This Cycle Outlook has been kindly provided by David Walling. (In case you missed the announcement about this new series, read this)

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by David Walling, who has generously contributed his time (this is not a sponsored post).

Greetings,

Here’s my current cyclic outlook.

Seem’s like the odds are that the 18-month cycle trough formed on Monday. If Monday’s low is taken out, then it didn’t. To confirm I will want to see the mid-point of price on these various instruments cross above their respective 20-day FLDs.

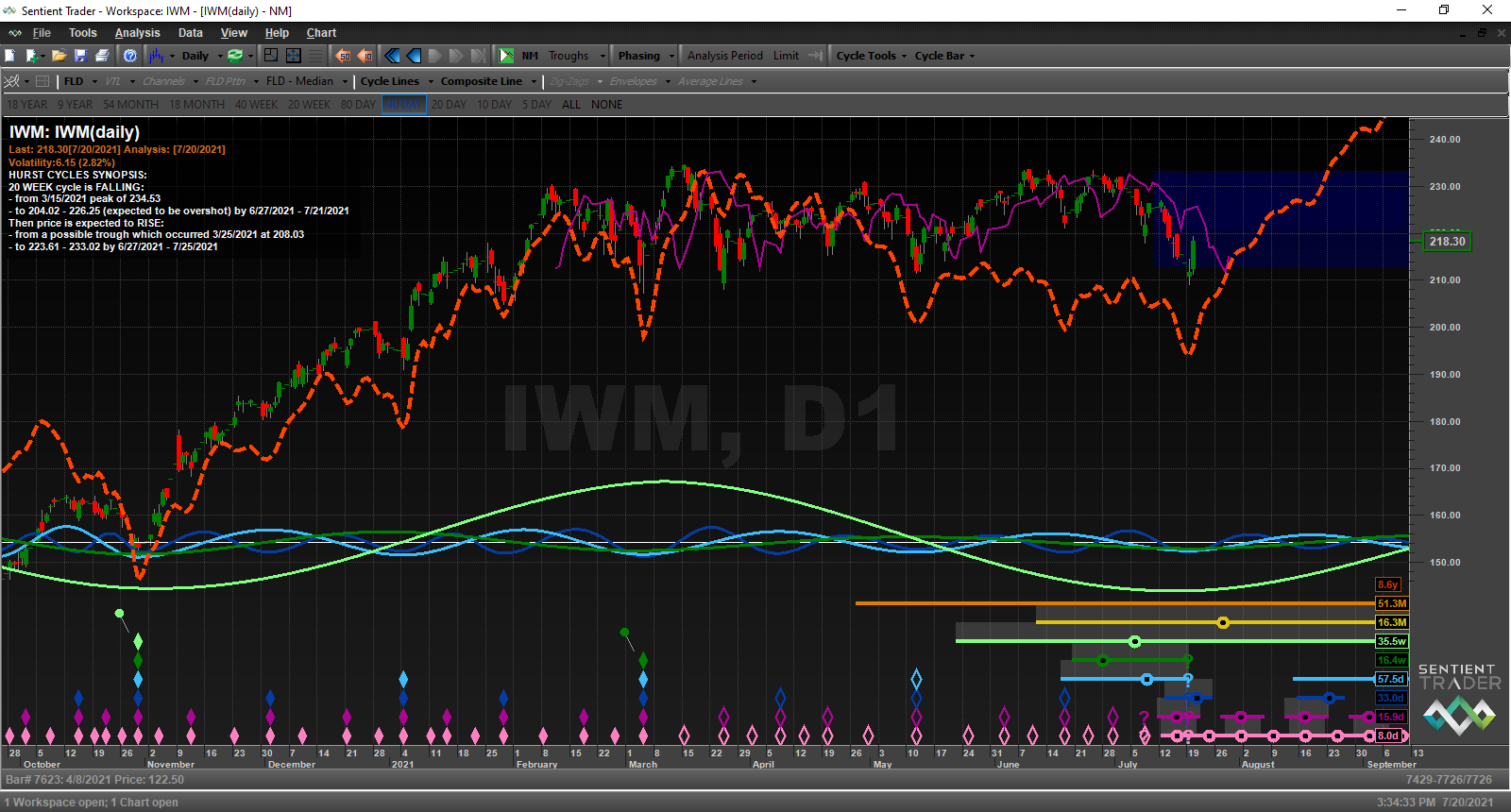

IWM – ST is currently projecting that the 18-month cycle trough has formed. Need the mid-point of price to cross above the 20-day FLD to confirm.

RUT – ST is currently projecting that the 18-month cycle trough has formed. Need the mid-point of price to cross above the 20-day FLD to confirm.

NDX – ST is currently projecting that the 18-month cycle trough has formed. Need the mid-point of price to cross above the 20-day FLD to confirm.

QQQ – there is perfecting timing here for the 20-week cycle trough to form which in turn is the formation of the 18-month trough. Need the mid-point of price to cross above the 20-day FLD to confirm.

SPX – there is perfect timing for the formation of the 18-month cycle trough and a perfect move into a 40-day price projection box. As you can see by the Composite Line that Sentient Trader is projecting good things as price moves out of this trough.

SPY – on Monday there was perfect timing for the 20-week cycle trough to form, which in turn is also the troughs of the 40-week and 18-month cycles. The mid-point of a future candle will need to form above the 20-day FLD to confirm. Here again, price precisely moved into a 40-day FLD price projection box.