-channel pause then please take a look at the full post on the Hurst Cycles site.

You should be aware that mid-channel pauses do not always form, but when they do they offer wonderful trading opportunities.

Join me on Monday for our Hurst Trading Room Live webinar in which I will be discussing the mid-channel pause in further detail. Register here: http://0s4.com/r/HTREG and check your timezone here: http://0s4.com/r/HTTIME