This Cycle Outlook has been kindly provided by David Walling. (In case you missed the announcement about this new series, read this)

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by David Walling, who has generously contributed his time (this is not a sponsored post).

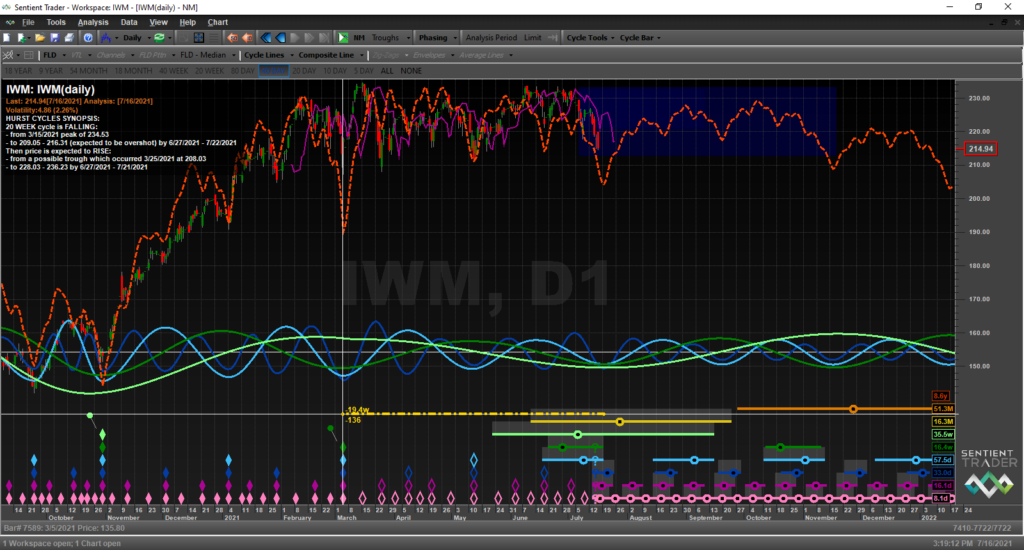

IWM – we have near perfect timing for a 20-week cycle trough which will in conjunction with the 40-week and 18-month cycle troughs.

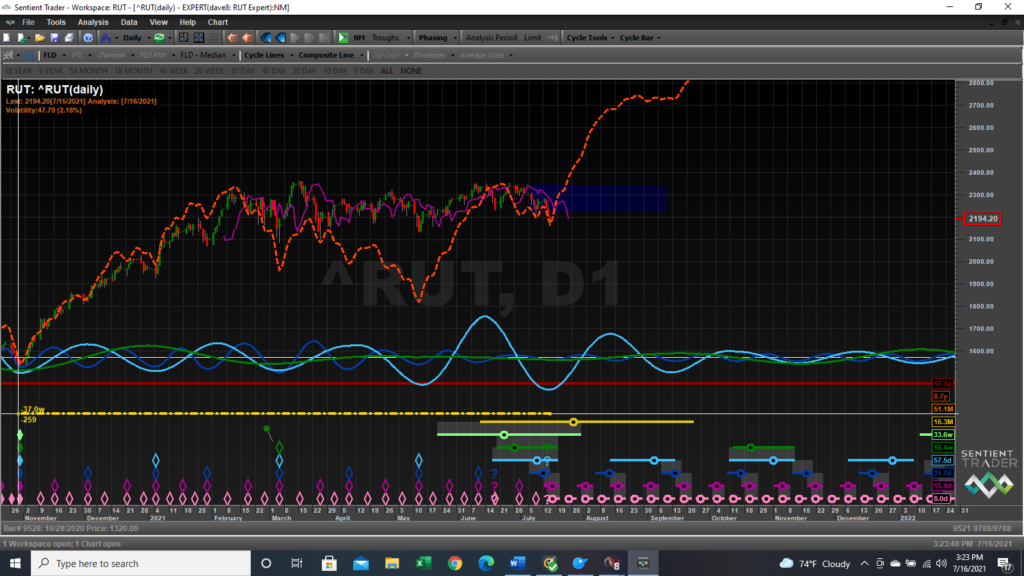

RUT – 40-week cycle timing looks good as well. Note the difference here between the IWM’s composite line to RUT’s composite line after the 18-month trough forms. Whereas with the IWM analysis it is looking for the 54month trough to form 16-18 months from now; while the RUT’s analysis is more bullish because it said that trough formed in March 2020. Since RUT has more data to analyze, I believe it to be more representative of future price action. Will it go up as shown on the chart? Probably not, but it suggests that we should expect good things to happen for a period of time after the 18-month trough finally forms.

