This Outlook has been kindly provided by David Walling. (In case you missed the announcement about this new series, read this)

The analysis is provided for your consideration and is not to be construed as financial advice. Please bear in mind our disclaimers which apply to all posts on this site.

Please note: Any questions about the post will be answered by our team, not by David Walling, who has generously contributed his time (this is not a sponsored post).

Greetings,

Here’s my current sector outlook.

Personally, I’m thrilled to see the market pulling back a little because pullbacks provide new opportunities for entering into long trades from longer term bases versus from short term flat bases or from bull flag type setups. Frightening the children, a little bit (as Tom Sosnof likes to say) isn’t necessarily a bad thing. I’m looking around for my catcher’s mitt now.

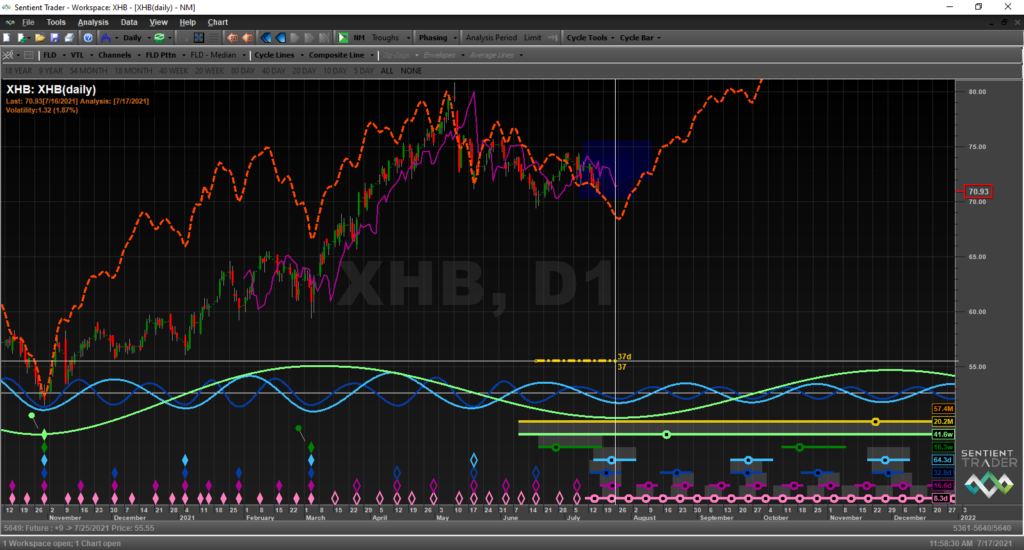

XHB – this home builders ETF didn’t form its prior 80-day cycle trough until May 19th. Therefore, it may continue to move down into the latter part of the week.

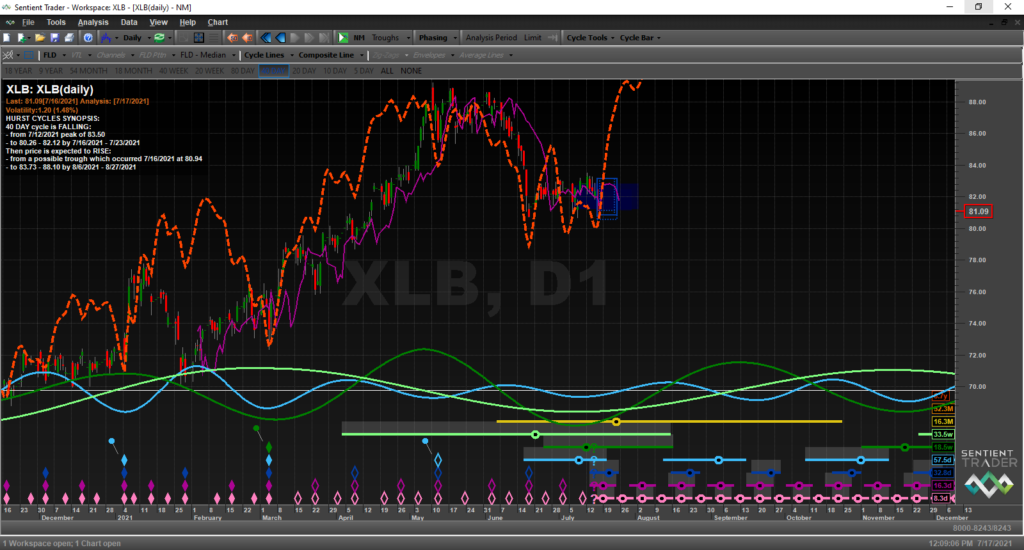

XLB – may have already formed its 18-month cycle trough. New bull cycle leaders often come from sectors and industry groups that bottom first.

