One of the reasons that I enjoy trading using Hurst’s cyclic principles is because it is a robust trading method. What I mean by this is that the trading decisions one makes are largely unaffected by analysis uncertainties.

The analysis of financial markets is not pure science. It is a learned skill, an art even, something that one strives constantly to improve. And that is why it is so useful to work with a robust trading method which is not entirely dependent on a perfectly accurate analysis.

The bounce out of last week’s trough provides a perfect example. My two most recent posts explained that I was short term bullish because of expecting a bounce out of a 40-week cycle trough. Indeed the market bounced, and has come right back to the level of the 18-month VTL that I wrote about three weeks ago (and which I mentioned would provide a good target for the bull move).

But as the market bounced I started examining more carefully what trough it was bouncing out of. A comment to last week’s post made the suggestion that it might be an 18-month trough, and a post this week on the Hurst Cycles site which discusses an outstanding 9-year FLD target made me look at the options.

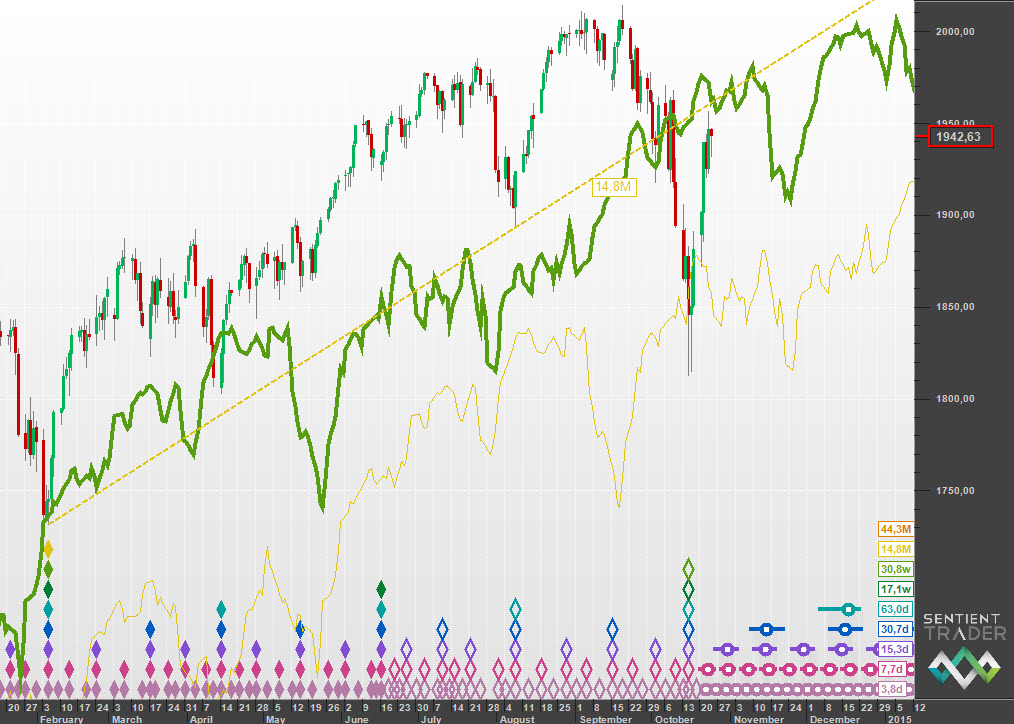

The fact is that both options are very viable, but the great thing is that it makes very little difference in terms of my trading decisions. Here is the option that I have been looking at, with the 40-week cycle trough formed last week:

The important points to note here are:

- That the VTL that was crossed by price in early October was the 18-month VTL. This means that the 54-month cycle peak has probably formed, which is at odds with the outstanding 9-year FLD target that John discussed.

- Price has bounced back up to that VTL, as it very often does (as I mentioned in this post)

- Over the next two weeks price faces resistance from both the 18-month VTL and the 40-week FLD.

