This Cycle Outlook has been kindly provided by David Walling.

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by the contributor.

Greetings,

I’ve been a little frustrated by the slow price action we’ve seen by price moving out of its 18m cycle trough, particularly in the indices. I’m also concerned that the SKEW has persistently stayed up and was up another 6 points yesterday. Therefore, I went to Sentient Trader to see what might be going on. The attached shows what I’ve found.

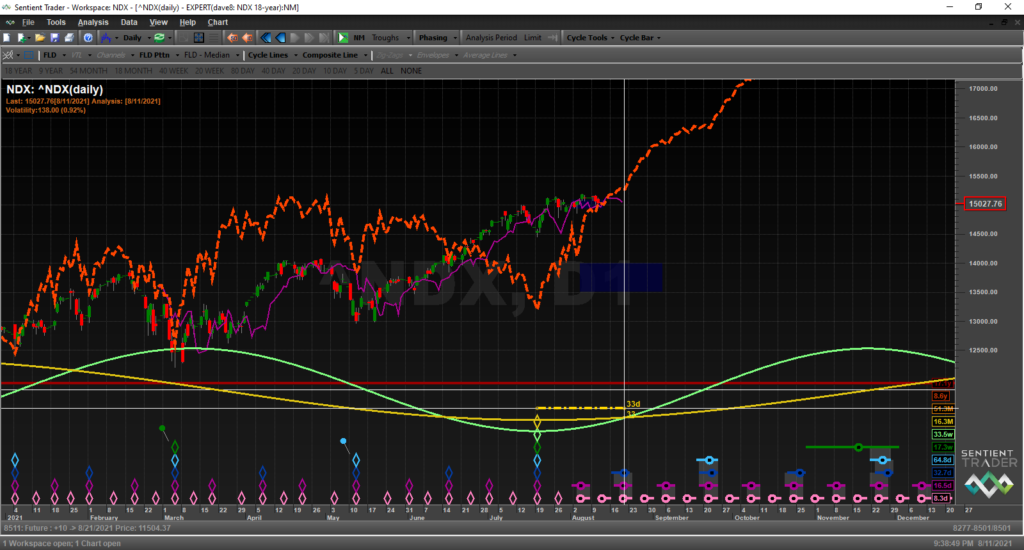

NDX – 40d cycle trough is due around August 21st. One note of concern NDX has a 20d FLD upside target of 15,394.57. It is currently 210.30 points shy of that target with time running out to achieve it. If it does not reach that target and if the target into the 40d trough is exceeded, that would be very concerning to me. The Composite Line is projecting a strong start to this 18m cycle; so far, the move out of that trough has been tepid.

XLC – 40d cycle trough due around August 20th.

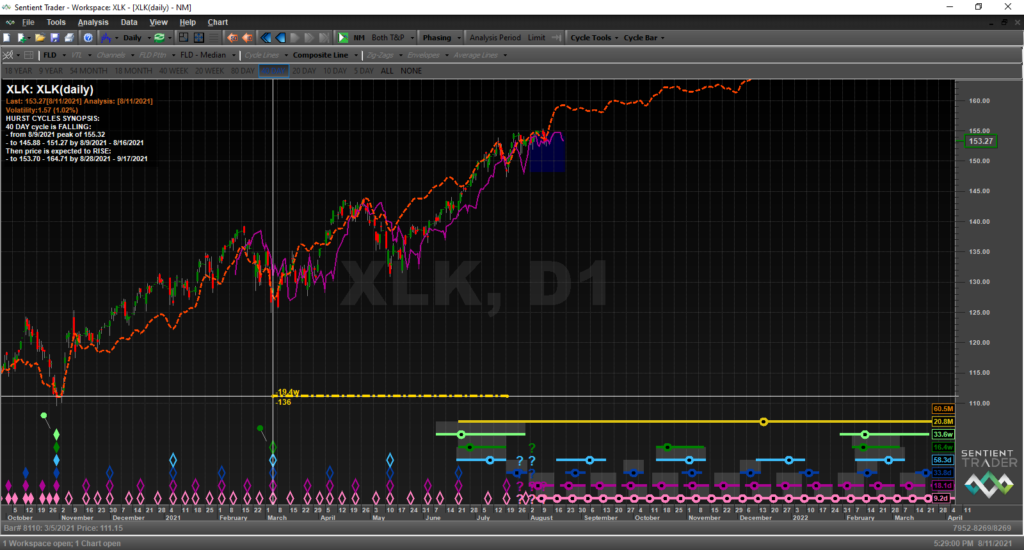

XLK – ST has not yet confirmed the formation of the 18m trough despite timing.

