This Cycle Outlook has been kindly provided by Oren @ChartingCycles.

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by the contributor.

ARKK Weekly – This is the main ETF I am using to track the growth sector, as it is one of the most popular and talked about. ARKK is rising in its 18m cycle, but also starting its fall into the 40w trough. Overall, it currently seems to need more sideways consolidation after such an explosive year in 2020.

ARKK Weekly – This is the main ETF I am using to track the growth sector, as it is one of the most popular and talked about. ARKK is rising in its 18m cycle, but also starting its fall into the 40w trough. Overall, it currently seems to need more sideways consolidation after such an explosive year in 2020. UBER Weekly

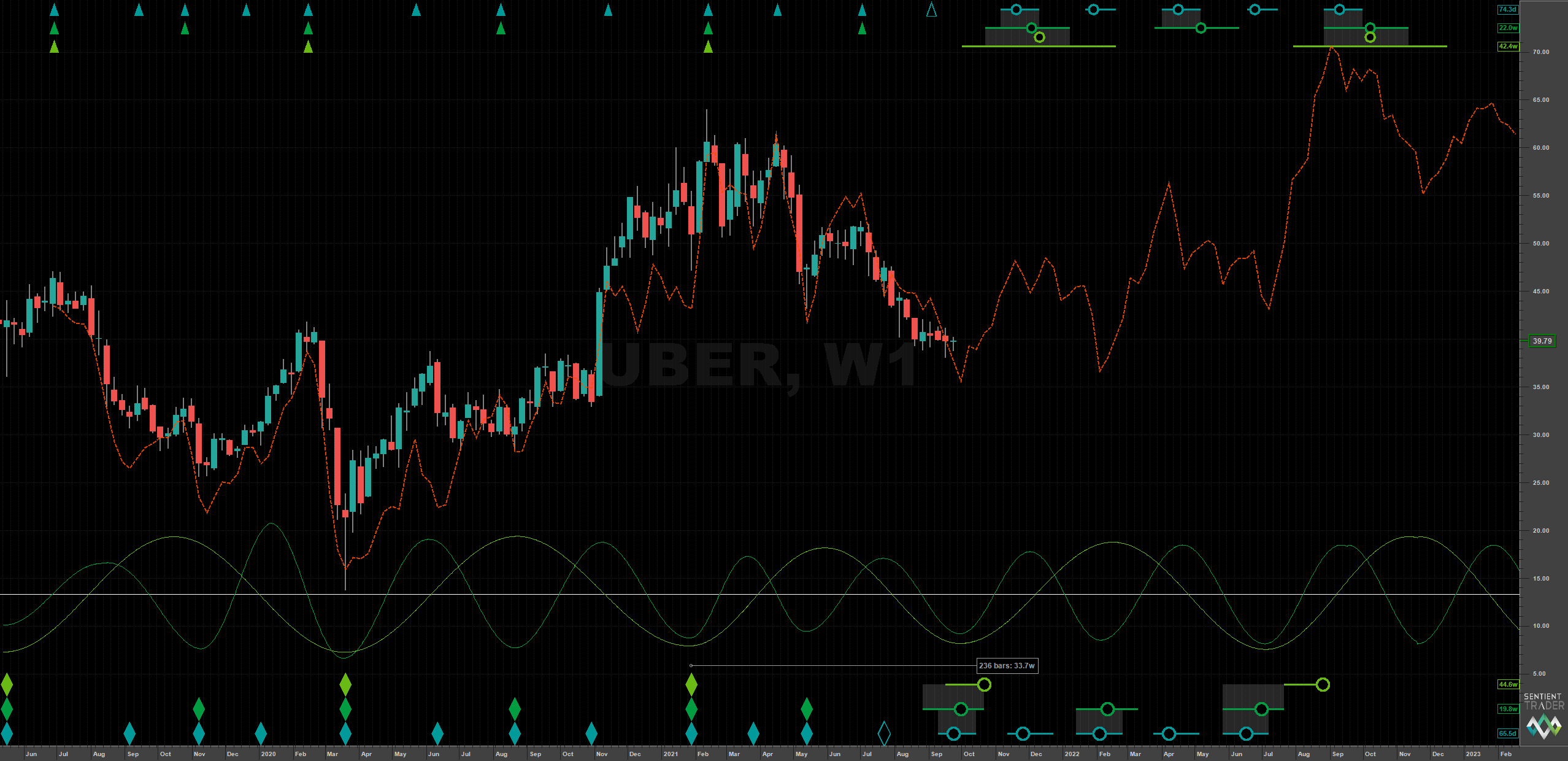

UBER Weekly  UBER – UBER is in the middle of putting in its 40w trough based off this analysis. As you can see in the weekly chart, this could potentially be a great long-term buying opportunity for UBER. I am watching for a close above the 40d VTL to help confirm the trough is in.