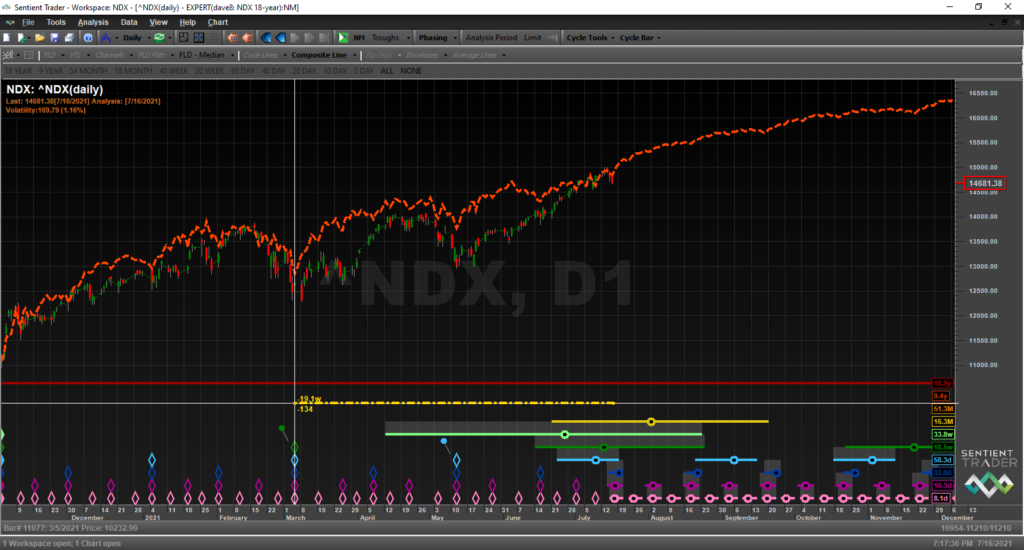

NDX – here too we have timing for the 20-week cycle trough which will form in conjunction with the 40-week and 18-month troughs.

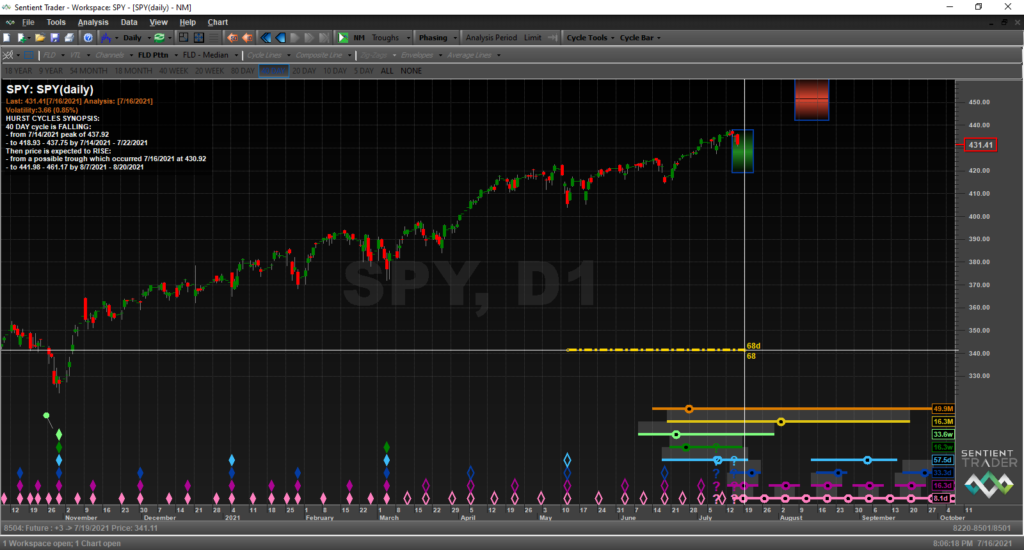

We certainly have timing for the 20-week trough to form and its formation will be in conjunction with the formation of the 40-week and 18-month trough as well. Pretty hard to argue with the placement of the previous 20-week trough being during the first week of March—note how clearly the low is defined.