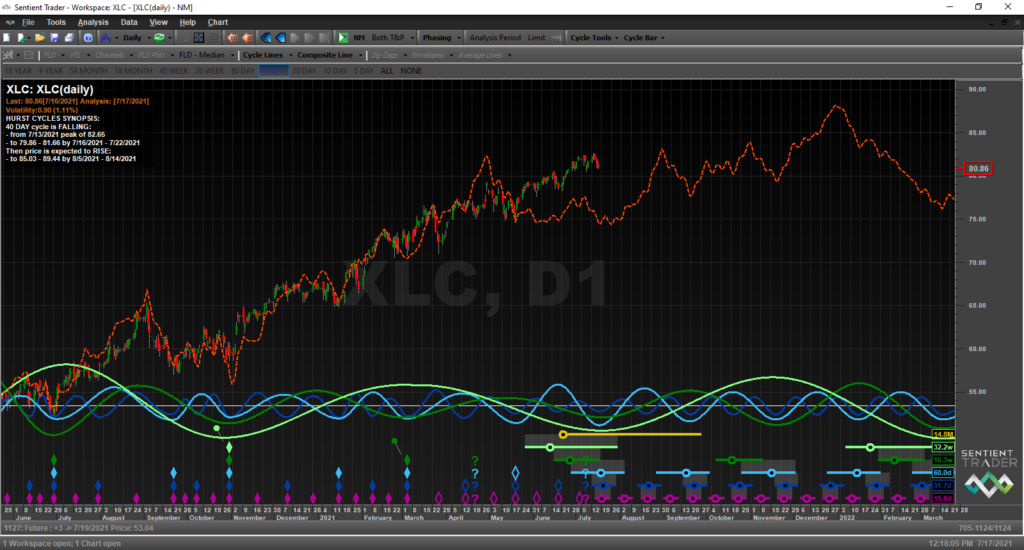

XLC – either formed its 18-month cycle trough or will form it soon.

XLE – this oil sector ETF formed a rather late 80-day cycle trough in May opening up the possibility for more downside action this week. Probably won’t see leadership emerge from this group after it bottoms. Sectors that bottom late sometimes become the laggards in the next bull cycle. Where investors and traders make mistakes is that they think they just needed that pullback before they rocket up again. Such a bias can sometimes get you into stocks that underperform that next cycles true leaders.