UBER – UBER is in the middle of putting in its 40w trough based off this analysis. As you can see in the weekly chart, this could potentially be a great long-term buying opportunity for UBER. I am watching for a close above the 40d VTL to help confirm the trough is in.

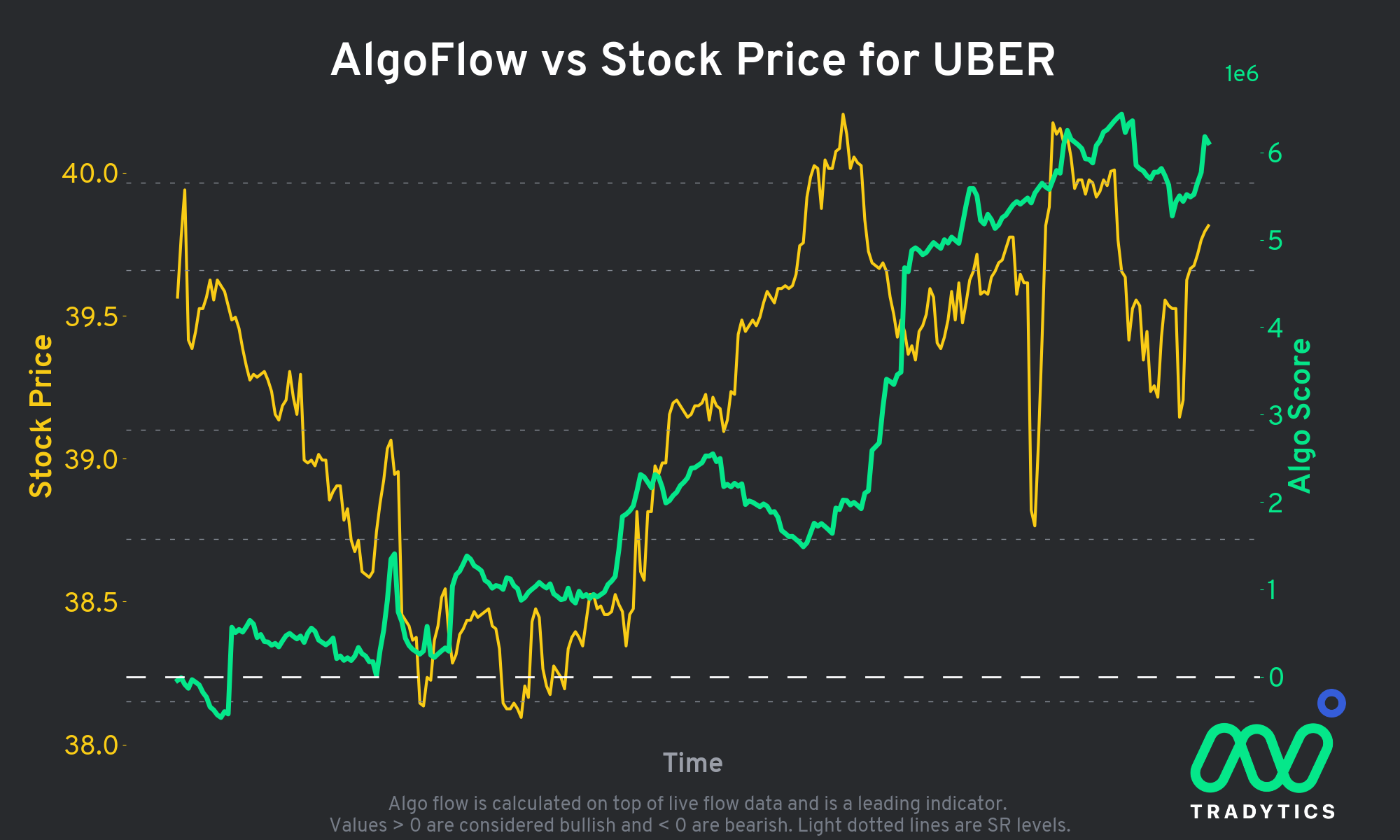

