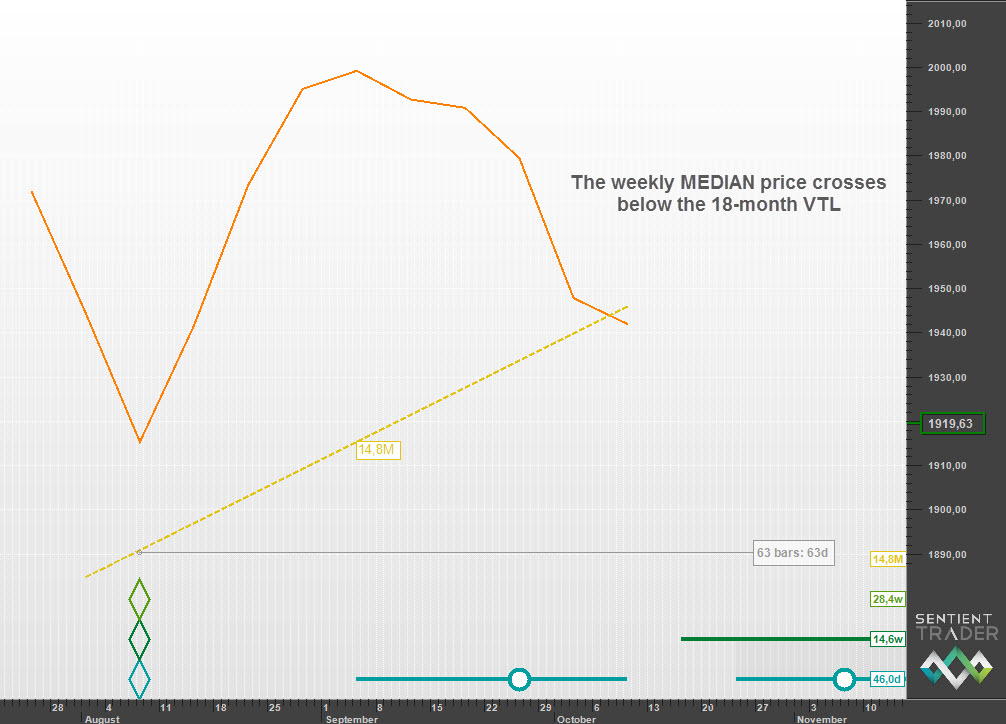

I wrote last week about price crossing below the 18-month VTL, and mentioned that I would want to see the median price on a weekly chart cross below the VTL before declaring that the 54-month cycle peak was behind us. That happened this week:

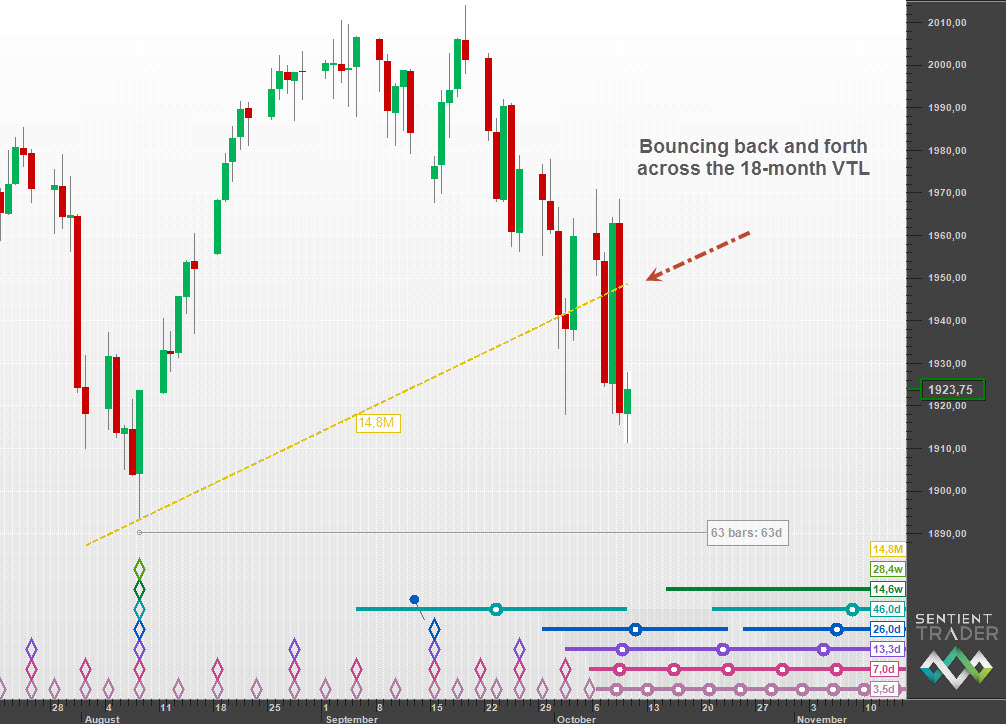

The week was characterized by big-range alternating up and down moves. When that happens I always suspect it is because price is struggling to cross an FLD or a VTL, and of course this week it was the 18-month VTL:

With the 54-month cycle peak behind us we are looking at a bearish year or two, and I wouldn’t be surprised if that bear starts exerting itself fairly soon after the 80-day cycle trough we are expecting now. And so although short-term the outlook is bullish with a trough of the 80-day cycle expected soon, in the medium to long term I am definitely turning bearish.

If you would like to read more about why I am turning bearish, please take a look at this post on the Hurst Cycles site: http://hurstcycles.com/turning-bearish/ Let me know what you think about the analysis option presented there!

Have a great week and profitable trading!