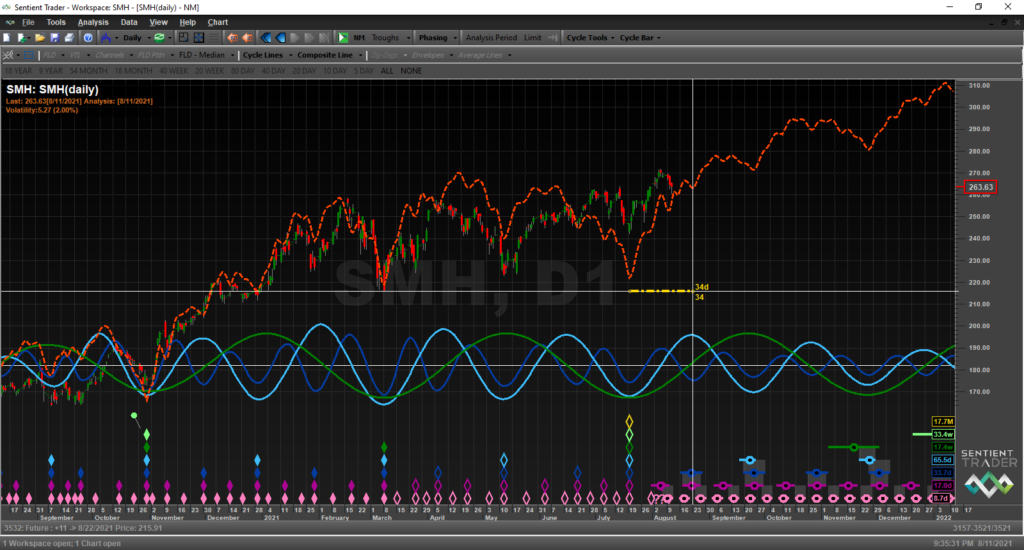

SMH – semiconductors. Looking for the 40d trough to form around August 22nd.

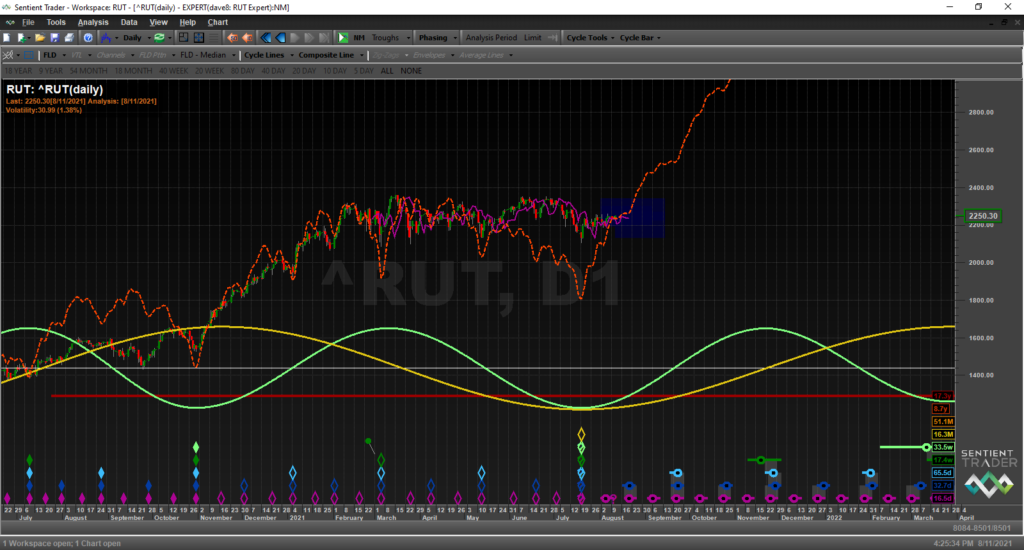

RUT – 40d trough expected around August 22nd. Has not yet met its 20d FLD target of 2301.30. Price still seems to be caught in a large Pause Zone.