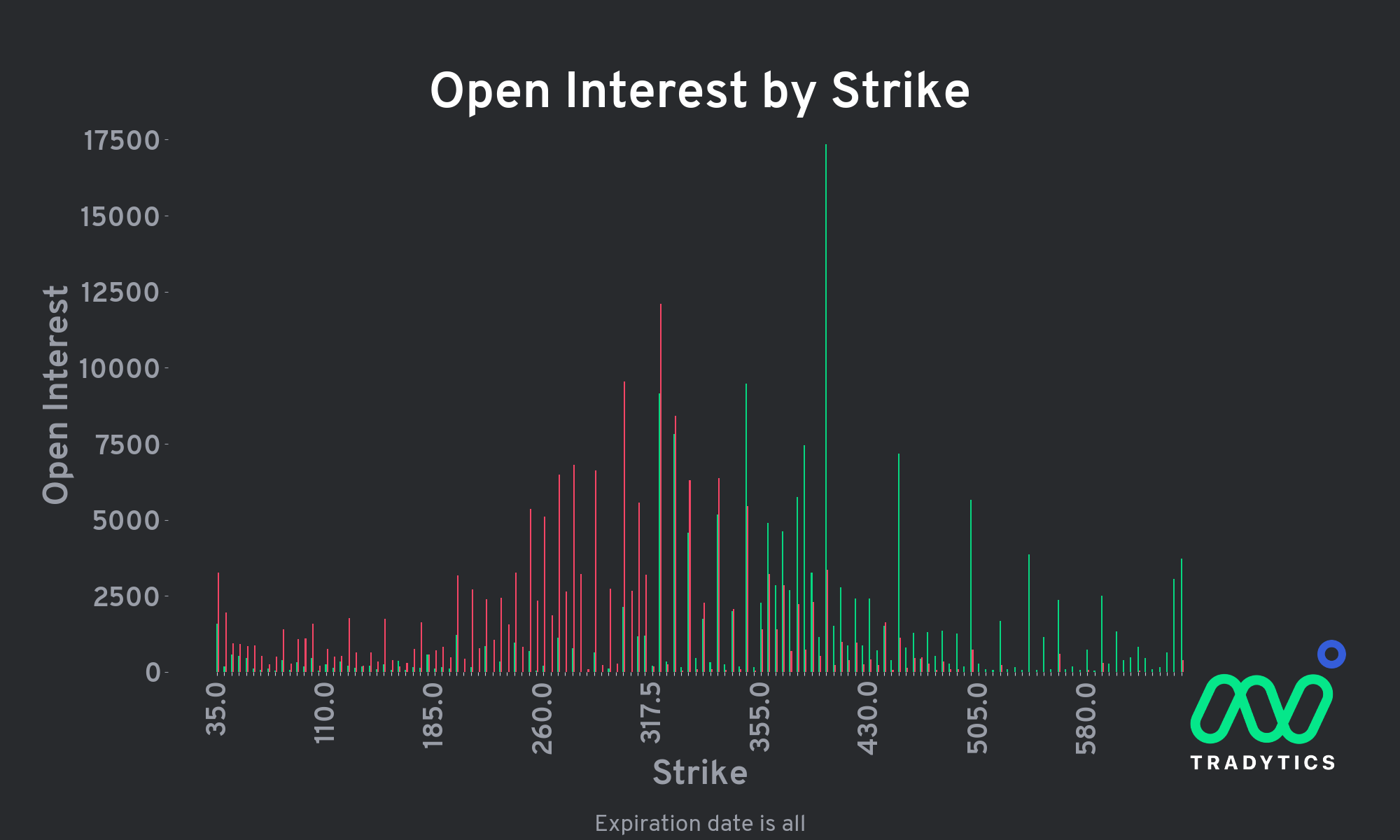

UBER Flow – I use option flow data to confirm sentiment has turned bullish during a projected trough. We can see for UBER, the 5-day AlgoFlow chart is very bullish, with a score of 6. The Open Interest chart is also leaning bullish.

