In September I discussed reasons why I expected the Euro to turn up in November or December of this year. That time is upon us, and I am watching the Euro carefully to see whether it is going to manage a turn up.

I presented various ideas about the magnitude of this trough in September, but rather than going back over that and getting distracted by longer term considerations, I find it easier to focus on the fact that the trough I am expecting should be of at least 40-week magnitude.

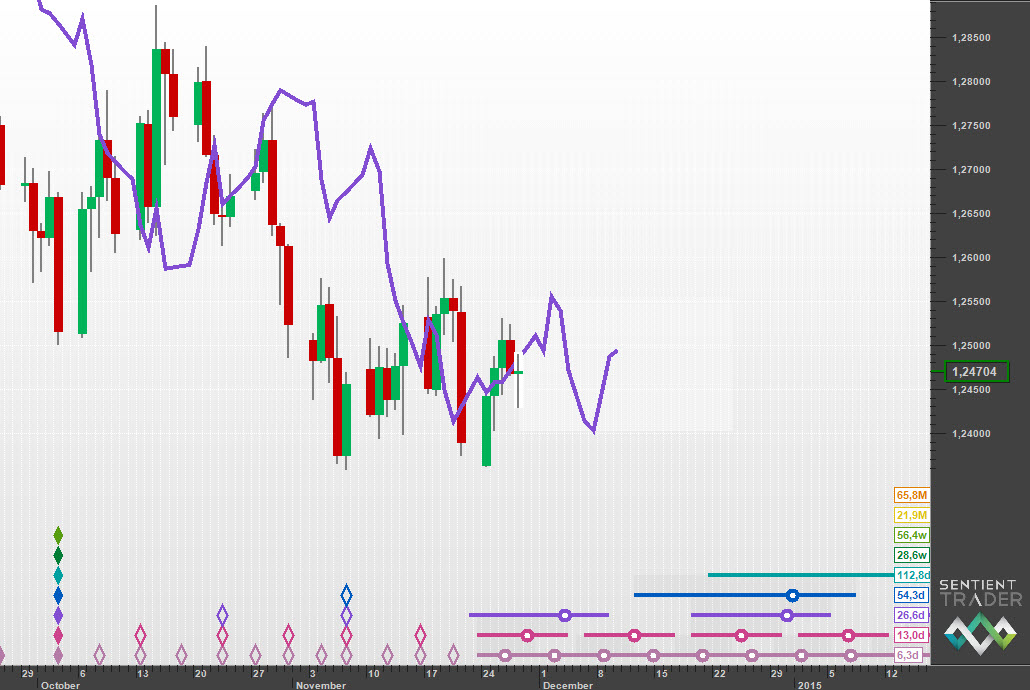

There is the possibility that the 40-week trough did form in October, as shown in this chart:

That provides us with a bearish outlook for the next six months or so. The bearish shape of the 40-day cycle into the November trough is clear (early peak, lower closing trough), but something interesting has happened since then: the 20-day cycle from 7 November until 24 November is not bearish … and so is it possible that we are seeing a turn up?

I think it is possible, and this is the analysis that might be playing out:

That doesn’t look much like a bounce out of a 40-week cycle trough, but not all troughs form perfect V-shapes. Often we see the first cycle or two of the shorter cycles seem to struggle to develop much bullish power before the market does eventually leap upwards, and the trough becomes apparent.

Whether that happens here remains to be seen, but it is not impossible that the 40-week cycle trough did form on 7 November 2014.

I will be watching the Euro very carefully over the next week or so because it is at a critical juncture.

Let me know what you think is happening. Have a great week and profitable trading!