SPX – 40d cycle trough expected around August 20th. Despite breaking out of a Pause Zone, SPX has yet to achieve its 20d FLD price target of 4,526.53.

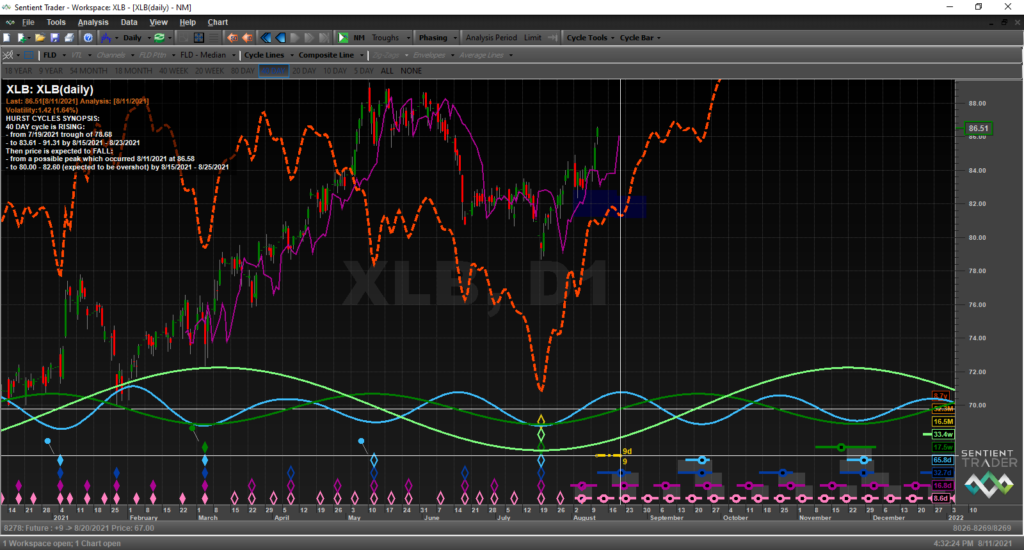

XLB – this materials ETF has had a very strong move out of its 18m cycle trough. The 40d trough is expected to form around August 20th.

XLE – is still struggling to move out of its 18m cycle trough.

XLF – like XLB it has had a very robust move out of its 18m cycle trough. Its 40d cycle trough is expected to form around August 20th.

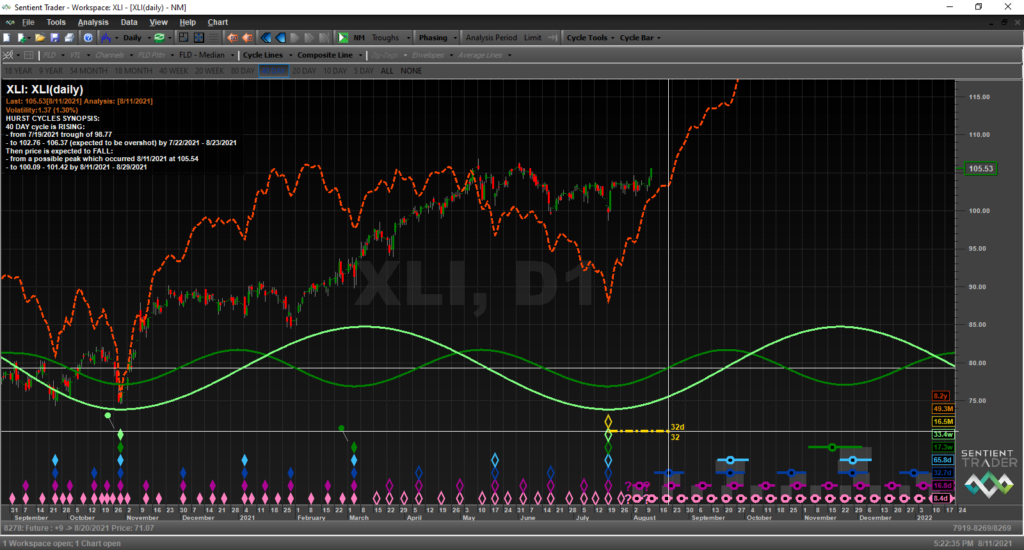

XLI – is expected to form its 40d cycle trough around August 20th.

