I recorded a Hurst Trading Room podcast this week about the fact that the S&P 500 has breached the 20-week VTL. (It was in fact a record-breaking podcast – my shortest ever podcast at a mere 15 minutes!)

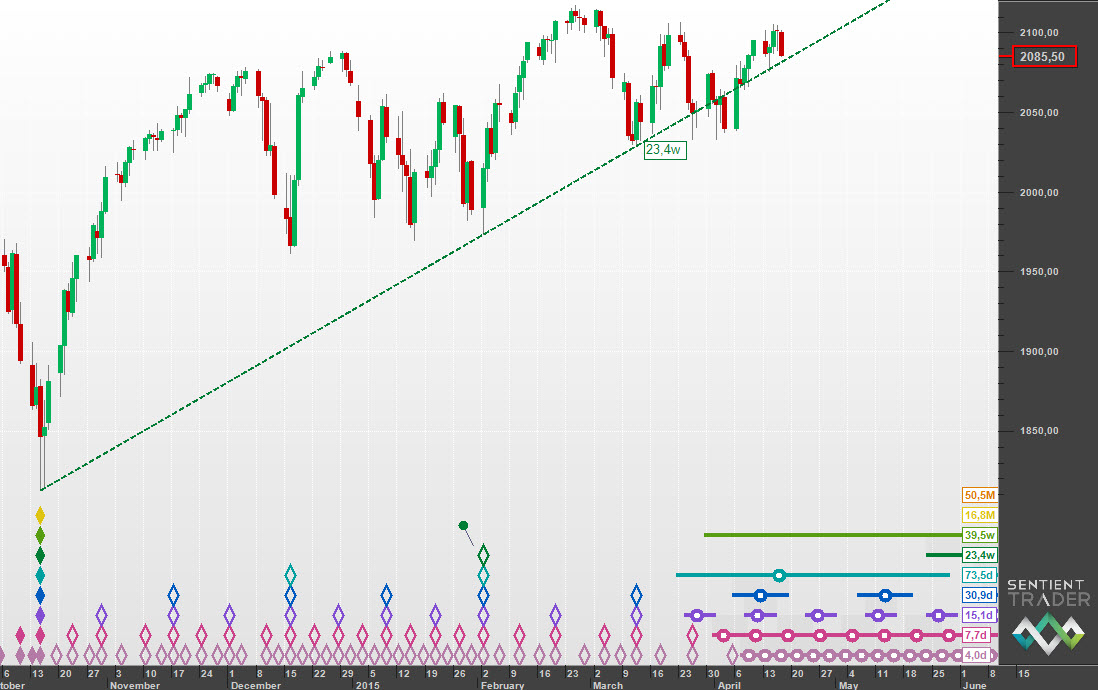

This breaching of the VTL is true for both of the most likely positions for the 20-week cycle trough. Here is the analysis with the trough in March 2015:

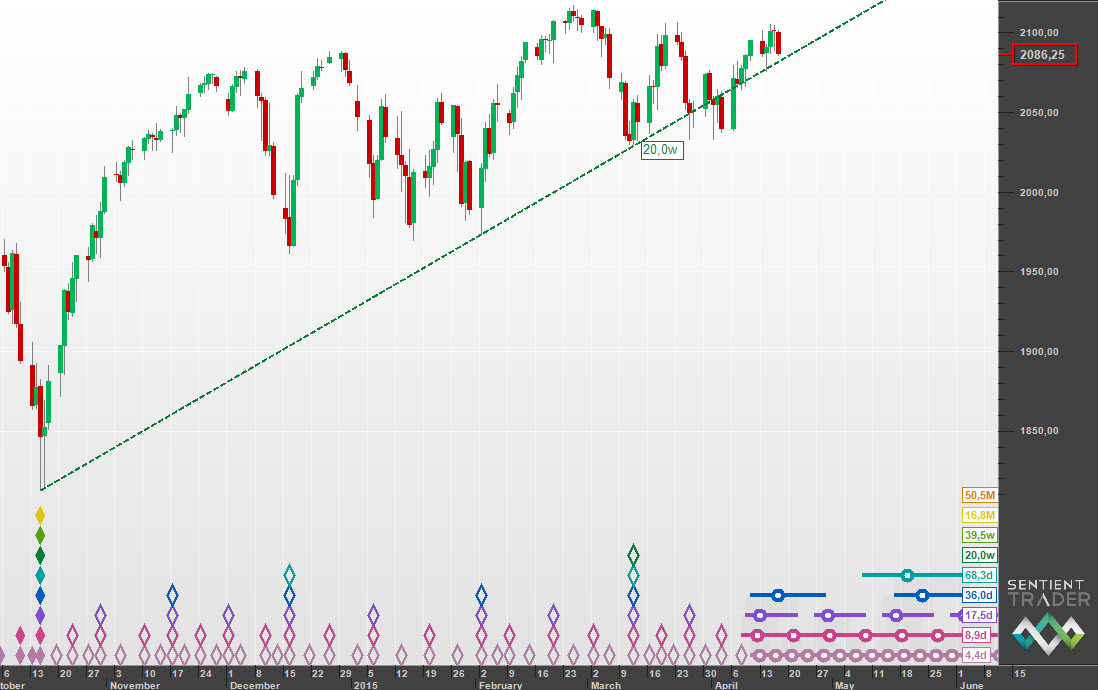

And here is the analysis with an early 20-week cycle trough in February 2015 (as discussed here):

In both cases the 20-week VTL has been breached to the downside, which means in theory that we have seen the peak of the current 40-week cycle. And so profits are likely to made on the short side from now until the 40-week cycle trough.

There is a third possible position for the 20-week cycle trough of course, which would mean that the 20-week VTL has not been breached at all. That position is in the first week of April 2015, either at the low of 1 April, or over the Easter weekend (3-6 April).

Positioning the 20-week cycle trough there would make a big difference in terms of what we expect to happen in the markets, and so it is an important consideration. I present an argument against positioning the 20-week trough there, which is unorthodox but nevertheless compelling. You can read all about it in this post on the Hurst Cycles website.

If my assumption that the trough in the first week of April 2015 is not a 20-week cycle trough, but an 80-day cycle trough then this gives us a clear picture of what to expect next:

A move down to an early 40-week cycle trough in June this year. We will get some ups and downs on the way of course, the most notable of which will be the 40-day cycle trough in early May.

Profitable trading! (Even if it is on the short side)