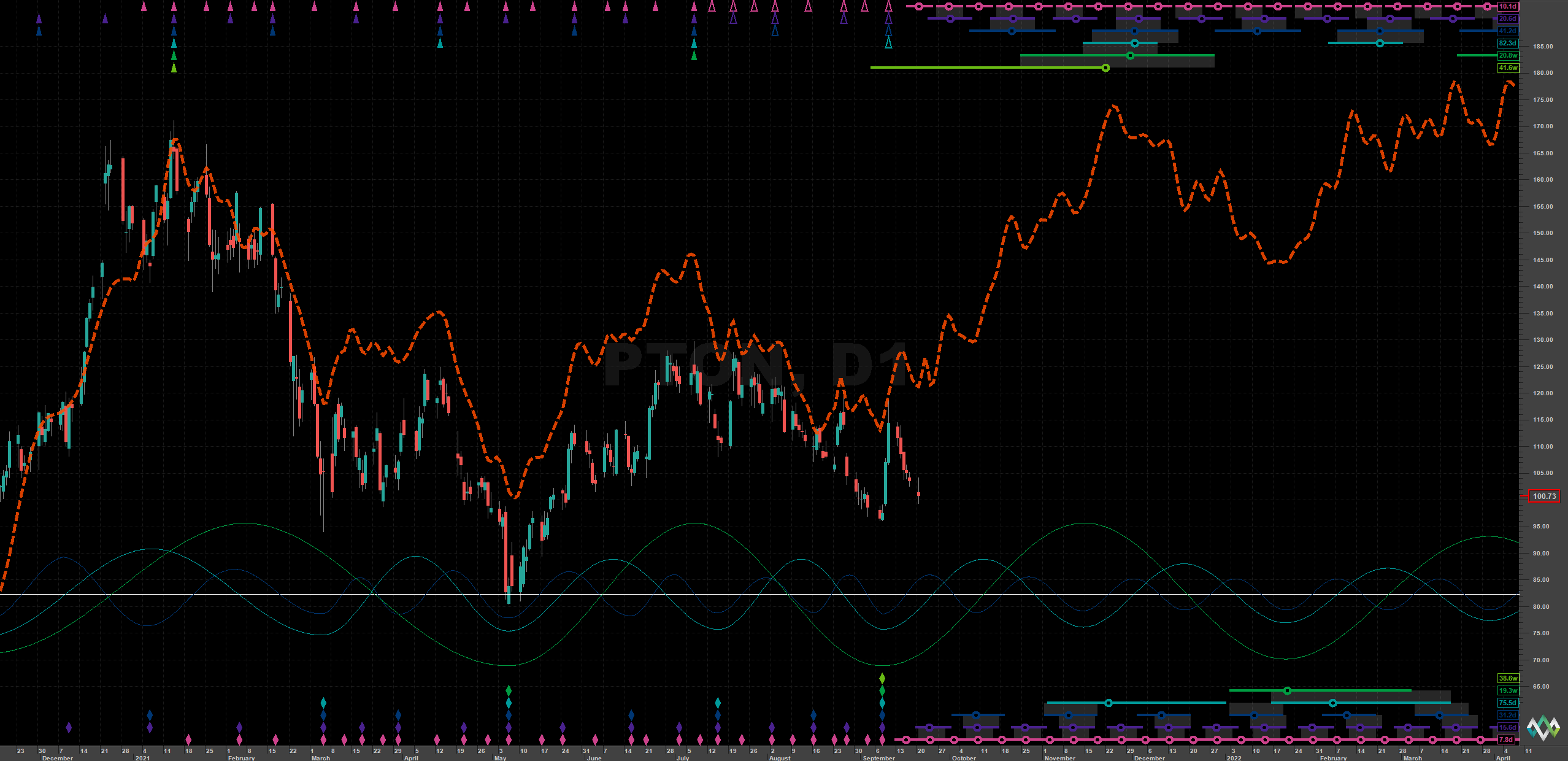

UBER Flow – I use option flow data to confirm sentiment has turned bullish during a projected trough. We can see for UBER, the 5-day AlgoFlow chart is very bullish, with a score of 6. The Open Interest chart is also leaning bullish. PTON – Sentient Trader believes PTON put in its 40w trough on September 8th. If the model is correct, we should expect a good size bounce on PTON in the coming days. PTON option flow is currently leaning bearish.