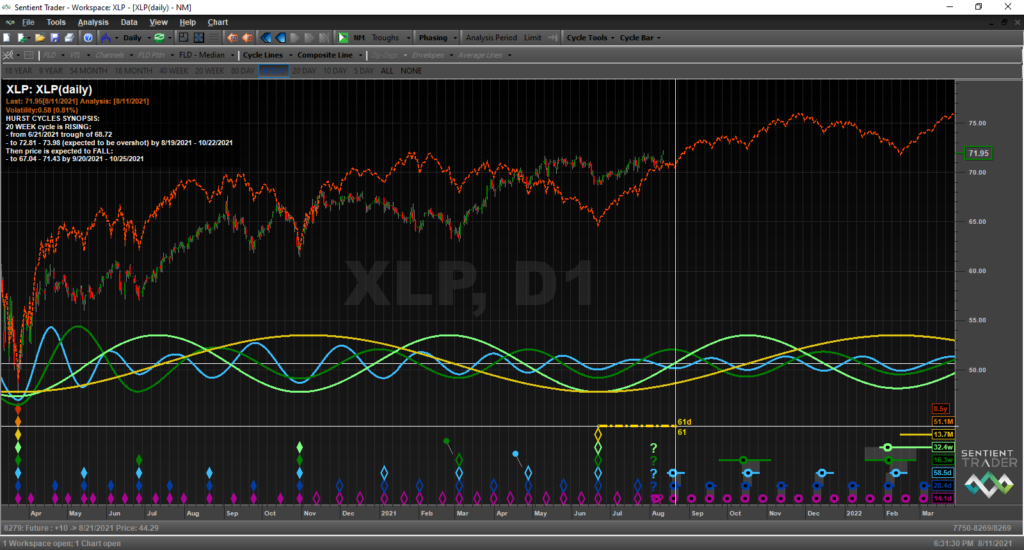

XLP – is expected to form its 80d cycle trough around August 21st.

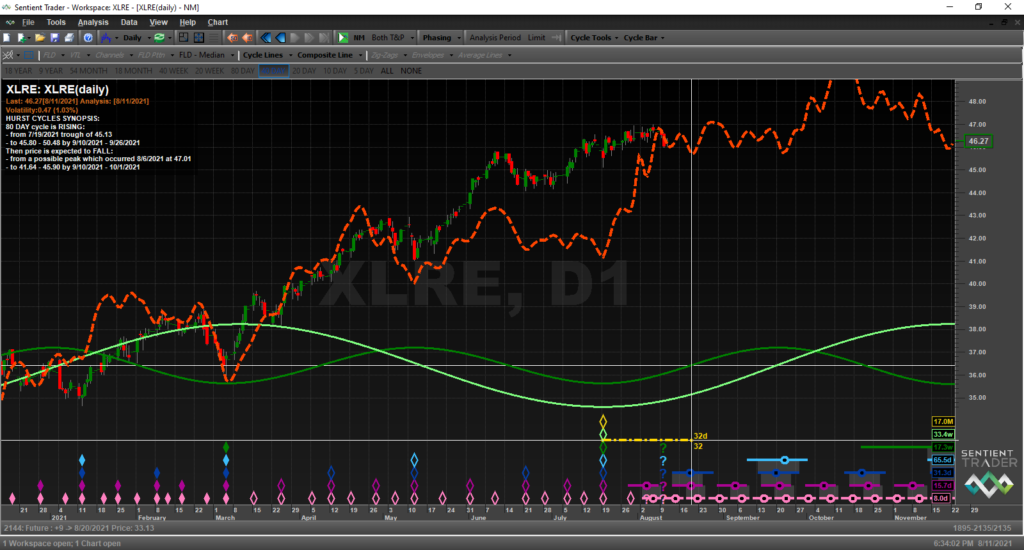

XLRE – has had a very subdued move out of its 18m cycle trough. It is expected to form a 40d cycle trough around August 20th.

