As any trough is approached in the markets I always like to stand by in anticipation of that trough, in case it happens early. Troughs occur early in bull markets, and we have been in a bull market for some time, so expecting an early trough has been a useful thing to do for the last few years.

To receive these blogs as soon as they are posted Join/Like/Follow Us. If you don’t do social media – click to Join Feedburner to receive these blogs by email.

When the US markets pushed up strongly this week I asked whether Monday 2 February was an early occurrence of the 20-week cycle trough that I have been expecting to form later in February.

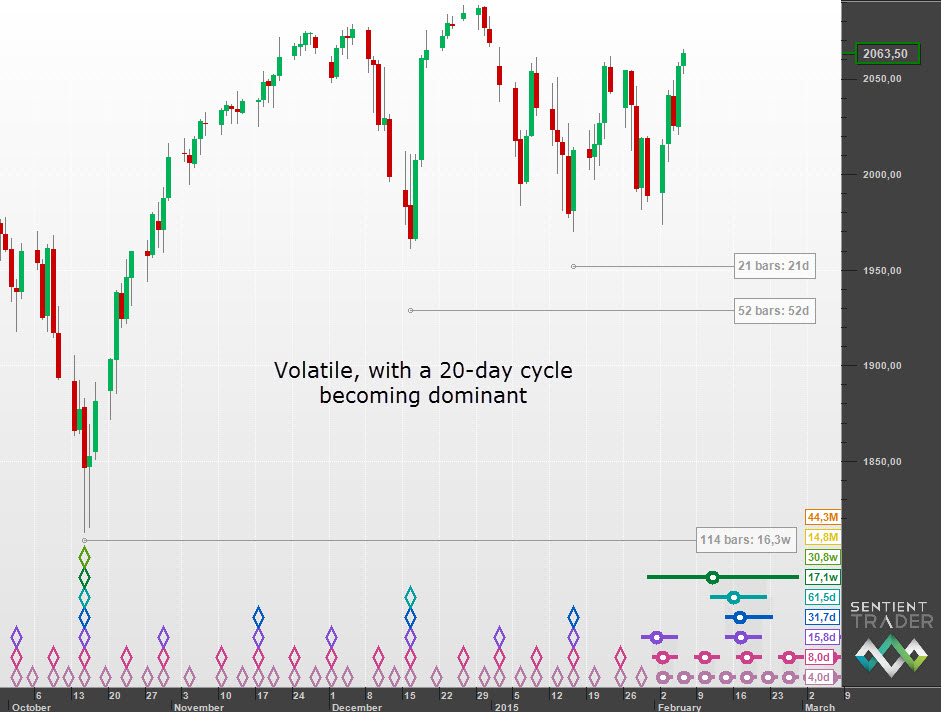

At first glance it seems more likely that the trough on 2 February 2015 was of only 20-day magnitude, and that the 20-week cycle trough still lies ahead of us.

But then why was the move up this week so strong? Often the simplest answer is the correct one, and the simple answer here is that the market is seeing an increased volatility at the 20-day level as that cycle rises to dominance, and so although it seems like too big a move for the rise out of a 20-day cycle trough, it might not be in the context of increased volatility.

This would explain the strong move and implies that the market will still move down (probably with equal strength) into the 20-week cycle trough as we have been expecting.

But we still haven’t answered the question of whether it is possible that the 20-week cycle trough has occurred early. I like to play Devil’s Advocate with any analysis, and there is an intriguing possibility here which suggests that the 20-week cycle trough has occurred, even if it is (almost) impossibly early. And that has to do with the Mid-Channel Pause.

Hurst defined something called the Mid-Channel Pause, which is the “pause” in price movement on the way up to the peak of the cycle, and a matching pause on the way down to the final trough of the cycle.

The Mid-Channel Pause (MCP) occurs at roughly the time of the trough of the cycle two degrees shorter than the cycle that formed the initial trough – the trough that forms the start of the developing M-shape. I discuss the MCP in more detail here.

When a trough occurs particularly early, and without much downside movement, producing an unbalanced and not very satisfactory cycle shape, I always ask myself whether an MCP is forming.

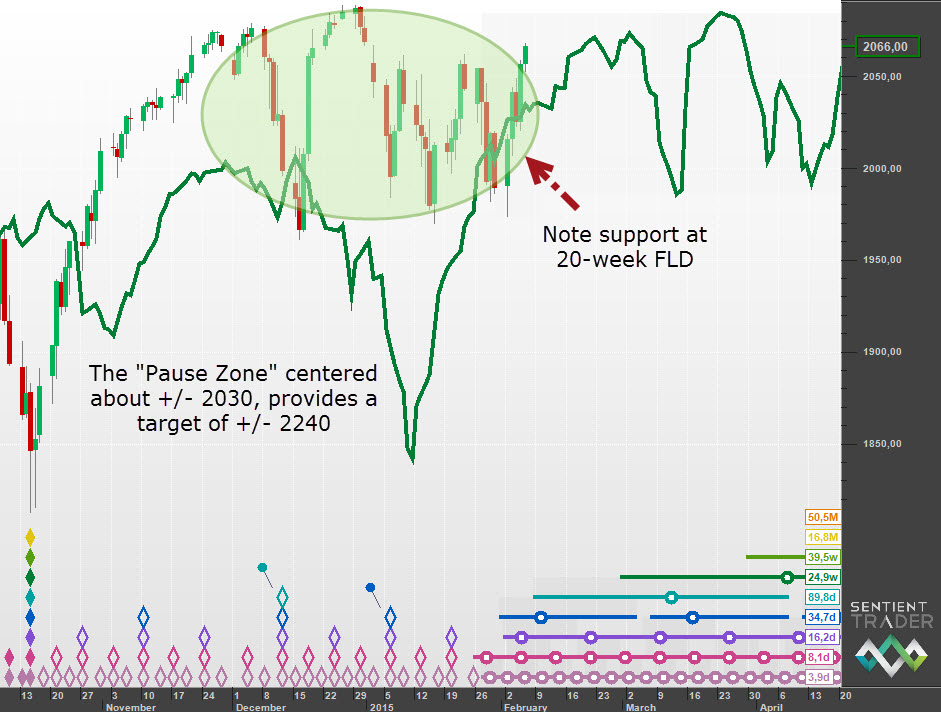

And it is definitely possible that we have seen an MCP form here:

The MCP suggests that the October 2014 trough was of 18-month magnitude (which is possible, although I continue to favor the 40-week option discussed here). The “Pause Zone” is fairly clear, and is centered around the 2030 area in price. Note also how price found approximate support at the level of the 20-week FLD, which is exactly what we would expect of a B-category interaction between price and that FLD.

How do we trade this?

Fortunately we don’t need to spend long suffering from “analysis paralysis”. In the short term:

In order for the first option to remain valid (that the 20-week cycle trough has not yet occurred), price will need to come down fairly strongly within the next two weeks. There might still be a good short trade to be made there, and then the bounce out of the 20-week cycle trough will offer a good long entry.

If the second option is the correct one (that the 20-week cycle trough has occurred and price is breaking out of an MCP) then price will not come down hard at all, but will probably form a typical B-cat interaction with the 20-day FLD. Then we will have a good long entry opportunity.

And so there will be a long opportunity coming along soon. But it is worth bearing in mind the medium to long term outlook:

If the first option turns out to be true, then it is likely that the 9-year peak has formed, and so there is a limited upside. If on the other hand the second option is correct then the 9-year peak probably still lies ahead of us, and there is more time for us to enjoy the profits from long trades.

Have a great week and profitable trading!