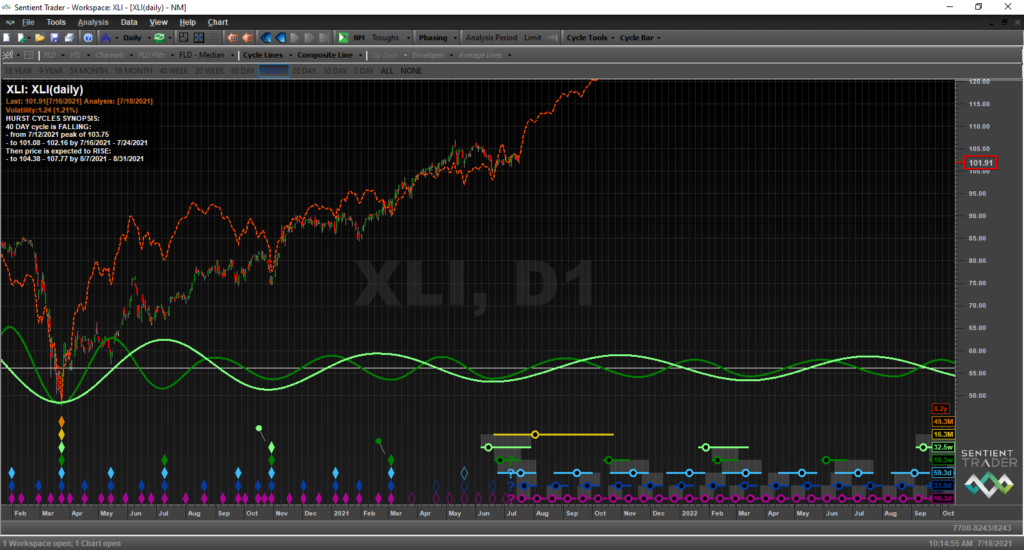

XLI – industrial may have already formed its 18-month cycle trough. Often the next group of leaders will form their major troughs before the others will. If the infrastructure bill passes, then stocks from this sector and its associated industry groups could provide us with the next group of market leaders. Sometimes traders turn their noses up on certain groups of stocks that didn’t perform as well in the past or that may come from cyclical industry groups. Many of us did that with the oil stocks last fall and missed out on the huge runup. That is why it is so important to use industry group rankings to see what groups are moving up in favor and which are falling out of favor. By doing so one won’t miss out on what’s becoming hot before it becomes obvious to even a so-called blind person. If you study past big winning traders, they aren’t biased that way. They also don’t fall in love with any stock or group of stocks. As one person told me who was primarily a long only trader: all stocks/ETFs are bad unless they are moving up.

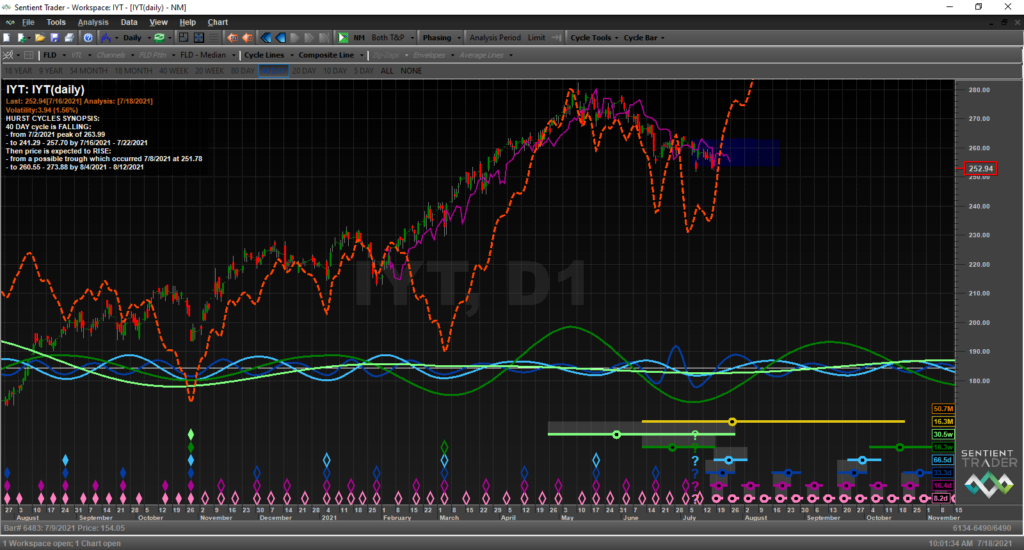

IYT – this transportation ETF is part of the industrials sector. It too may have formed its 18-month cycle trough.

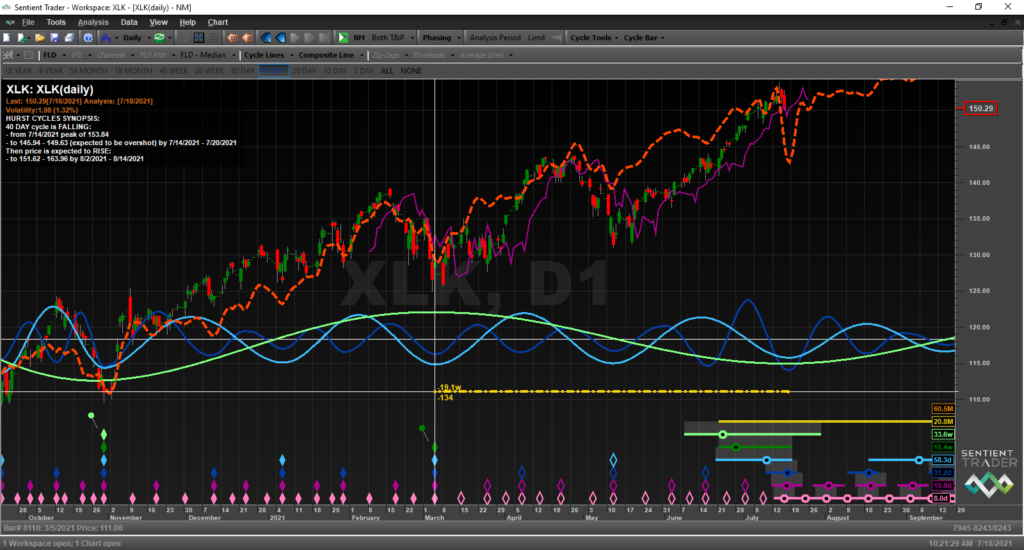

XLK – many times a sector is so strong that it refuses to fall down into a trough until the very last moments of the cycle. When such sharp sell offs occur over a couple of days, traders get hyper excited and think there must be something really wrong under the hood—so to speak. Sentient Trader is looking for XLK to form its trough early this coming week if it hasn’t already.