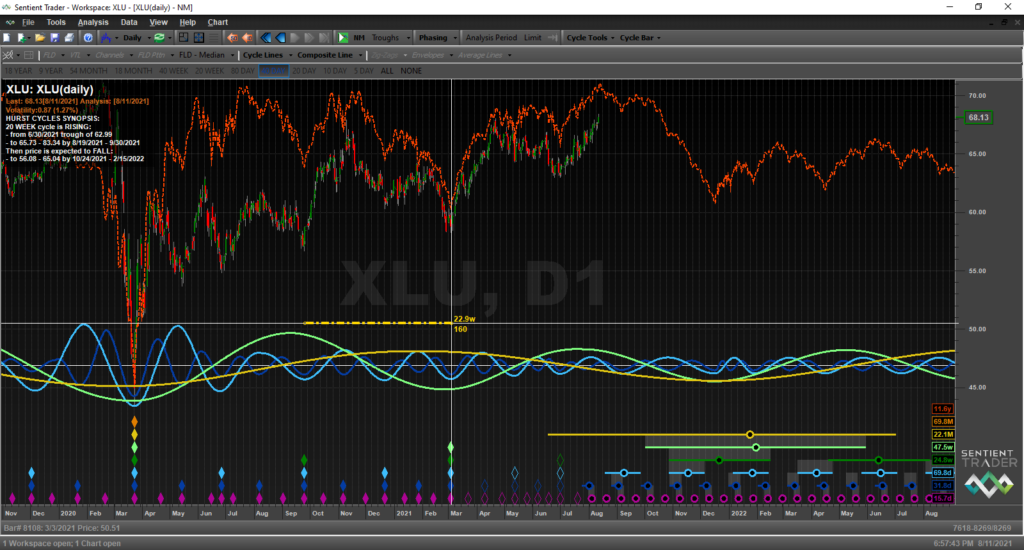

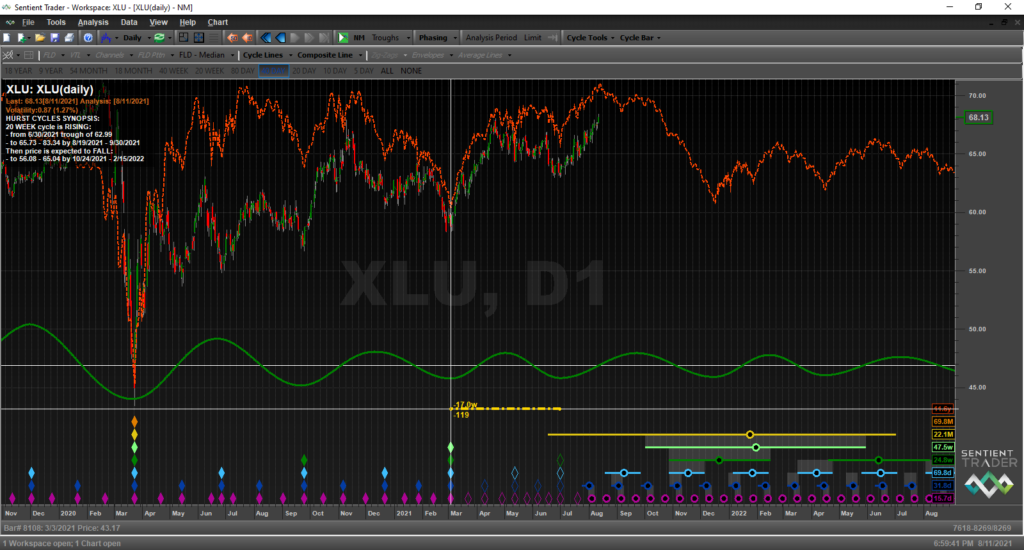

XLU – not all trading instruments precisely fit the nominal model all of the time. It’s interesting to note that on page 33 of Hurst’s book, The Profit Magic of Stock Transaction Timing where he discussed the nominality principle, he identified a 26w cycle. Then, when he developed the cycles course, the 13-week and 26-week cycles, which he had written about earlier, disappeared and were replaced by 20-week and 40-week nominal cycles. (From here on you could say I’m getting out over my skis a bit) Apparently, at one point in time he saw this 26-week beat frequently enough that he thought it should be identified as a nominal cycle. For the most part when looking for cycles in the market I most often experience the 20-week and 40-week cycles being the most prevalent. However, there are times when a very prominent 26-week cycle shows up on the chart. And when this occurs, I struggle as to what to do with it. Last year on September 26th, a very prominent cycle formed in XLU at 26.4 weeks. This was followed by another long cycle of 22.9 weeks—see chart below.