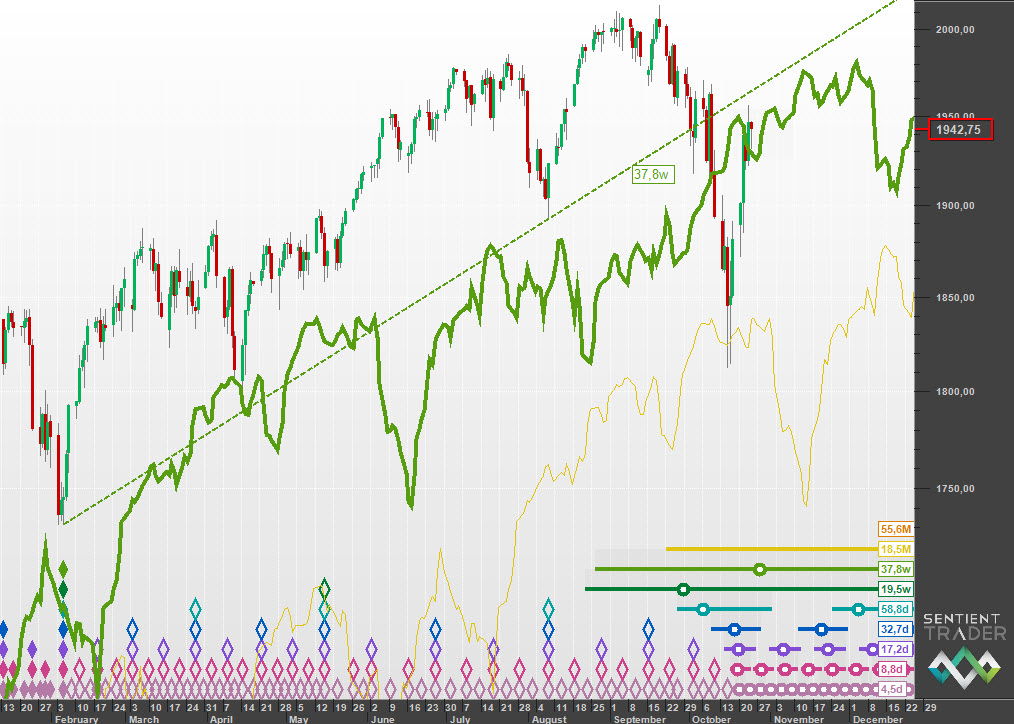

It is also very possible that we have just witnessed an 18-month cycle trough, as shown here:

And the important points here are:

- That the VTL that was crossed by price in early October was the 40-week VTL. This means that the 18-month cycle peak was confirmed, which might or might not be the 54-month cycle peak, and therefore allows for the possibility of another new high as suggested by the outstanding 9-year FLD target that John discussed.

- Price has bounced back up to that VTL, as it very often does, and so for immediate trading purposes there is very little difference.

- Over the next two weeks the market still faces fairly substantial resistance from both the 40-week VTL and the 40-week FLD.

This debate about the magnitude of the recent trough is a fairly academic one. When it comes down to actually making trading decisions they would have been very similar no matter which analysis one chose.

Hurst wrote that whereas different analysts would reach different analysis results, the end result of trading decisions would most often be the same. How I wish he could see the evidence of that in our discussions today!

The debate about the magnitude of the trough is a fairly academic one, but of course there are differences, which can be summarized as:

- If the recent trough was of 40-week magnitude that is more immediately bearish, because we do not expect a higher price than the high of late September, and we expect a much deeper (lower) trough in about 9 months time.

- On the other hand if the recent trough was of 18-month magnitude then the outlook is more bullish in the near term, and we would expect to see new highs (up to the target of 2150 as discussed by John). And the trough in 9 months time would possibly not be at a lower price, as the market will probably hold up for longer. However even if this is a more immediately bullish outlook we still expect the bearish move down into the next 54-month (and 9-year) cycle trough, it will just happen a little later.

Please read the full post on Hurst Cycles in which I dig a little deeper, and also take a look at John’s post about that 9-year FLD target, and the discussion that is taking place around that.

Have a great week and profitable trading!