XLK – the technology ETF with the composite line shown. Again, a nominal 20-week cycle beat is 19.48 weeks. On Monday it will be 19.57 weeks since the prior 20-week trough formed in March. So, we have near perfect timing.

XLK – the technology ETF with the composite line shown. Again, a nominal 20-week cycle beat is 19.48 weeks. On Monday it will be 19.57 weeks since the prior 20-week trough formed in March. So, we have near perfect timing.

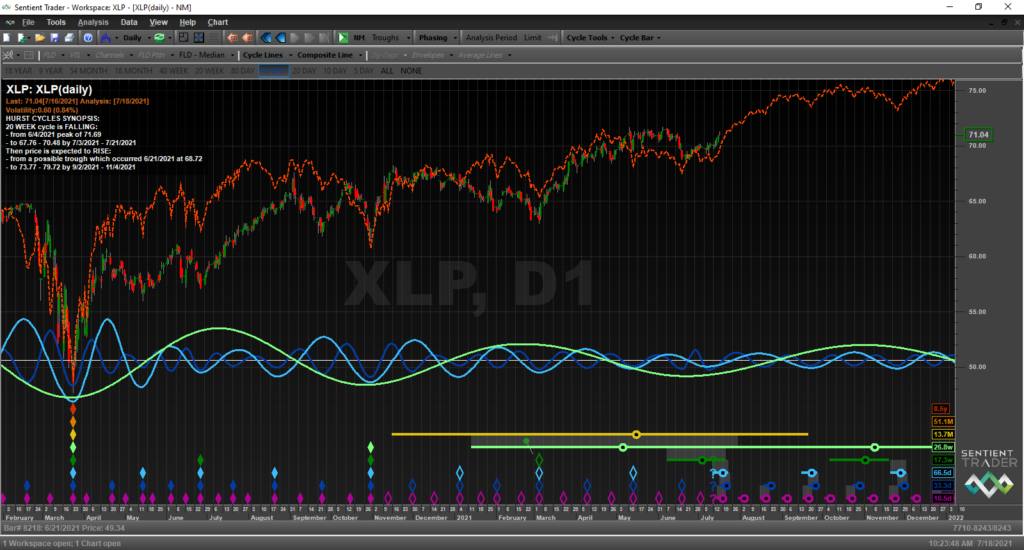

XLP – the consumer staples ETF appears to have formed its 18-month cycle trough this past week.

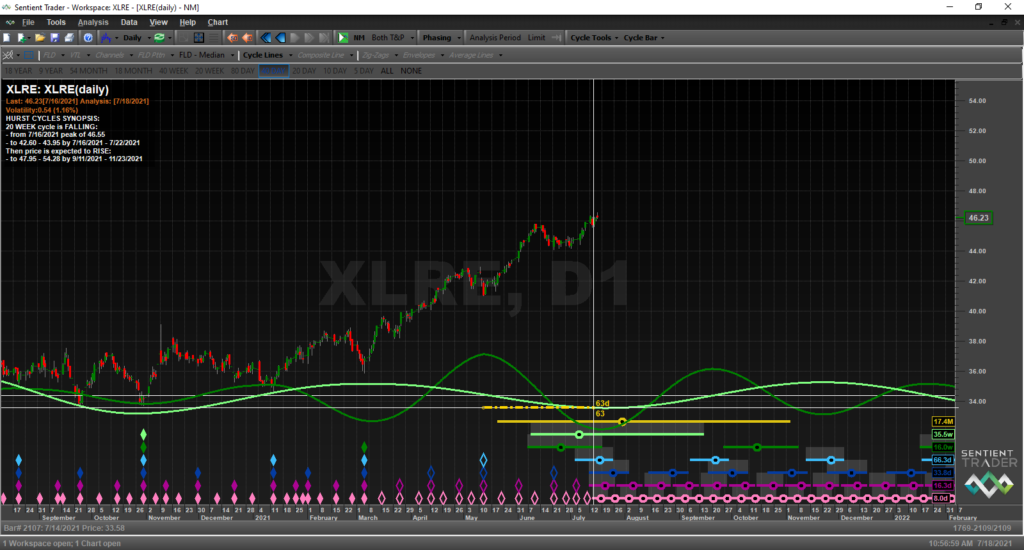

XLRE – the real estate ETF appears to have already formed its 18-month cycle trough as well.