It wasn’t until the third 20-week cycle formed did things get back to a more nominal cycle beat. However, where almost all other sector ETFs have formed their respective 18-month cycle troughs on July 19th or 20th, it appears that the 18-month trough, for XLU still lies ahead and may not form until late fall. This may seem strange, but if we recall the 18-month trough that formed in March of 2020, wasn’t expected to form until June or July of 2020. As Hurst would describe it a fundamental interaction took place, in this case the Covid 19 crisis that hit the world early last year, which accelerated the formation of that 18-month trough. Therefore, one possibility for understanding this is that the stocks making up XLU, are lengthening the duration of their current 18-month cycles so to get things back into not only a cyclical but seasonal rhythm. Just a supposition on my part since it is not something that I have studied by analyzing the top weighted stocks found in XLU.

XLV – visual analysis alone shows that XLV has exceeded its 20d FLD price target. A 40-day cycle trough is expected around August 22nd.

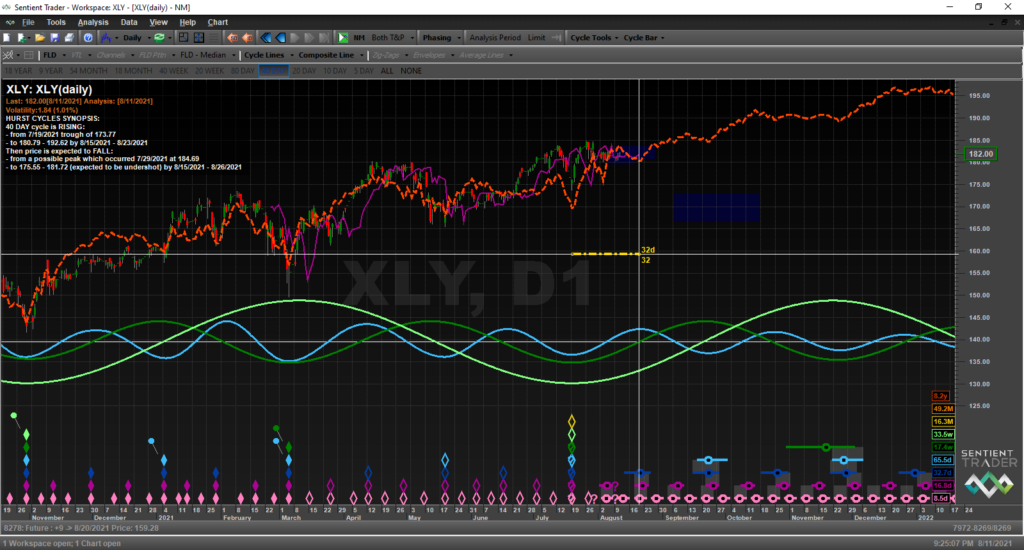

XLY – has not yet come close to reaching the 20d FLD price target. A 40d cycle trough is expected around August 20th.