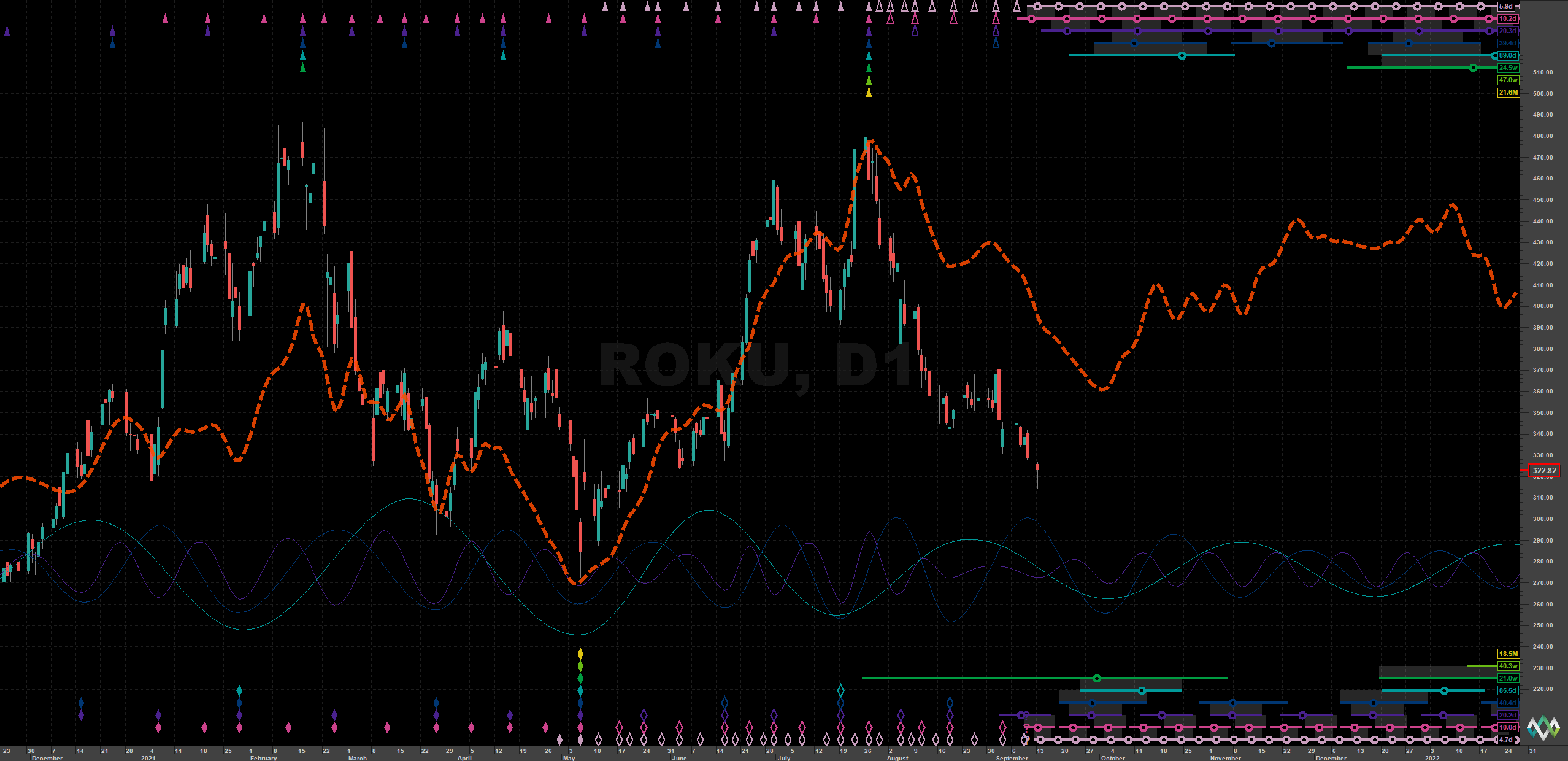

PTON – Sentient Trader believes PTON put in its 40w trough on September 8th. If the model is correct, we should expect a good size bounce on PTON in the coming days. PTON option flow is currently leaning bearish. ROKU – ROKU is approaching its 20w trough here. I am watching for a close above the 40d VTL to help confirm the trough is in.

ROKU – ROKU is approaching its 20w trough here. I am watching for a close above the 40d VTL to help confirm the trough is in.

ROKU Flow – Similar to UBER, ROKU’s AlgoFlow and Open Interest charts are leaning bullish.

ROKU Flow – Similar to UBER, ROKU’s AlgoFlow and Open Interest charts are leaning bullish.

Find @ChartingCycles on Twitter

Would you like to share your analysis here? Write us on info@sentienttrader.com!