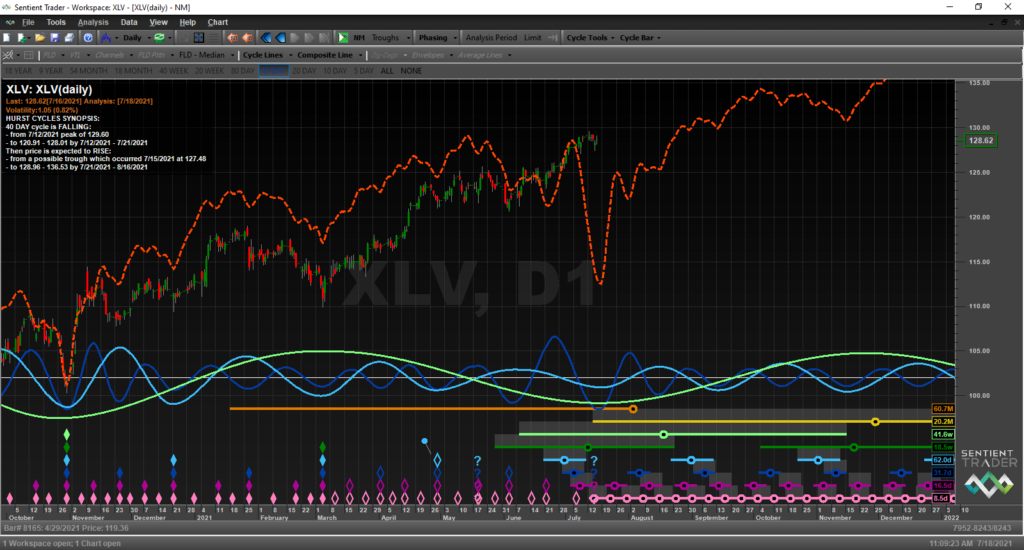

XLV – the health care sector. It also has timing for the 18-month cycle trough to form anytime.

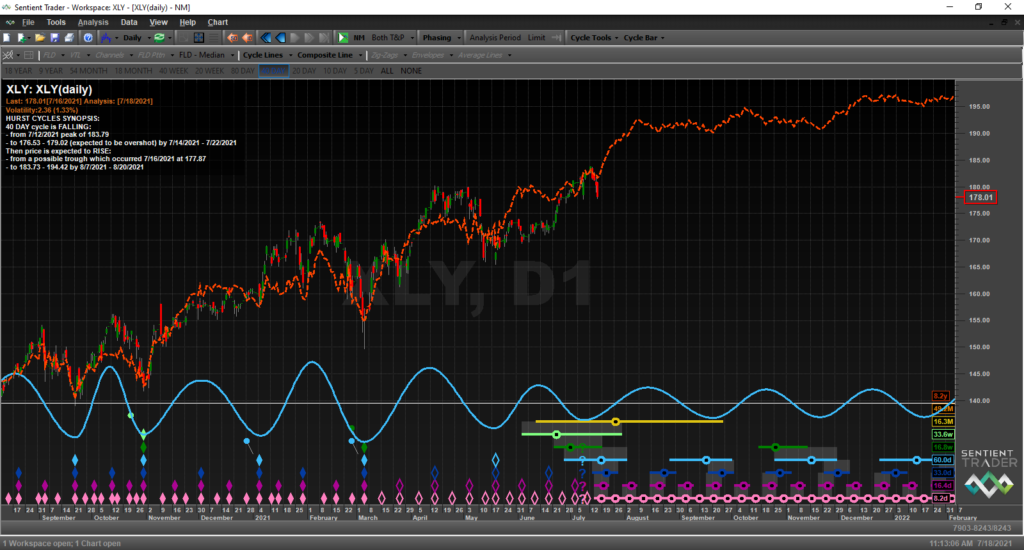

XLY – consumer discretionary ETF has timing for the 18-month cycle trough to form anytime now as well.

XSD – semiconductor ETF also has timing for the 18-month trough to form anytime now.