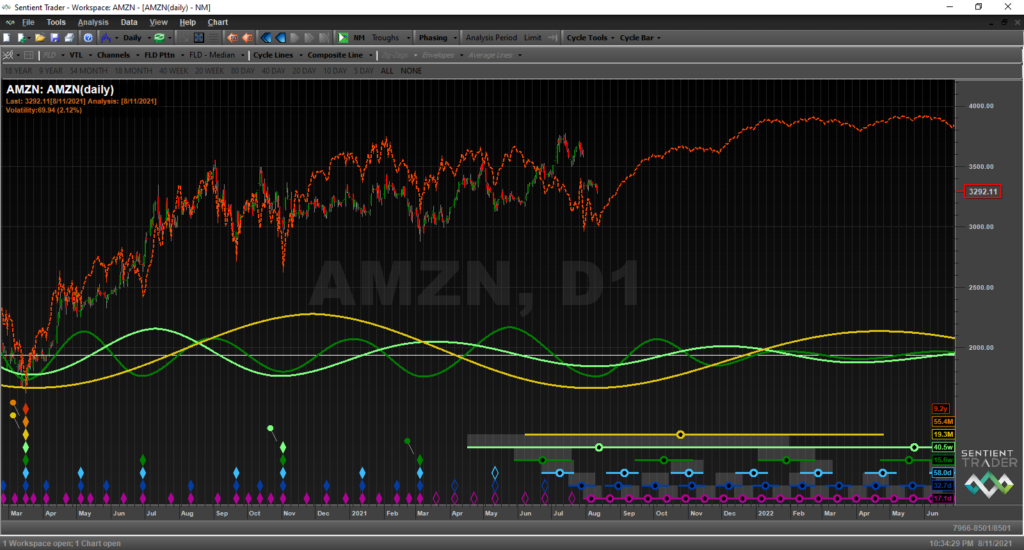

AMZN – makes up 21.94% of XLY and its recent struggles have contributed to the muted move by XLY.

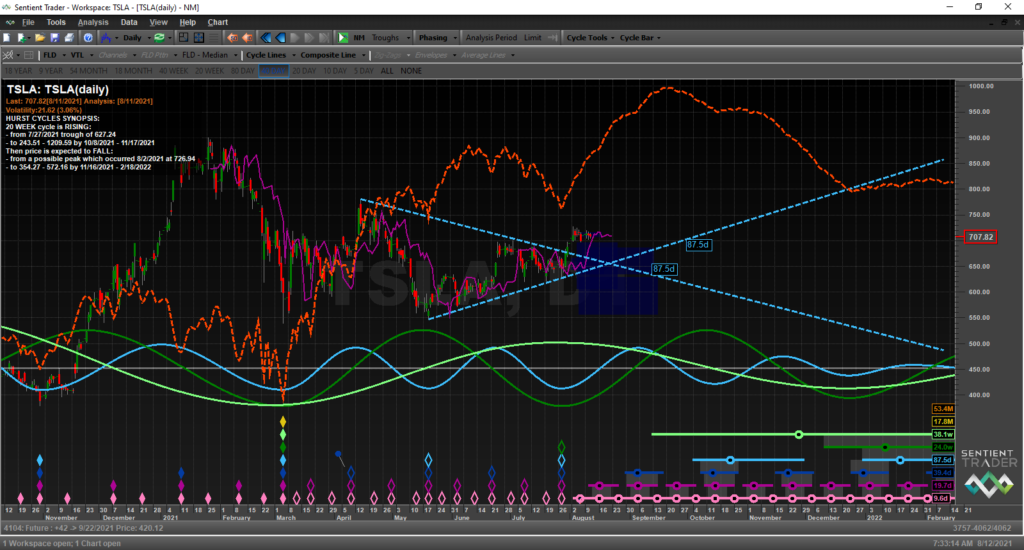

TSLA – makes up 13.52% of XLY. Together with AMZN they account for 35.46% of the ETFs weighting. Obviously when they struggle XLY is not going to do well and visa-versa. Above is a weekly chart of TSLA showing that the March 2020 low was not its 18m cycle low but only one of 40week duration. Therefore, for TSLA instead of the March low in 2021 being a 20w cycle trough (like the Indices and its sector ETF) it was its 18m cycle trough. This may explain in part the dramatic drop TSLA experienced after peaking earlier this year. With AMZN and TSLA now in a position to start doing better it should benefit not only the price movement of XLY but of QQQ, NDX and SPY and SPX as well.

Switching back to the daily chart, it appears that TSLA is in the process of forming a 20d cycle trough as it reaches towards its 20d FLD. If this is the correct analysis, then sometime soon TSLA should move up and out of the little flag pattern it is in. Currently the Composite Line is forecasting a favorable period for TSLA into the second half of September. Then it will begin the process of moving into first an 80d cycle trough and eventually a 40w cycle trough which is currently projected to form in late December 2021.