Here again we have timing for the 40-week trough to form which in turn would be timing for the 18-month trough. Let’s break this down into its corresponding segments in order to make the case for this assumption.

Pretty hard to argue against March 4th not being the location of the 20-week trough since we have a well-defined or prominent low occurring within 10% of the time such a low would be expected. The nominal 20-week cycle period is 19.48 weeks and 17.9 weeks is 91.9% of that nominal period.

Regarding the 80day cycle trough it would be hard to argue against May 11th not being the trough of the first 80-day cycle after the 20-week cycle trough because we have another prominent low with timing. The normal or nominal 80-day cycle beat is 68.2 days and the May 11th trough formed 69 days after the March low.

Likewise, it would be hard to argue against June 18th being the trough of the first 40-day cycle after the 80-day cycle. The normal or nominal 40-day cycle beat is 34.1 days and the June 18th trough formed 37days after the 80-day trough. This too was a fairly prominent low for such a minor cycle.

On Monday, July 19th it will be exactly 68 days from the May 11th trough. So, there will be timing for the low to occur then if in fact it didn’t occur today. The FLD pattern projection box for the 40day cycle trough clearly shows the timing range for this trough.

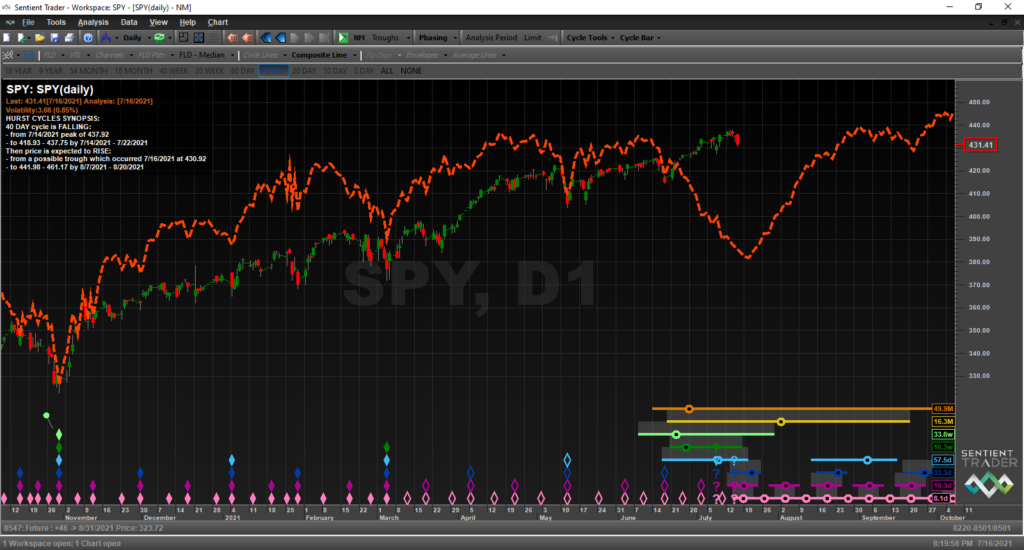

Finally, the Composite Line is looking for the 18-month trough to form by July 19th. Not much of an event but it is what it is. And it looks like it will not produce the type of prominent low one would expect during the formation of such a significant cycle trough. Let’s compare it now to a couple of other charts to understand why this might be.

The German market ETF (EWG) showing what the SPY might have looked like it there wouldn’t have been massive amounts of monetary and fiscal support from the Fed and the US government. No way to prove this and not saying it wasn’t needed–just a supposition.

