This Cycle Outlook has been kindly provided by David Walling.

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by the contributor.

Greetings,

One of my stock screens brought up some oil related tickers so I thought it was time to see what Sentient Trader had to say about the future outlook for crude and two of the ETFs that are related to it. The following shows what I found out.

/CL – I always find it reassuring when another instrument forms it’s 18-month cycle trough around the same time that the US stock indices form their troughs. Here is Sentient Traders Analysis indicating that the 18-month trough in crude oil formed on July 20th. This analysis is of ST’s own doing without any pinning on my part to influence the analysis in any way. Also, as of Friday’s close, price is 17-days out from the 18m cycle low, which provides timing for the formation of the 20day cycle trough. Therefore, I will be looking to see if price starts to move up again on Monday, August 9th.

XLE – is the oil sector ETF and according to this analysis, which I have influenced, it is saying that the odds are the 18-month cycle trough formed on July 19th—same as crude. Furthermore, the composite line is projecting good things for this ETF as it moves out of its 20d cycle trough.

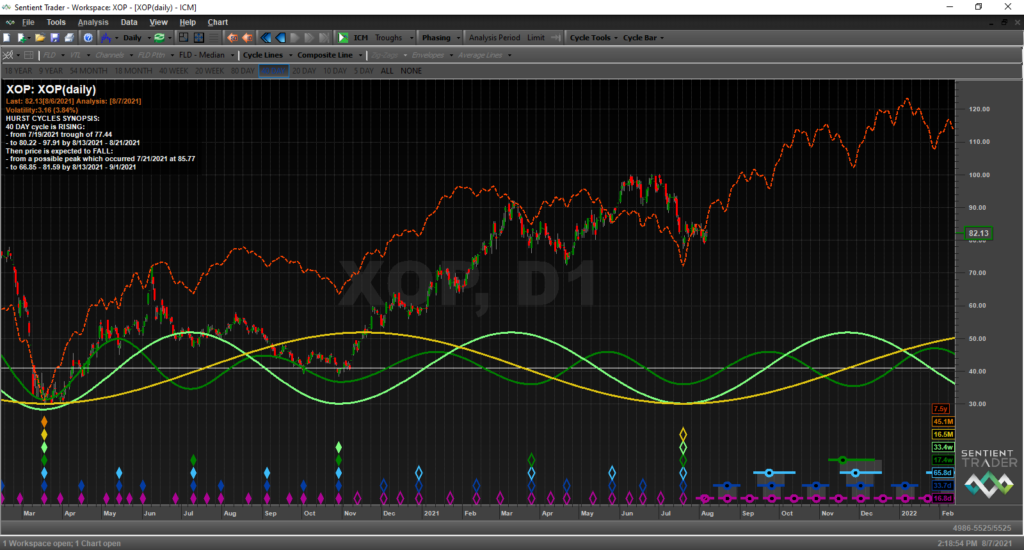

XOP – is an oil producers ETF. It is also showing that the 18m cycle trough formed on July 19th. As you can see, I have not recently influenced the analysis in any manner—last time was pinning a trough in 2016. Once again, Sentient Trader’s composite line is suggesting good things lie ahead for this ETF and many of the stocks that make it up—of course this assumes that the analysis is correct.