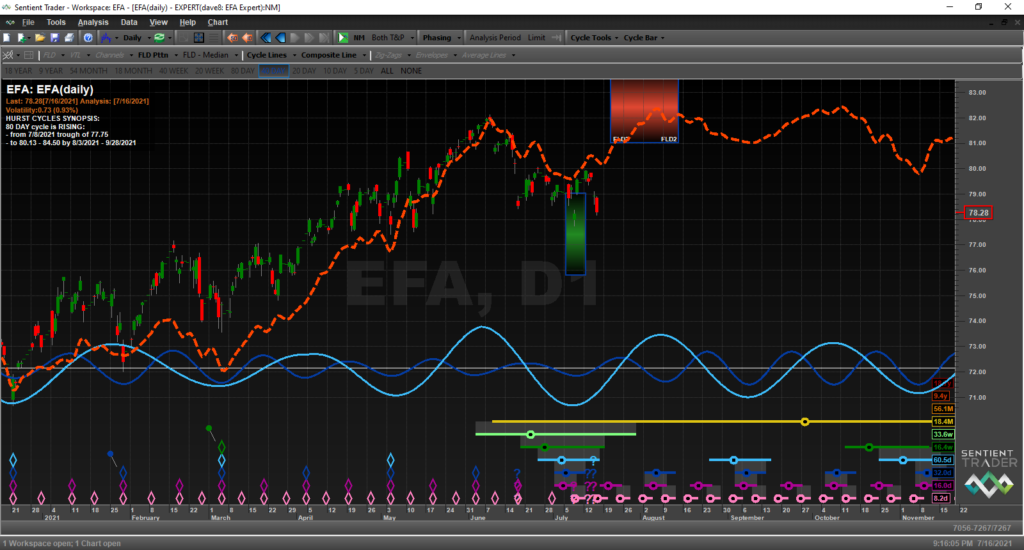

EFA – the large and mid-cap international stock ETF had a 5.2% pullback as it formed its 18-month trough. It most likely formed its trough last week—if not then it too has timing to form it early next week.

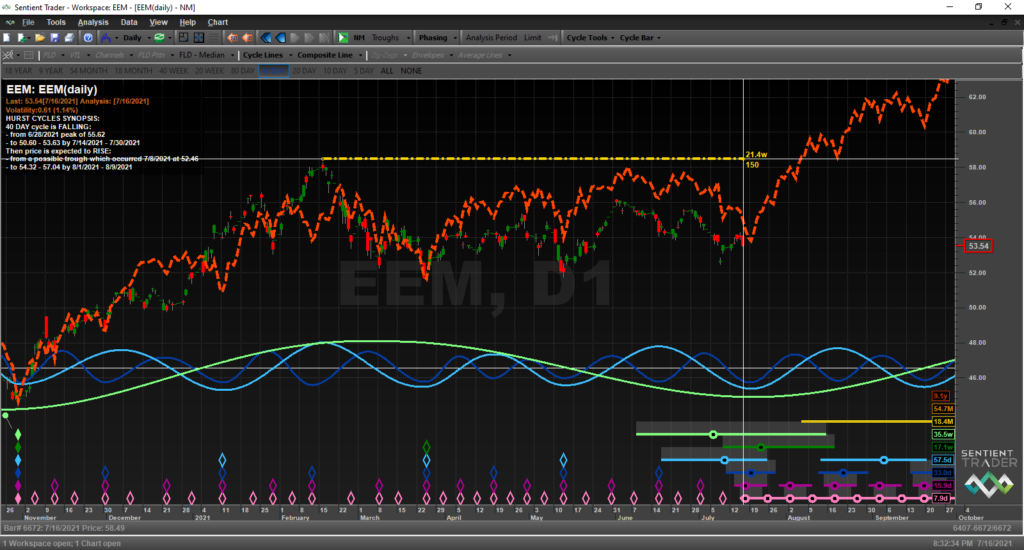

Compare the EEM to the SPY and NDX. Note that EEM formed the 18-month cycle peak 21.4 weeks ago whereas SPY made all time highs this week. I’m not an economist nor do I play one on TV, but sometime the simplest answer for this is the best. I say yes we have a strong economy, but it has received a lot of help.